Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

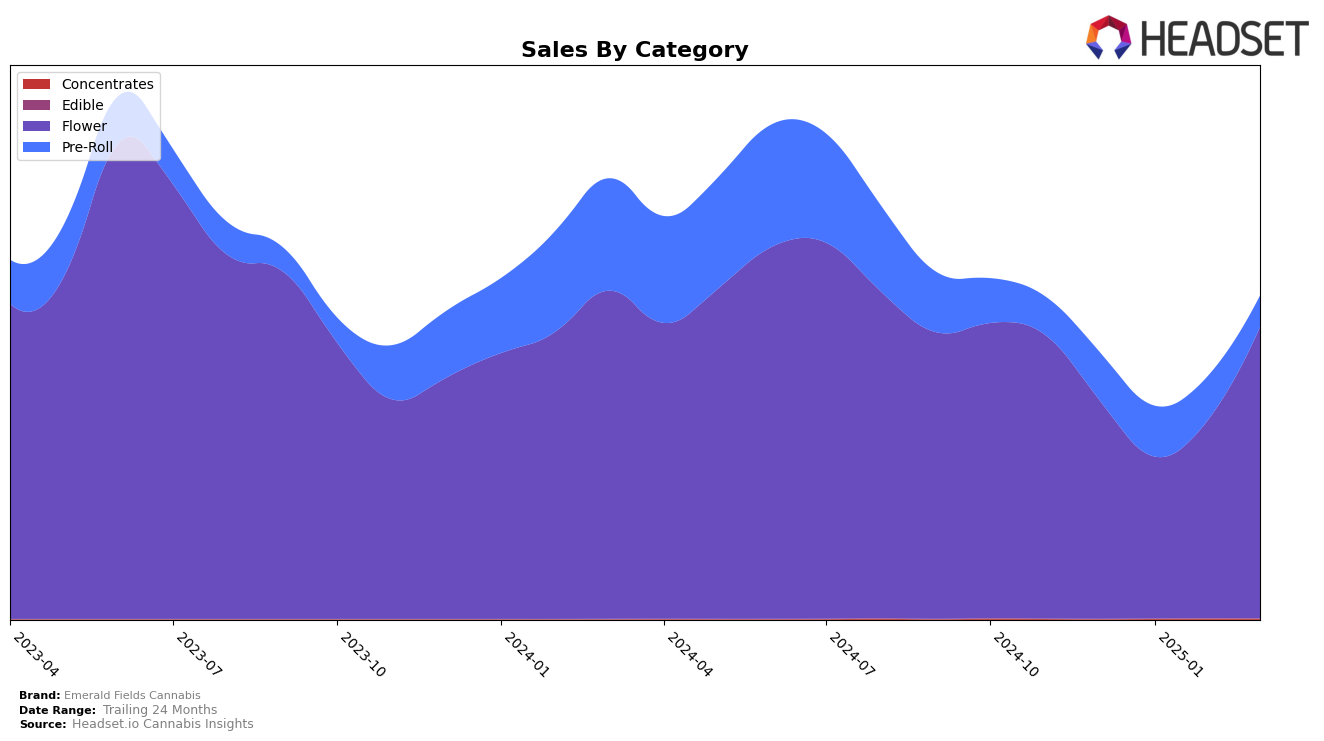

Emerald Fields Cannabis has demonstrated notable performance in the Oregon market, particularly within the Flower category. The brand has seen significant upward movement, climbing from the 22nd position in January 2025 to the 8th position by March 2025. This positive trend is underscored by a substantial increase in sales from January to March, indicating a strong consumer demand for their Flower products. However, the brand's absence from the top 30 in certain months for other categories suggests areas where improvements could be made or where market conditions might not be as favorable.

In contrast, Emerald Fields Cannabis's performance in the Pre-Roll category in Oregon reflects a more challenging market environment. Despite being ranked 32nd in January 2025, the brand experienced a decline to the 43rd position by March 2025. This downward trend coincides with a decrease in sales, highlighting potential competitive pressures or shifts in consumer preferences within the Pre-Roll segment. The brand's struggle to consistently remain within the top 30 across all categories suggests a need for strategic adjustments to capture more market share and improve brand presence.

Competitive Landscape

In the competitive landscape of the Oregon flower category, Emerald Fields Cannabis has experienced notable fluctuations in its ranking and sales performance. Starting from December 2024, Emerald Fields Cannabis held the 11th position, but it dropped out of the top 20 in January 2025, indicating a significant decline in market presence. However, it rebounded to the 12th rank in February 2025 and further improved to the 8th position by March 2025, showcasing a strong recovery. This upward trend in ranking aligns with a substantial increase in sales from February to March 2025. In contrast, competitors like Grown Rogue and Otis Garden maintained higher rankings throughout the same period, though Grown Rogue experienced a decline from 2nd to 7th place by March 2025. Meanwhile, High Tech and Kaprikorn also saw varying ranks, with High Tech dropping from 3rd to 10th and Kaprikorn maintaining a relatively stable position. These dynamics suggest that while Emerald Fields Cannabis faces stiff competition, its recent sales surge indicates potential for further growth and increased market share in the Oregon flower category.

Notable Products

In March 2025, the top-performing product for Emerald Fields Cannabis was Apples and Bananas x Garlikoff Diamond Infused Pre-Roll, which soared to the number one rank with sales totaling 1910 units. Frosted Bubba (Bulk) followed closely in second place, marking its strong presence in the Flower category. Garlic Banana x Glitter Bomb Diamond Infused Pre-Roll improved its position from fifth to third place, indicating a positive sales trend. Champagne Showers x Tropsantos Diamond Infused Pre-Roll experienced a slight drop from first to fourth place compared to February 2025. Mimosa (28g) maintained its position in the top five, showcasing consistent demand in the Flower category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.