Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

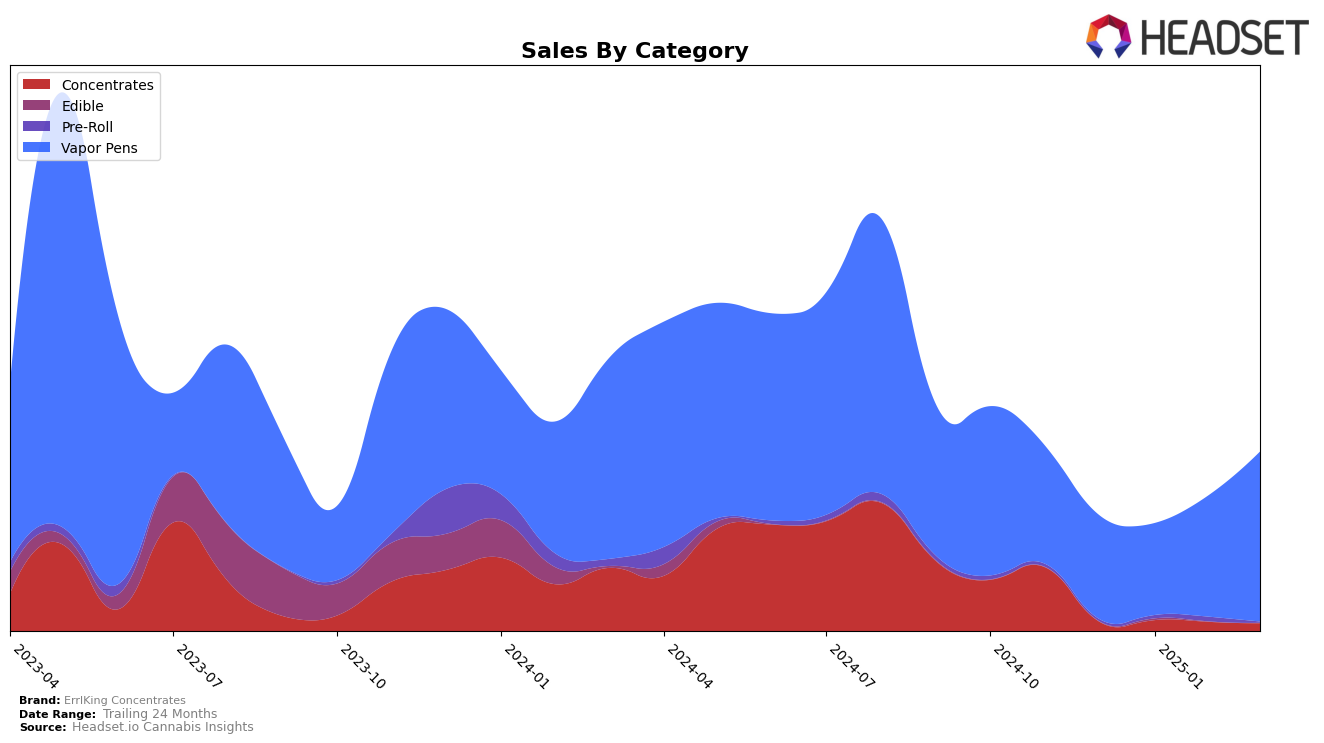

ErrlKing Concentrates has shown varied performance across different categories and states. In the Concentrates category within Michigan, the brand did not make it into the top 30 rankings from December 2024 through March 2025, indicating a challenging market position in this category. This lack of visibility in the top rankings could suggest that ErrlKing Concentrates is facing stiff competition or possibly needs to reevaluate its strategies in this segment. The absence from the top 30 in consecutive months highlights an area for potential improvement or a shift in focus to strengthen their presence.

Conversely, in the Vapor Pens category in Michigan, ErrlKing Concentrates has demonstrated impressive upward momentum. Starting from the 41st position in December 2024, the brand climbed to the 23rd position by March 2025. This significant rise in ranking suggests effective market strategies or increased consumer demand in this category. The upward trend in sales figures, notably with a single month's sales reaching over $400,000, underscores the brand's growing influence and successful penetration in the Vapor Pens market. This positive trajectory in Michigan's Vapor Pens category could be a promising indicator of ErrlKing Concentrates' potential for future growth and expansion.

Competitive Landscape

In the competitive landscape of the Michigan vapor pens market, ErrlKing Concentrates has demonstrated a notable upward trajectory in brand rank from December 2024 to March 2025. Starting at rank 41 in December, ErrlKing climbed to rank 23 by March, showcasing a significant improvement in market presence. This upward movement is particularly impressive when compared to competitors such as Redbud Roots, which consistently hovered around the 20th rank but did not break into the top 20, and Magic, which improved from rank 29 to 24 during the same period. Meanwhile, Amnesia experienced a decline from rank 16 to 22, and Giggles showed a modest improvement from rank 28 to 25. ErrlKing's sales growth is also noteworthy, as it saw a substantial increase from February to March, surpassing the sales of Magic and Giggles, and closing the gap with Amnesia. This positive trend indicates a strengthening market position for ErrlKing Concentrates, suggesting potential for continued growth and increased consumer interest in their products.

Notable Products

In March 2025, Gummy Shark Distillate Cartridge (1g) remained the top-performing product for ErrlKing Concentrates, maintaining its rank at number one with sales reaching 5,592 units. King's Choice - Watermelon Zkittles Distillate Cartridge (1g) saw a significant rise from fourth place in February to second place in March, with sales of 5,446 units. King's Choice - Strawberry Cough Distillate Cartridge (1g) entered the rankings at third place, indicating strong performance. Sour Diesel Distillate Cartridge (1g) debuted at fourth place, while King's Choice - Blackberry Kush Distillate Cartridge (1g) dropped from third to fifth place compared to February. The Vapor Pens category appears to be a consistent top performer for ErrlKing Concentrates, with several products showing notable sales increases.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.