Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

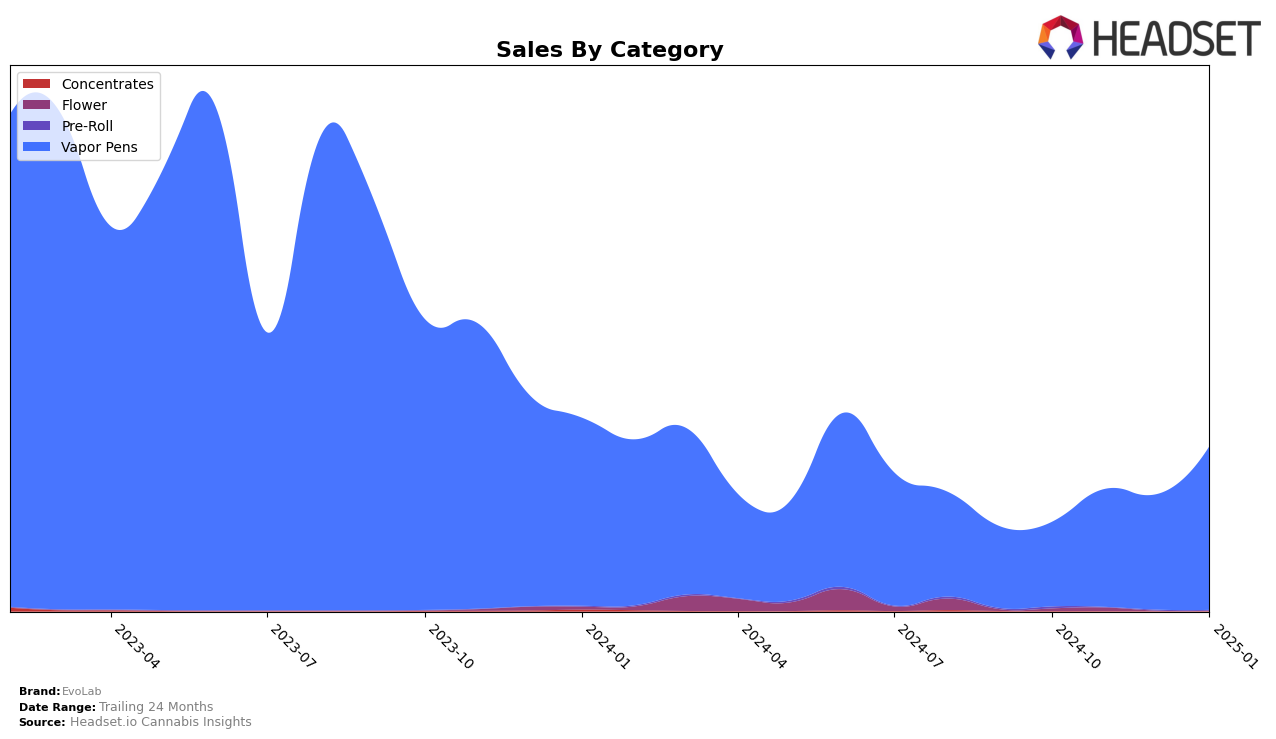

EvoLab has demonstrated varied performance across different states and categories, with notable movements in the Vapor Pens category. In Arizona, EvoLab has shown a steady improvement, climbing from the 68th position in October 2024 to the 55th position by January 2025. This upward trend is indicative of growing consumer interest and possibly increased market penetration in the state. Conversely, in Maryland, EvoLab's presence in the top 30 has been inconsistent, with the brand not ranking in November 2024 and January 2025, suggesting challenges in maintaining a strong foothold in this market.

In Colorado, EvoLab has made significant strides, particularly in the Vapor Pens category. The brand has moved from the 36th position in October 2024 to the 17th position by January 2025, highlighting a robust increase in popularity and sales volume. This improvement could be attributed to strategic marketing efforts or product innovations resonating well with the Colorado consumer base. The absence of EvoLab in the top 30 rankings in some months in Maryland, however, points to potential market saturation or competitive pressures that may require strategic adjustments to regain and sustain market share.

Competitive Landscape

In the competitive landscape of vapor pens in Colorado, EvoLab has demonstrated a significant upward trajectory in terms of rank and sales over the past few months. Starting from a rank of 36 in October 2024, EvoLab climbed to 17 by January 2025, indicating a strong improvement in market presence. This rise is particularly notable when compared to competitors like The Colorado Cannabis Co. and Olio, both of which experienced a decline in rank during the same period. Despite AiroPro maintaining a relatively stable position, EvoLab's sales surged significantly, closing the gap with these established brands. This upward trend suggests that EvoLab's strategic initiatives in product development or marketing may be resonating well with consumers, positioning it as a formidable competitor in the Colorado vapor pen market.

Notable Products

In January 2025, the top-performing product for EvoLab was the Colors - White Cherry Co2 Disposable (1g) from the Vapor Pens category, maintaining its number one rank from the previous month with sales reaching 1687 units. Following closely in the rankings, the Colors - Strawberry Lemonade BDT Distillate Disposable (1g) held the second position, although it had previously been ranked first in November 2024. The Colors - Grape Dreams BDT Distillate Disposable (1g) climbed back to the third position after a dip to fourth place in December 2024. The Colors - Blueberry CO2 Disposable (1g) secured the fourth spot, marking a return to the rankings after being absent in December. Finally, the Colors - Cosmic Apple BDT Distillate Disposable (1g) remained steady at the fifth position, having entered the rankings in December 2024.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.