Apr-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

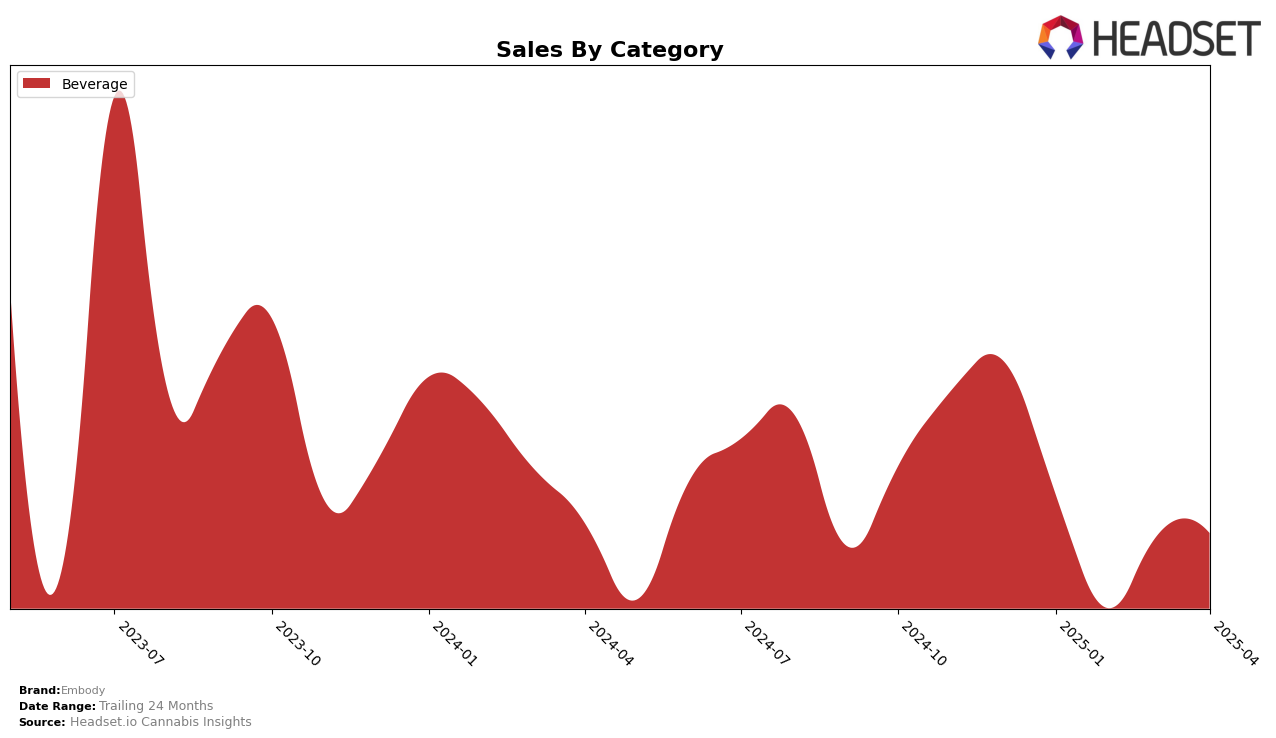

Embody has shown a consistent presence in the Beverage category in Ontario, maintaining its position within the top 30 brands throughout the first four months of 2025. Notably, Embody's rank slightly fluctuated between 23rd and 25th, indicating a stable yet competitive performance in the market. Despite the fluctuations, the brand managed to recover from a dip in sales seen in February, with sales figures rebounding in March and April. This suggests a potential seasonal or promotional influence that might have affected consumer purchasing behavior during this period.

While Embody's steady ranking in Ontario's Beverage category suggests resilience, the absence of rankings in other states or provinces within the top 30 indicates possible areas for growth or market entry. The brand's ability to maintain its ranking despite a competitive environment in Ontario highlights its established presence, yet the lack of visibility in other regions could be seen as a missed opportunity for expansion. The data implies that while Embody has a foothold in Ontario, there might be untapped potential in other markets that could be explored to enhance their brand footprint across different states and provinces.

Competitive Landscape

In the competitive landscape of the beverage category in Ontario, Embody has experienced fluctuating rankings, maintaining a position within the top 25 but never breaking into the top 20 from January to April 2025. Embody's rank shifted from 23rd in January to 25th in February, then improved slightly to 24th in March, and returned to 23rd in April. This indicates a relatively stable but unremarkable presence in the market. In contrast, Summit (Canada) and Deep Space have shown more dynamic movements, with Summit briefly exiting the top 20 in February and March but reclaiming the 19th spot in March. Meanwhile, Deep Space consistently hovered around the 20th position, indicating stronger market penetration than Embody. Dulces also demonstrated a notable decline, dropping from 19th in January to 24th in April, aligning closely with Embody's performance. These insights suggest that while Embody maintains a consistent presence, it faces stiff competition from brands like Summit and Deep Space, which have shown resilience and stronger sales momentum, potentially impacting Embody's market share and sales growth.

Notable Products

In April 2025, Embody's top-performing product was the CBD/THC Peach + Ginger White Sparkling White Tea from the Beverage category, maintaining its rank at number one for the fourth consecutive month with sales reaching 1,907 units. The CBD/THC Blood Orange + Rosemary Tea also held steady in second place, although its sales figures slightly declined compared to previous months. Notably, both products have consistently been the top two since January 2025, demonstrating strong consumer preference and market stability. The Peach + Ginger variant's sales saw a significant increase from March to April, indicating a growing demand. This consistency in rankings highlights the popularity and customer loyalty towards these specific tea products from Embody.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.