Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

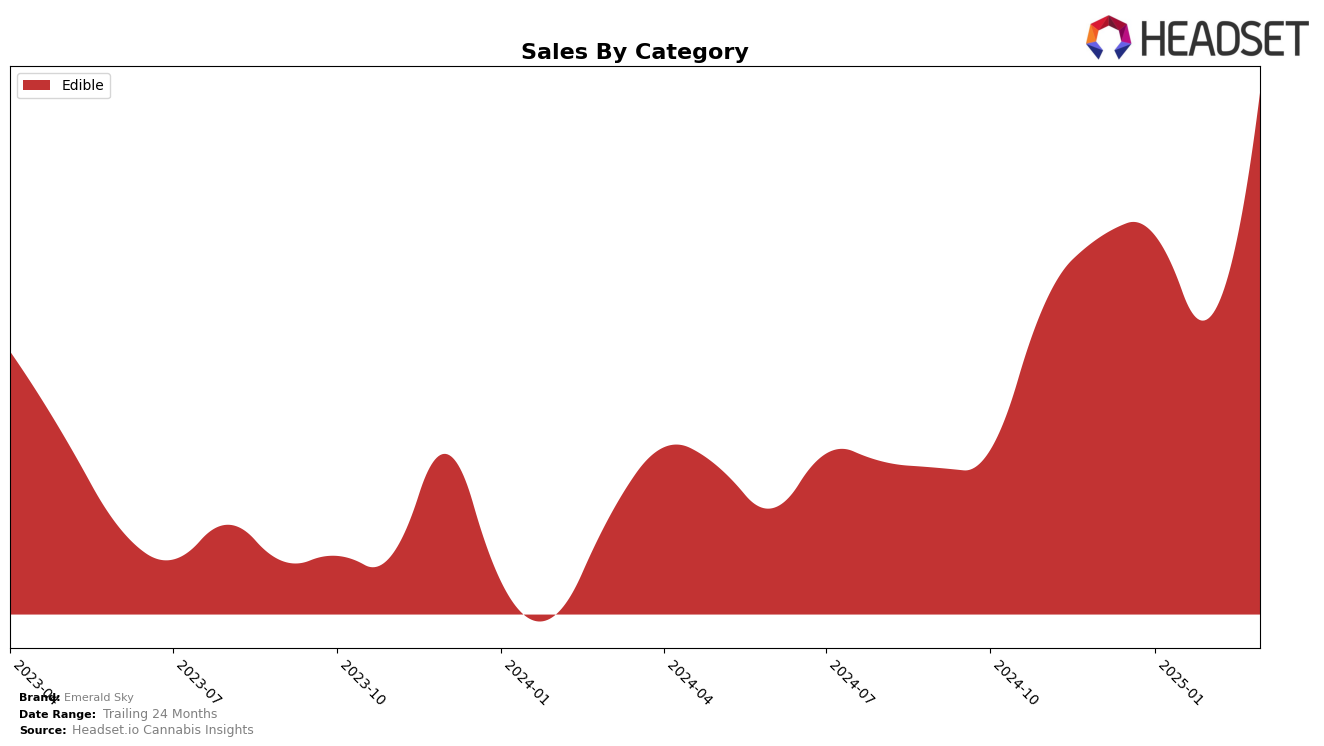

Emerald Sky has demonstrated consistent performance in the California edible category, maintaining a steady presence in the top 10 rankings from December 2024 through March 2025. The brand's ranking improved slightly from 11th in December 2024 to 10th place in January 2025, where it remained through March. This stability in rank suggests a strong foothold in the competitive California market, where Emerald Sky has managed to sustain its position amidst fluctuating sales volumes. Notably, March 2025 saw a significant uptick in sales, indicating a potential seasonal boost or successful marketing strategy that month.

While Emerald Sky's performance in California is commendable, the absence of rankings in other states or provinces implies that the brand has not yet broken into the top 30 in those areas. This could be seen as a limitation in their market reach or a strategic focus on California. The consistent ranking within the top 10 in the California edible category, however, highlights their strength and potential for growth if they choose to expand their geographical focus. This performance analysis suggests that while Emerald Sky is a key player in California, there is untapped potential in other markets that could be explored for future growth opportunities.

Competitive Landscape

In the competitive landscape of the California edible cannabis market, Emerald Sky has maintained a consistent rank of 10th from December 2024 through March 2025. This stability in ranking indicates a solid market presence, although it faces stiff competition from brands like Drops, which has consistently ranked just above Emerald Sky at 9th place during the same period. Notably, Plus has held a strong 8th position, suggesting a significant gap in market share that Emerald Sky might aim to close. Despite a slight dip in sales in February 2025, Emerald Sky's sales rebounded in March 2025, showcasing resilience and potential for growth. Meanwhile, ABX / AbsoluteXtracts has shown an upward trend, moving from 16th to 12th place, which could pose a future threat if their momentum continues. Overall, while Emerald Sky holds a stable position, the competitive dynamics suggest opportunities for strategic initiatives to enhance its market standing.

Notable Products

In March 2025, the top-performing product for Emerald Sky was the Berry Blaze Gummy (100mg) in the Edible category, maintaining its consistent first-place ranking from previous months with sales of 8109. The Melon Thunder Hybrid Gummy (100mg) also held its second-place position, showcasing stable performance. The Indica Peanut Butter Dark Chocolate Cups 10-Pack (100mg) remained in third place, despite a dip in sales compared to February. Grape Quake High Dose Gummy (100mg) improved its ranking to fourth place, up from fifth in February. Notably, the Strawberry Slam Gummy (100mg) entered the rankings in March at fifth place, indicating a positive reception among consumers.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.