Sep-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

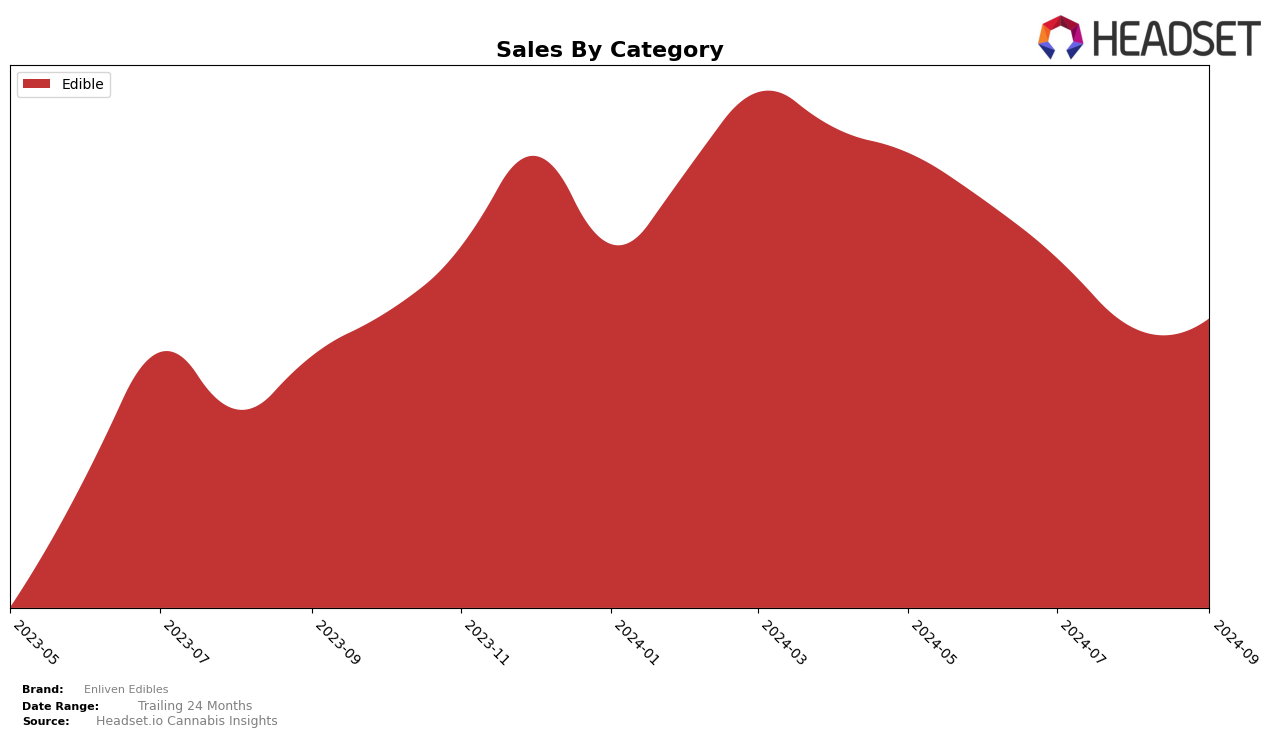

Enliven Edibles has experienced a gradual decline in its ranking within the Edible category in Illinois over the past few months. Starting at position 23 in June 2024, the brand slipped to 27 by September 2024. This downward trajectory is mirrored in their sales figures, which have decreased from $236,692 in June to $169,556 by September. This suggests a potential challenge in maintaining market share or consumer interest in this state. The consistent presence within the top 30, however, indicates that while they are facing competitive pressures, they still hold a significant position in the market.

Interestingly, Enliven Edibles has not appeared in the top 30 brands for any other states or categories during this period. This absence could be interpreted as a missed opportunity for expansion or a focus on maintaining their current standing in Illinois. The lack of presence in other states might suggest a strategic decision to concentrate efforts within a specific market, or it could highlight potential areas for growth and diversification. Understanding the dynamics of their performance in Illinois might offer insights into how they could replicate or improve their standing in other regions.

Competitive Landscape

In the Illinois edibles market, Enliven Edibles has experienced a noticeable decline in its ranking over the past few months, dropping from 23rd in June 2024 to 27th by September 2024. This trend highlights a competitive landscape where brands like DIBZ and Midweek Friday have shown stronger performances. Notably, Midweek Friday surged to 17th place in July and August before falling back to 26th in September, indicating a volatile but competitive presence. Meanwhile, DIBZ maintained a more stable rank, staying within the top 25 for most of the period. The sales data suggest that while Enliven Edibles' sales have decreased, competitors like Bubby's Baked have seen fluctuations, with a peak in August. This competitive pressure underscores the need for Enliven Edibles to innovate and adapt to regain its footing in the market.

Notable Products

In September 2024, Fruity Flintstoned Cereal Bar 5-Pack (100mg) maintained its position as the top-performing product for Enliven Edibles, despite a slight decrease in sales to 1725. Cinnamon Toast Munch Crispy Cereal Bar (100mg) held steady at the second rank, showing a consistent increase in sales from previous months. Cookies and Cream Cereal Bar 5-Pack (100mg) re-entered the rankings in third place, indicating a resurgence in popularity. Chocolate Chip Cookies (10mg) dropped to fourth place, a notable change from its peak as the top product in July 2024. Lastly, Chocolate Chip Cookies 10-Pack (100mg) rounded out the top five, despite a decline in sales compared to earlier months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.