Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

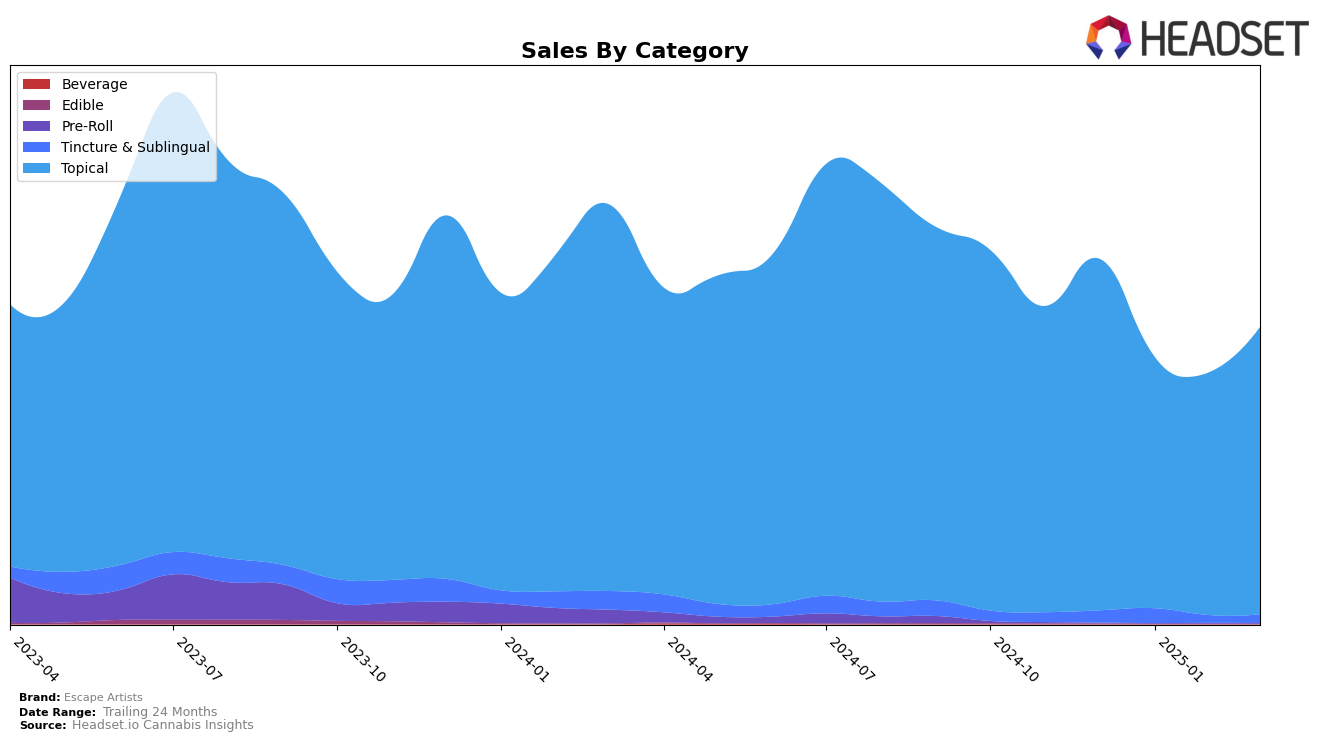

Escape Artists has shown a consistent performance in the Colorado market, particularly within the Topical category, where they maintained the top position from December 2024 through March 2025. This stability highlights their strong hold and consumer preference in this segment. In the Tincture & Sublingual category, they experienced some fluctuations, with a peak at the second position in January 2025 before settling at fourth place in March. This indicates a competitive landscape in this category, suggesting opportunities for growth or a need to strategize to regain higher rankings.

In other states, Escape Artists' performance in the Topical category varies. In Michigan, they consistently held the fifth position for the first three months of 2025 but did not rank in the top 30 in March, which could be seen as a concerning trend. Conversely, in Missouri, they maintained a solid second place consistently, reflecting strong brand recognition and consumer loyalty. Similarly, in New Jersey, they held the second position, albeit with fluctuating sales figures. Meanwhile, in Nevada, they remained steady at fourth place, suggesting a stable but competitive presence in the market.

Competitive Landscape

In the competitive landscape of the Colorado topical cannabis market, Escape Artists has consistently maintained its position as the leading brand from December 2024 through March 2025. Despite fluctuations in sales, Escape Artists has retained the top rank, demonstrating strong brand loyalty and market presence. Competitors such as Mary's Medicinals and Mary Jane's Medicinals have consistently held the second and third positions, respectively, but their sales figures are notably lower than those of Escape Artists. This indicates that while these brands are stable in their rankings, they are not closing the gap in sales, suggesting that Escape Artists' strategies in product innovation or customer engagement may be more effective. The consistent top ranking of Escape Artists highlights its dominance and suggests a strong competitive advantage in the Colorado market.

Notable Products

In March 2025, the CBD/CBG/THC 2:1:2 Cedar & Black Pepper Relief Cream maintained its top position as the best-selling product for Escape Artists, recording sales of 1848. The CBD:CBG:CBN:THC 5:1:1:5 Eucalyptus + Lavender Relief Cream improved its rank from third to second, reflecting a notable increase in popularity with sales rising to 1147. The CBD/THC 20:1 Lavender Relief Cream climbed to third place from fifth, showing a significant recovery in its ranking. Meanwhile, the CBD/CBG/THC 2:1:2 Rose & Bergamot Relief Cream held steady in fourth place, consistent with its February ranking. The CBD/THC 1:1 Lavender Relief Cream dropped from second to fifth, indicating a decline in sales momentum.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.