Jul-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

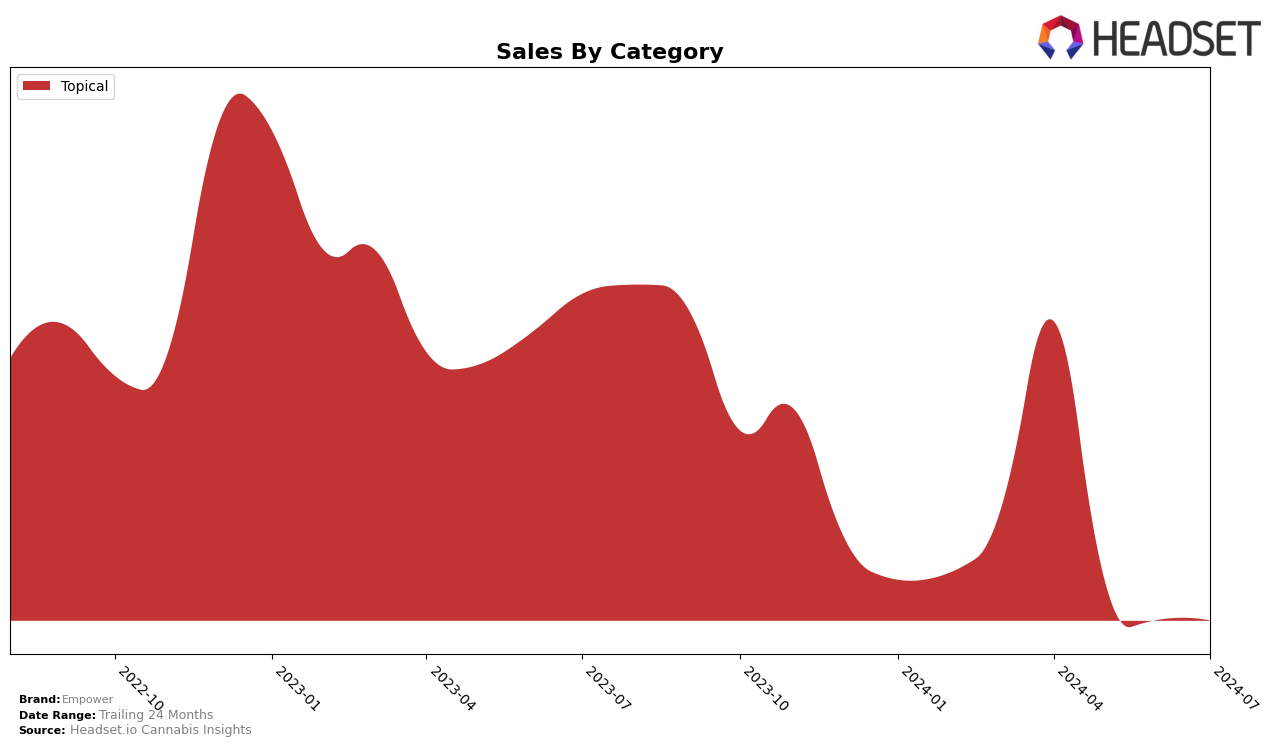

Empower has shown a notable performance in the Topical category within the state of Oregon. In April 2024, Empower was ranked 4th, which is a strong position considering the competitive nature of the cannabis market. However, it is important to note that Empower did not appear in the top 30 brands for the months of May, June, and July 2024. This absence from the rankings could be indicative of either a decline in sales or increased competition from other brands. The significant drop in ranking suggests that Empower may need to reassess its market strategies to regain its position.

Across other states and categories, the performance of Empower remains less clear due to the lack of available ranking data. The brand's absence from the top 30 in multiple months could be seen as a negative indicator of its market penetration and consumer preference. However, it's also possible that Empower is focusing its efforts on specific markets or product lines not captured in this dataset. The initial strong showing in Oregon's Topical category demonstrates potential, but the subsequent drop-off highlights the challenges faced in maintaining a consistent market presence.

Competitive Landscape

In the Oregon Topical cannabis market, Empower has shown notable fluctuations in its competitive positioning over recent months. In April 2024, Empower held the 4th rank, but it did not appear in the top 20 for May, June, or July, indicating a significant drop in market presence. This decline contrasts with the consistent performance of Synergy Skin Worx, which maintained its 3rd rank throughout the same period, suggesting a stable customer base and potentially better market strategies. Meanwhile, Peak Extracts and Angel (OR) both showed more dynamic movements, with Peak Extracts fluctuating between the 4th and 5th ranks and Angel (OR) moving from 5th to 4th and then to 6th. These shifts highlight a competitive landscape where Empower's absence from the top ranks could signal a need for strategic adjustments to regain market share and improve sales performance.

Notable Products

In July 2024, the top-performing product for Empower was THC Roll on (30ml, 1oz), which secured the first rank with a notable sales figure of 23 units. Black Label - 4Play Sensual Oil (150mg THC, 5ml) followed closely in second place, showing a consistent rise from fourth in April and third in May. White Label - CBD Peppermint Juniper Topical Relief Lotion (175mg CBD, 50ml) maintained its strong performance, ranking third after being second in June. White Label - CBD Soaking Salts (500mg CBD, 16oz) made its debut in the rankings at the third position. Black Label - Lavender x Bergamot Soaking Salts (80.4mg CBD, 72mg THC, 16oz), which was second in June, did not appear in the top ranks for July.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.