Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

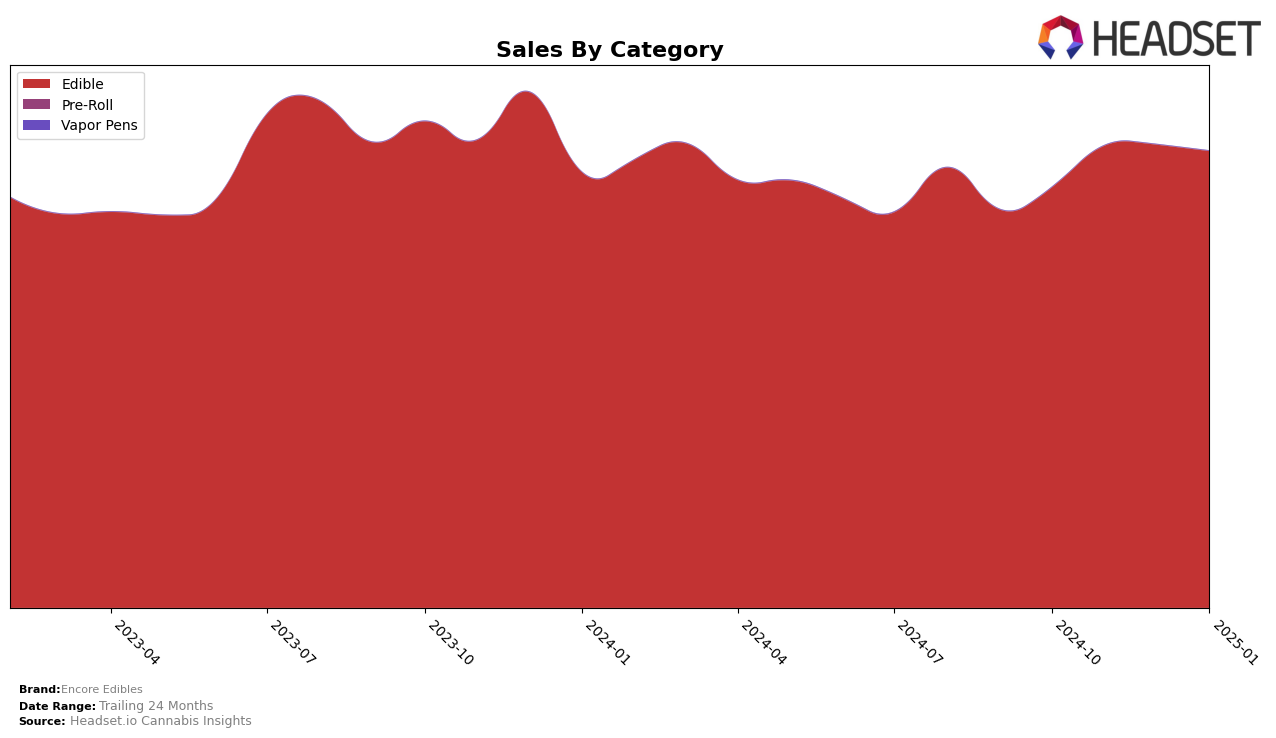

Encore Edibles has demonstrated a consistent performance in the Illinois edibles market, maintaining a steady rank of 4th from October 2024 through January 2025. This stability indicates a strong foothold in the state, with sales figures showing a slight fluctuation but remaining robust overall. In contrast, the brand's performance in Massachusetts has been more variable, with rankings moving from 17th in October 2024, improving to 14th in November and December, before dropping to 18th in January 2025. This decline in rank, coupled with a noticeable decrease in sales during January, suggests potential challenges in maintaining market share in Massachusetts.

In Maryland, Encore Edibles has shown resilience, holding the 3rd position in October, November, and January, with a slight dip to 5th in December 2024. This slight fluctuation indicates a competitive landscape but overall strong market presence. Meanwhile, in Ohio, Encore Edibles has exhibited impressive upward mobility, climbing from 6th place in October to 2nd by January 2025. This positive trend in Ohio reflects growing consumer preference and effective market strategies. The absence of Encore Edibles from the top 30 rankings in other states or categories suggests areas where the brand might not have a significant presence or is facing stronger competition.

Competitive Landscape

In the competitive landscape of the Illinois edibles market, Encore Edibles consistently maintained its position at rank 4 from October 2024 through January 2025. Despite a steady rank, Encore Edibles faces stiff competition from brands like Wyld and Wana, which have held higher ranks during the same period. Notably, Wana has shown a strong performance, securing the second rank consistently, while Wyld fluctuated slightly but remained in the top three. Although Encore Edibles' sales figures increased from October to November 2024, they experienced a slight decline in December 2024 and January 2025, indicating a potential challenge in maintaining momentum against these leading competitors. Meanwhile, Ozone and Lost Farm have shown more variability in their rankings, with Ozone dropping to eighth place in November and December before climbing back to sixth in January, suggesting opportunities for Encore Edibles to capitalize on market shifts and improve its standing.

Notable Products

In January 2025, Encore Edibles' top-performing product was the Sour Black Cherry RSO Gummies 10-Pack (100mg), which climbed to the number one rank with sales of 13,209 units. This product showed a consistent upward trend, moving from fourth place in October and November 2024, to second in December 2024. The Indica Concord Grape RSO Gummies 10-Pack (100mg) secured the second spot, improving from its fourth-place ranking in December. Sativa Tropical Mango RSO Gummies 10-Pack (100mg), which had been the top product from October to December 2024, fell to third place. The Indica Sweet Berry Burst Gummies 10-Pack (100mg) ranked fourth, while Strawberry Gummies 10-Pack (100mg) remained in fifth place, maintaining its consistent ranking over the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.