Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

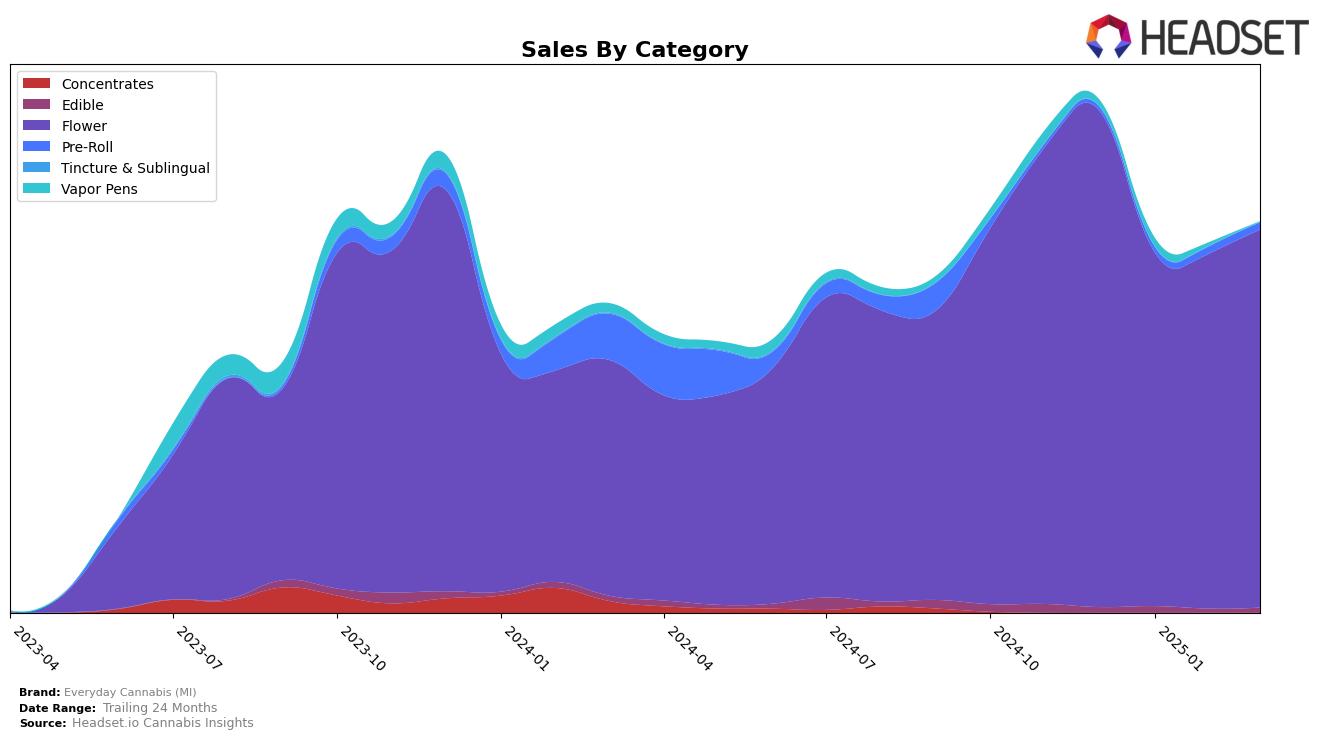

Everyday Cannabis (MI) has shown varied performance across its category rankings in recent months. In the Flower category within Michigan, the brand experienced a notable decline from December 2024 to February 2025, dropping from 11th to 20th. However, March 2025 saw a slight recovery with a rise to 18th place. This fluctuation in rankings is reflective of the competitive nature of the Flower category in Michigan. The brand's sales figures also mirrored these movements, with a dip in January 2025 but a subsequent increase in March 2025, indicating a potential rebound in consumer demand or market strategy adjustments.

Interestingly, the absence of Everyday Cannabis (MI) from the top 30 in other states or categories suggests a concentrated market presence primarily in Michigan's Flower sector. This focus could be a strategic decision to consolidate their brand strength in a specific area, although it also highlights potential opportunities for expansion or diversification. The brand's fluctuating rankings and sales figures in Michigan are crucial indicators of its current market position and can inform future strategies for maintaining or improving its standing in the Flower category. Overall, while there's room for growth, the brand's recent performance underscores the dynamic and competitive cannabis market landscape.

Competitive Landscape

In the competitive landscape of the Michigan flower category, Everyday Cannabis (MI) has experienced notable fluctuations in its market position from December 2024 to March 2025. Starting at rank 11 in December, the brand saw a decline to rank 19 in January and 20 in February, before slightly recovering to rank 18 in March. This trend indicates a challenging period for Everyday Cannabis (MI), as competitors like High Supply / Supply and Six Labs have shown dynamic movements in the rankings. Notably, High Supply / Supply started at rank 8 in December, dropped to 21 in February, and then improved to 16 in March, while Six Labs made a significant leap from outside the top 20 in December to rank 17 in February and March. The sales figures for Everyday Cannabis (MI) have remained relatively stable, but the competitive pressure is evident as brands like Glorious Cannabis Co. and Hytek also vie for market share, with Glorious Cannabis Co. maintaining a consistent presence in the top 20. This competitive environment underscores the need for strategic marketing and product differentiation for Everyday Cannabis (MI) to regain and sustain a higher rank in the Michigan flower market.

Notable Products

In March 2025, Everyday Cannabis (MI) saw Gary Satan (3.5g) as their top-performing product in the Flower category, maintaining its number one position with sales reaching 7,190 units. Puffo Gelato (3.5g) climbed to the second spot from fifth place in February, showing a significant increase in popularity. Rainbow Runtz (3.5g) debuted at the third position, while Sherb Cream Pie (3.5g) followed closely at fourth. Kombucha Cream Pre-Roll (1g) secured the fifth position, rounding out the top performers. Notably, Gary Satan (3.5g) has consistently held the top rank, highlighting its sustained demand over the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.