Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

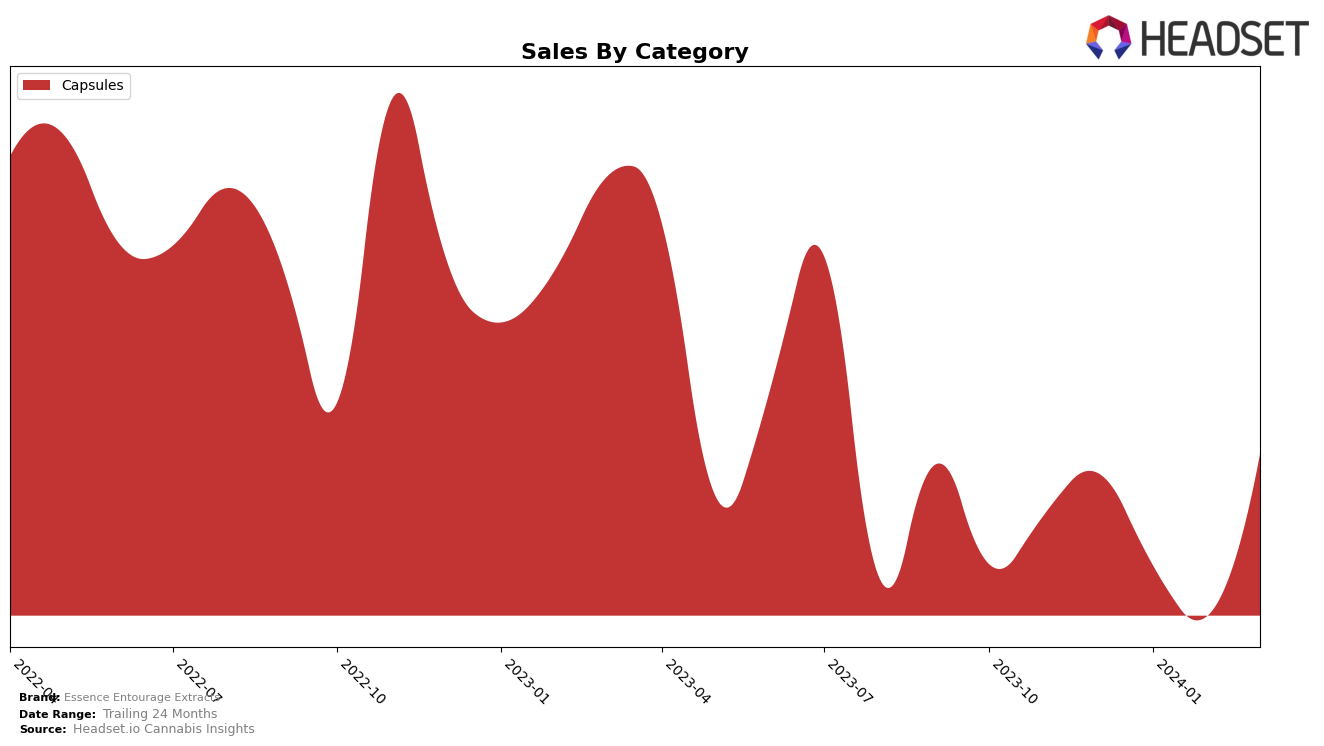

In the competitive landscape of the Washington cannabis market, Essence Entourage Extracts has demonstrated a consistent performance in the capsules category. The brand maintained a strong presence among the top 10 brands, with slight fluctuations in rankings from December 2023 to March 2024. Specifically, Essence Entourage Extracts held the 6th position in December 2023, experienced a minor drop to the 7th position in January and February 2024, and then rebounded to the 6th position by March 2024. This movement indicates a stable demand for their capsule products within the state, despite a slight dip in sales from December 2023 to February 2024, before seeing an increase again in March 2024. The sales figures, starting at 6331 units in December and dipping to 4361 units in February before rising to 6636 units in March, suggest a potential seasonal fluctuation or a successful marketing effort that led to the March rebound.

While the provided data focuses solely on the Washington state market, it's indicative of Essence Entourage Extracts' ability to navigate the competitive landscape of cannabis capsules. The brand's performance, particularly the recovery in rankings and sales in March 2024, suggests resilience and a potentially loyal customer base. However, without data from other states or categories, it's challenging to gauge the overall performance of Essence Entourage Extracts across different markets or product lines. The brand's ability to maintain a top 10 ranking consistently over the observed months is commendable, yet the absence from the top 30 in other states or categories could point towards areas of opportunity or challenges in market penetration and brand recognition beyond the Washington capsules market.

Competitive Landscape

In the competitive landscape of the cannabis capsules category in Washington, Essence Entourage Extracts has experienced a fluctuation in its market position, as evidenced by its rank changes from December 2023 to March 2024. Initially ranked 6th in December, it dropped to 7th in January and February before climbing back to 6th in March. This shift in rank reflects a dynamic competitive environment, particularly against brands like Constellation Cannabis, which consistently held the 4th position with a notable increase in sales, and Fine Detail Greenway, maintaining the 5th spot but with a significant sales volume that suggests a strong consumer preference. Other competitors, such as Trail Blazin Productions and Northwest Cannabis Solutions, also show a consistent market presence, indicating a highly competitive market. The sales trends and rank changes suggest that while Essence Entourage Extracts is holding its ground, there is a clear opportunity for growth and improvement to increase its market share and consumer base in this category.

Notable Products

In March 2024, Essence Entourage Extracts saw Essence Indica - Northern Lights Swallowable Tablets 10-Pack (100mg) leading their sales chart with a notable figure of 191 units, maintaining its top position from February. Following closely was Essence Sativa - Acapulco Gold Swallowable Tablets 10-Pack (100mg), which slipped to the second rank after being the best-seller in January. The third spot was captured by Sativa Essence Tablets (100mg), which saw a significant jump in its ranking from fourth in February to third, showcasing a substantial increase in demand. CBD/THC 1:1 Catatonic Swallowable Tablets 10-Pack (100mg CBD, 100mg THC) ranked fourth, improving its position from the previous month. Lastly, making its first appearance on the list, Essence Indica - Blueberry Swallowable Tablets 10-Pack (100mg) entered the rankings directly at the fifth position, indicating a strong market entry.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.