Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

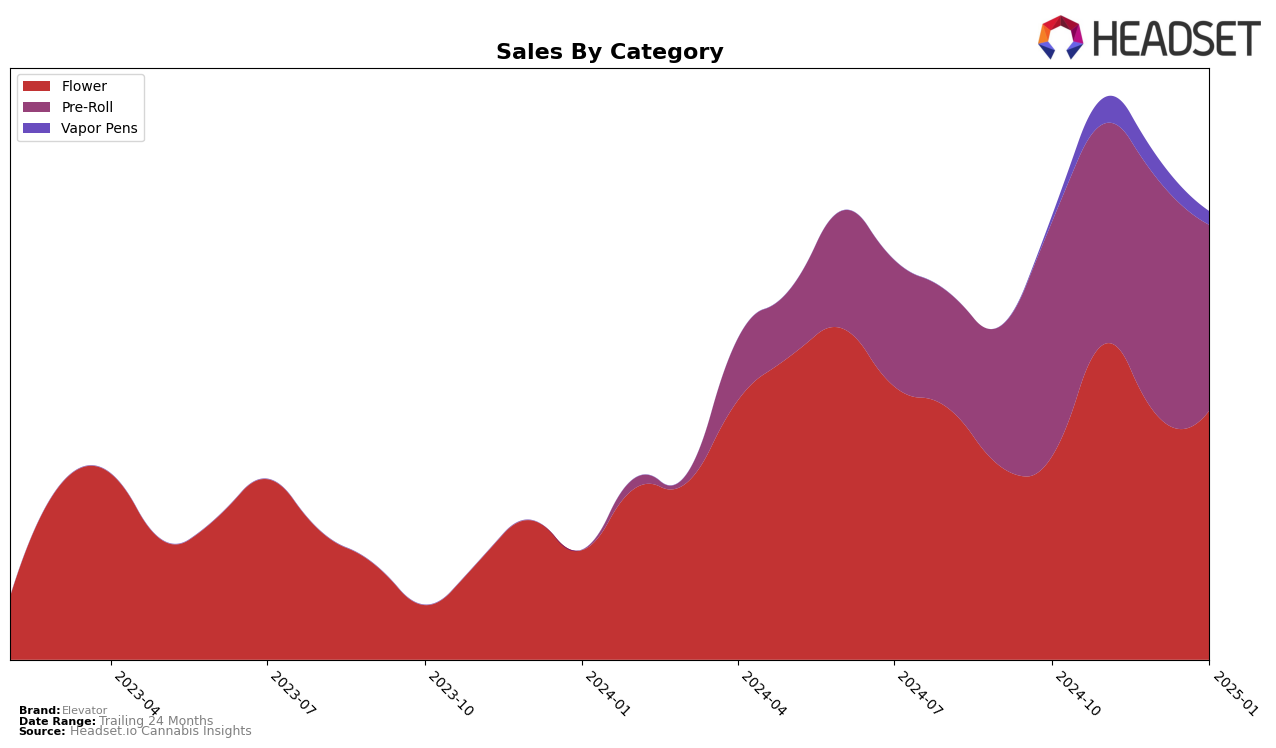

Elevator has shown a strong presence in the Saskatchewan market, particularly in the Flower and Pre-Roll categories. In both these categories, Elevator maintained the top rank for October and November 2024, indicating a strong consumer preference and robust sales performance. However, by December 2024 and January 2025, there was a slight decline in their ranking to third place in the Flower category. This movement could suggest increased competition or shifts in consumer preferences. Despite this, Elevator's consistent presence in the top three highlights its strong brand recognition and market penetration in Saskatchewan's Flower and Pre-Roll segments.

In the Vapor Pens category, Elevator's performance was less dominant in Saskatchewan. Starting with no ranking in October 2024, the brand entered the top 30 in November and December, reaching the 29th position in December. However, by January 2025, Elevator fell out of the top 30, which could be seen as a challenge for the brand in this category. This fluctuation indicates potential volatility or a need for strategic adjustments to capture a larger market share in Vapor Pens. The data suggests that while Elevator excels in certain categories, there is room for growth and improvement in others.

Competitive Landscape

In the competitive landscape of the flower category in Saskatchewan, Elevator has experienced notable shifts in its market position over the past few months. Initially holding the top rank in October and November 2024, Elevator saw a decline to the third position by December 2024 and maintained this rank into January 2025. This change in rank coincides with the rise of The Loud Plug, which climbed from the seventh position in October 2024 to secure the top spot by December 2024, maintaining it in January 2025. Meanwhile, Bake Sale made a significant leap from being outside the top 20 to the second position by January 2025. Despite these shifts, Elevator's sales have remained relatively stable, indicating a resilient customer base. However, the competitive pressure from rapidly ascending brands like The Loud Plug and Bake Sale suggests that Elevator may need to innovate or adjust its strategies to reclaim its leadership position in the Saskatchewan flower market.

Notable Products

In January 2025, the top-performing product for Elevator was Sativa Pre-Roll (0.5g) in the Pre-Roll category, maintaining its number one rank from December 2024, despite a slight drop in sales to 2771 units. Following closely, Fives Pre-Roll 5-Pack (2.5g) held steady at the second position, showing consistent performance over the months. Indica Pre-Roll (0.5g) slipped to third place after topping the charts in December 2024. A new entry, Animal House Haze Pre-Roll 3-Pack (1.5g), debuted at fourth place, indicating a strong market reception. Lastly, Indica Pre-Roll 5-Pack (2.5g) rounded out the top five, experiencing a rank drop from fourth to fifth, reflecting a decrease in sales momentum.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.