Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

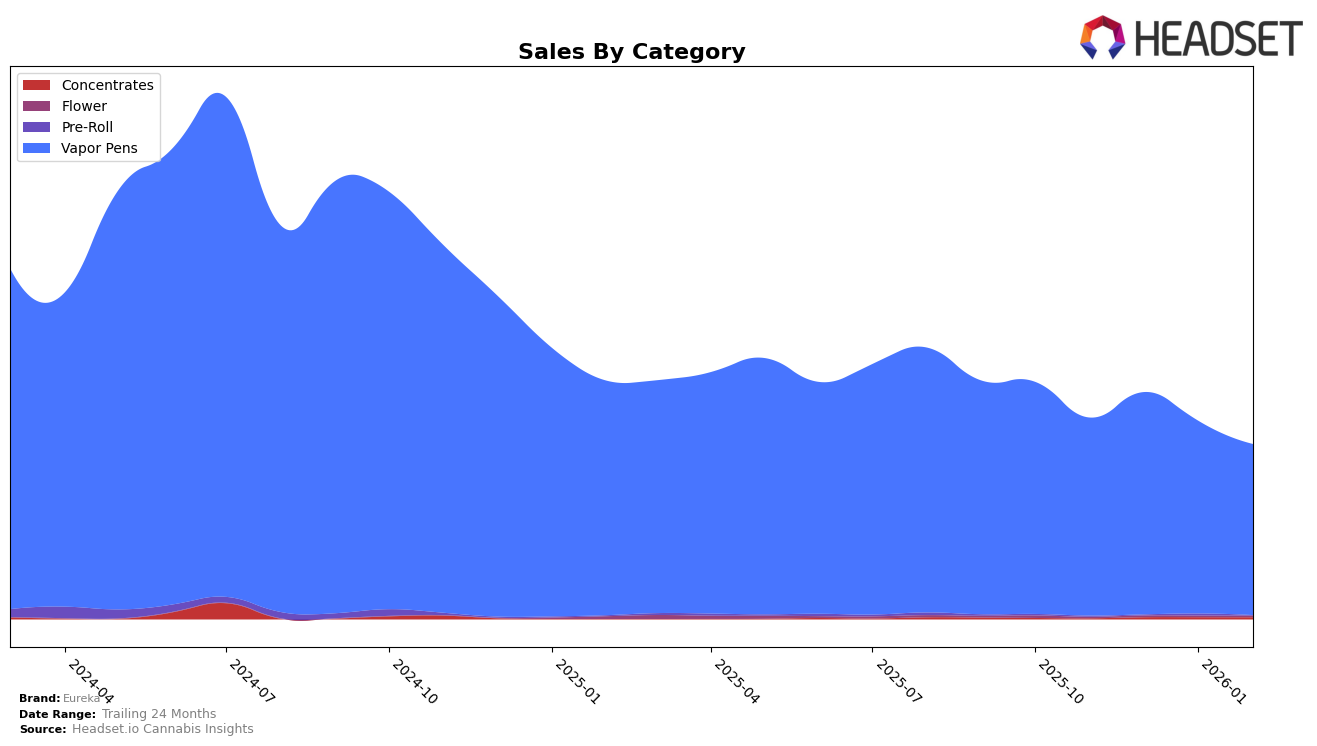

In California, Eureka's performance in the Vapor Pens category shows a subtle yet positive trend. From November 2025 to February 2026, the brand improved its ranking from 57th to 49th, indicating a gradual increase in market presence. However, despite this upward movement, Eureka did not break into the top 30 brands, which suggests that while they are gaining ground, there is still significant competition to overcome. In Colorado, the brand maintained a stronger position, consistently ranking within the top 20, although it experienced a slight dip from 12th in December 2025 to 16th in February 2026. This suggests some volatility in their performance in this market.

In contrast, Eureka's presence in Massachusetts was virtually non-existent until February 2026, when they entered the rankings at 91st place. This late entry indicates a new or renewed effort in the state, but their position outside the top 30 suggests considerable room for growth. Meanwhile, in New York, Eureka maintained a consistent presence, albeit at the lower end of the top 30, with rankings fluctuating slightly between 24th and 29th place over the months. This consistency in New York reflects a stable but modest foothold, highlighting the potential for strategic initiatives to boost their standing further in this competitive market.

Competitive Landscape

In the competitive landscape of Vapor Pens in New York, Eureka has experienced a downward trend in rank from November 2025 to February 2026, moving from 24th to 29th position. This decline in rank is accompanied by a decrease in sales, suggesting a potential challenge in maintaining market share. Notably, competitors like Dragonfly Cannabis have shown a positive trajectory, climbing from 42nd to 30th place, indicating a significant improvement in their market position. Meanwhile, Sapphire Farms and ghost. have also experienced fluctuations, with Sapphire Farms dropping from 18th to 28th and ghost. from 19th to 27th, reflecting a volatile market environment. Despite these shifts, Eureka's consistent presence in the rankings highlights its established brand recognition, though the competitive pressure from rising brands like Dragonfly Cannabis suggests a need for strategic adjustments to regain momentum.

Notable Products

In February 2026, the top-performing product for Eureka was Fusion - Tropical Twist Distillate Reload Disposable (1g), which regained its number one rank with notable sales of 962 units. Strawberry Clemonade Distillate Reload Pod (1g) climbed to the second position, showing an upward trend from its third-place ranking in January 2026. Classic - Melon Madness Distillate Reload Pod (1g) secured the third spot, maintaining a consistent presence in the top ranks despite not being ranked in January. Banana OG Live Resin Reload Pod (1g) made its debut on the list, coming in fourth. Fusion - Concord Crush Resin Reload Pod (1g) remained steady at fifth, showing resilience despite fluctuating rankings in previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.