Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

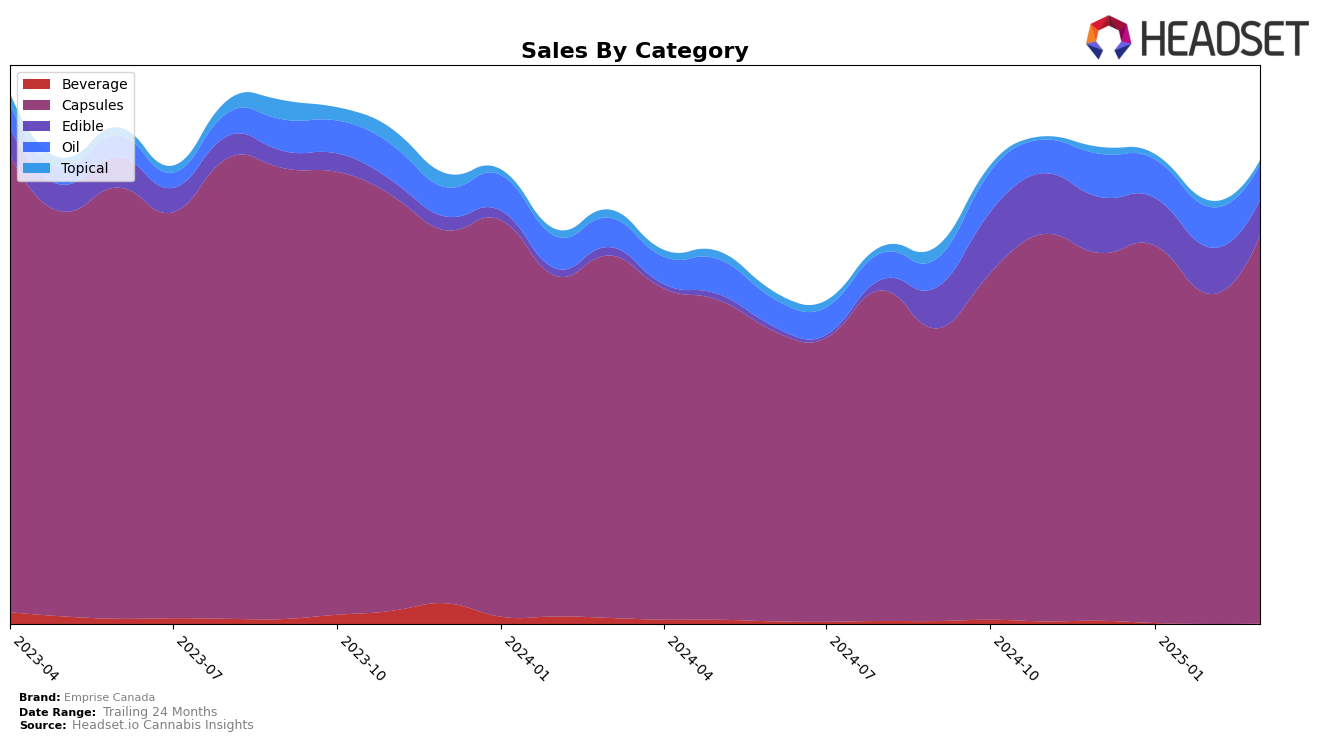

Emprise Canada's performance in the Alberta market has shown notable fluctuations across different categories. In the Capsules category, the brand maintained a strong presence, consistently ranking within the top 6 from December 2024 to March 2025, peaking at 4th place in January and February. However, in the Edibles category, Emprise Canada experienced more variability, with rankings ranging from 14th to 19th over the same period. This suggests a more stable foothold in Capsules compared to Edibles in Alberta, highlighting potential areas for growth or strategic focus in the latter category.

In British Columbia, Emprise Canada has demonstrated consistent strength in the Capsules category, maintaining a solid 2nd place ranking throughout the observed months. This indicates a strong market position and consumer preference for Capsules in this province. Conversely, their performance in the Oil category began with an absence in the top 30 in December 2024, but they quickly climbed to 12th by January 2025 and held steady around 11th place in subsequent months. This upward trend in Oils suggests growing consumer interest and potential for further market penetration. Meanwhile, in Ontario, the brand consistently held the 5th position in Capsules, while showing some volatility in the Oil category, with rankings fluctuating between 14th and 18th. This indicates a strong but potentially saturating market for Capsules, while Oils may offer opportunities for strategic growth.

Competitive Landscape

In the Ontario cannabis capsules market, Emprise Canada consistently held the 5th rank from December 2024 through March 2025. Despite maintaining its position, the brand faced fluctuating sales, with a noticeable decline from December to February, before a slight recovery in March. This stability in rank amidst sales volatility suggests that while Emprise Canada is a strong contender, it faces stiff competition from brands like Tweed and Glacial Gold, which consistently ranked higher. Tweed maintained a solid 3rd position with significantly higher sales figures, indicating a robust market presence. Meanwhile, Glacial Gold also held its 4th position with sales figures that, although declining, remained above those of Emprise Canada. The competitive landscape highlights the need for Emprise Canada to strategize on boosting sales to climb the ranks in this dynamic market.

```

Notable Products

In March 2025, THC Light Year Softgels 30-Pack (300mg) maintained its position as the top-performing product for Emprise Canada, leading the sales with 3121 units sold. The CBD/THC 1:1 Softgels 15-Pack (150mg CBD, 150mg THC) rose to the second spot, despite a slight drop in sales compared to previous months. Rapid - Grape Sativa Soft Chew (10mg) secured the third position, experiencing a decline from its February rank. Rapid- Blue Raz Indica Gummy (10mg) fell to fourth place, continuing its downward trend since December 2024. Notably, the CBN/CBD 1:5 Softgels 30-Pack (300mg CBN, 1500mg CBD) reappeared in the rankings at fifth place, marking a return after not being ranked in February.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.