Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

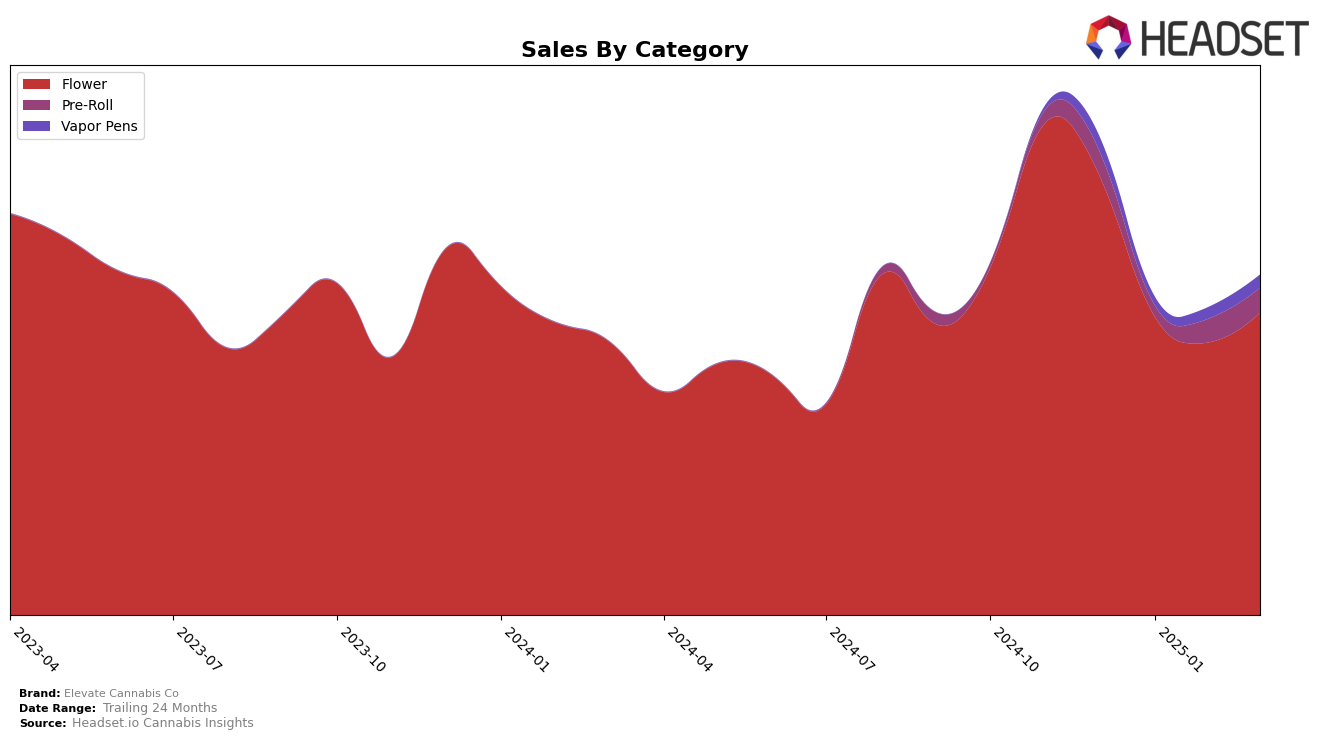

Elevate Cannabis Co has shown varied performance across its product categories in Arizona. In the Flower category, the brand has experienced fluctuations, initially ranking 29th in December 2024, slipping slightly out of the top 30 in January 2025, but then rebounding to 27th by March 2025. This indicates a positive trend, albeit with some volatility. In contrast, their Pre-Roll category performance saw a notable improvement, where they climbed from 36th in December to 32nd by February and maintained that position in March. This suggests a strengthening presence in the Pre-Roll market. However, the Vapor Pens category remains a challenge, as the brand has not broken into the top 30, with ranks consistently above 57th, highlighting an area for potential growth or reevaluation.

In Missouri, Elevate Cannabis Co's performance in the Flower category has been relatively stable, albeit with a slight decline. Starting at 21st in December 2024, the brand dropped to 29th by March 2025. Despite this downward movement, the brand's sales figures in Missouri remain robust, indicating a solid customer base even as competition intensifies. The consistent presence in the top 30 suggests a resilient market position, but the decline in ranking could signal the need for strategic adjustments to regain higher positioning. This performance reflects the competitive nature of the Missouri market, where maintaining a lead requires continuous innovation and market engagement.

Competitive Landscape

In the competitive landscape of the Missouri flower category, Elevate Cannabis Co has experienced a notable decline in rank from December 2024 to March 2025, moving from 21st to 29th position. This decline is juxtaposed against the performance of competitors such as Sublime, which saw an improvement in rank from 32nd to 28th over the same period, and Honey Green, which maintained a stable presence in the top 30, peaking at 27th in March 2025. Meanwhile, Cookies showed a significant recovery, climbing from an absence in the top 20 in January 2025 to 30th by March 2025. Despite these shifts, Elevate Cannabis Co's sales in March 2025 saw a slight rebound compared to February, indicating potential for recovery. However, the brand faces stiff competition from Vertical (MO), which, despite a dip in March, had a stronger overall sales trajectory earlier in the year. These dynamics suggest that Elevate Cannabis Co needs to strategize effectively to regain its competitive edge in the Missouri flower market.

Notable Products

In March 2025, the top-performing product for Elevate Cannabis Co was Grapefruit Durban (3.5g) in the Flower category, which climbed to the number one rank, moving up from its consistent second place in previous months, with sales reaching 6,958 units. Headband Cookies (3.5g) also in the Flower category, slipped to second place after maintaining the top spot from December 2024 through February 2025. Grapefruit Durban Pre-Roll (1g) showed significant improvement, advancing from fifth to third place in the Pre-Roll category. Mac & Cheese Pre-Roll (1g) saw a slight decline, dropping from third to fourth place. Hell's OG (3.5g) re-entered the rankings in March 2025 at fifth place, after not being ranked in February.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.