Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

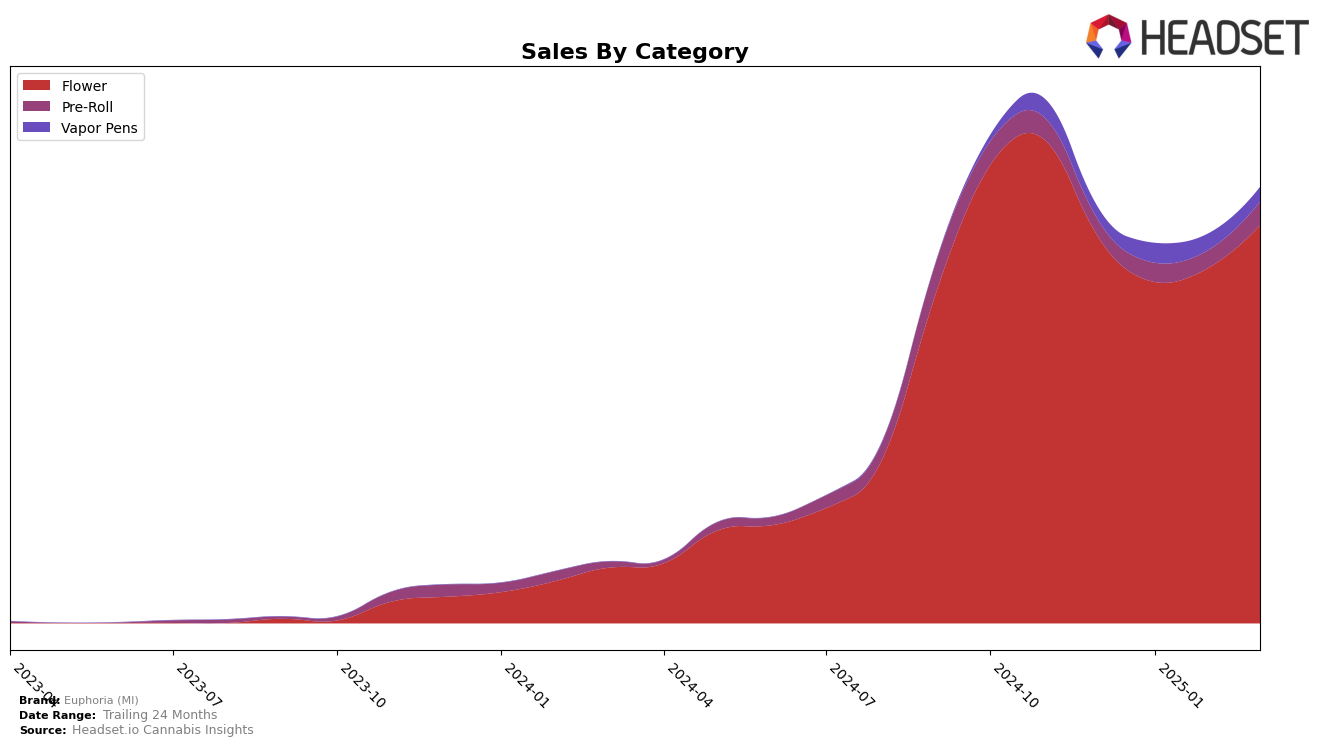

Euphoria (MI) has shown a dynamic performance across various categories in the state of Michigan. In the Flower category, Euphoria maintained a presence in the top 30 brands, with rankings fluctuating between 25th and 28th from December 2024 to March 2025. This consistent ranking indicates a stable demand for their Flower products, despite a slight dip in January 2025. However, their performance in the Pre-Roll category was less prominent, as they did not make it into the top 30 brands until March 2025, when they debuted at the 100th position. This late entry into the Pre-Roll market suggests either a recent product launch or a need for strategic improvements to enhance their market penetration.

In the Vapor Pens category, Euphoria (MI) made its mark by entering the rankings at 99th place in January and February 2025, though they fell out of the top 30 in March. This initial ranking highlights a potential growth opportunity in a competitive market segment. The sales figures for Vapor Pens indicate a decline from January to February, suggesting that while there is interest, the brand may need to focus on differentiation or marketing strategies to sustain and improve their position. The absence of Euphoria in the top 30 across multiple months in this category may point to challenges in establishing a strong foothold or could reflect broader market dynamics at play in Michigan.

Competitive Landscape

In the competitive landscape of the Michigan flower category, Euphoria (MI) has experienced fluctuating rankings, indicating a dynamic market presence. Despite not breaking into the top 20, Euphoria (MI) showed a promising improvement in February 2025, climbing to 25th place, before slipping back to 28th in March 2025. This movement suggests a volatile but potentially upward trajectory in sales performance. In contrast, Fluresh experienced a notable decline, dropping from 13th in December 2024 to 26th by March 2025, which could signal an opportunity for Euphoria (MI) to capture market share. Meanwhile, NOBO and Carbon have shown inconsistent rankings, with NOBO making a significant leap to 29th in March 2025 after a low of 69th in February, and Carbon fluctuating around the 30th position. High Profile has demonstrated a steady climb, reaching 27th in March 2025, posing a competitive challenge. These shifts highlight the competitive pressures and opportunities for Euphoria (MI) to enhance its market position in Michigan's flower category.

Notable Products

In March 2025, the top-performing product for Euphoria (MI) was 10K Jack Pre-Roll (1g) in the Pre-Roll category, maintaining its number one rank for four consecutive months with impressive sales of 6441 units. High Society Pre-Roll (1g) held steady in the second position, showing a consistent performance from February 2025. Early Riser Pre-Roll (1g) improved its ranking from fourth in February to third in March, indicating a positive sales trend. Apples & Bananas Premium Pre-Roll (1g) debuted in the rankings in February and secured the fourth position by March. Bog Walker (3.5g) in the Flower category maintained its fifth position from December 2024, despite a temporary absence from the rankings in January 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.