Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

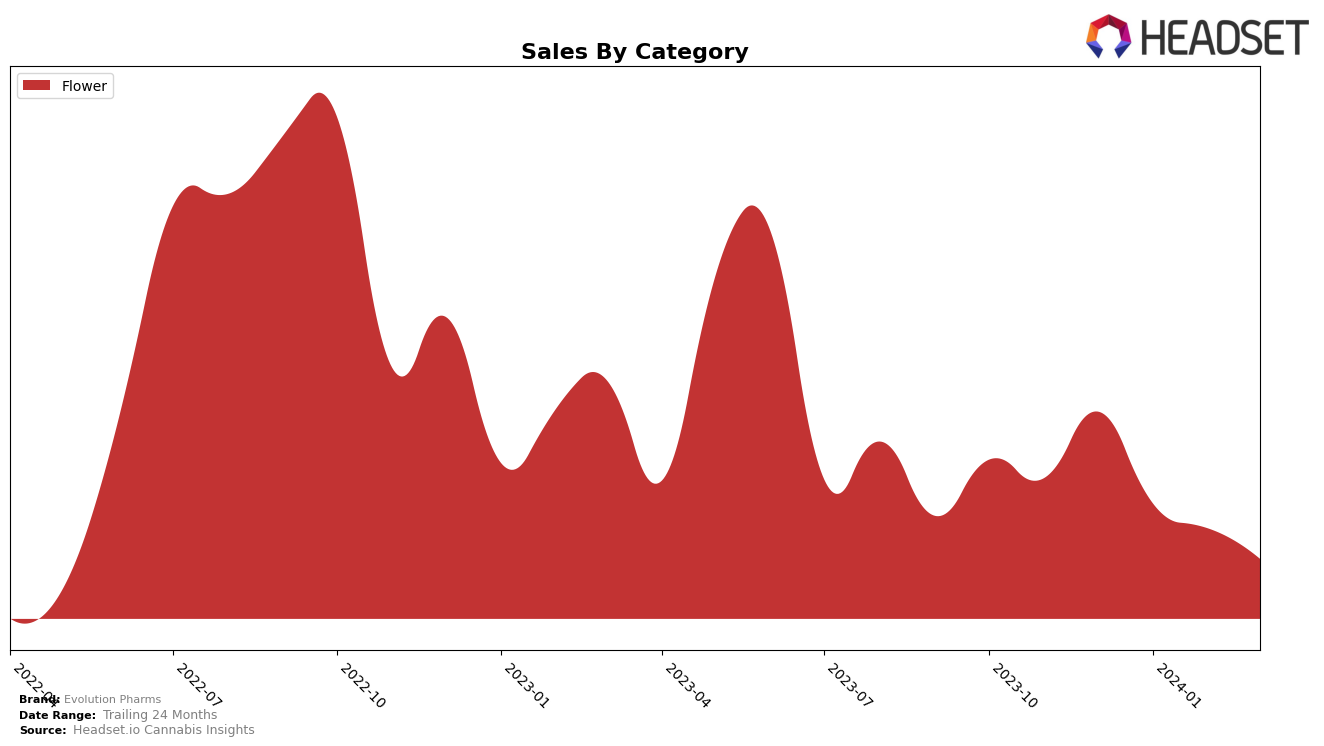

In the competitive cannabis market of Arizona, Evolution Pharms has shown a noteworthy trajectory in the Flower category, albeit with challenges. Starting at rank 18 in December 2023, the brand experienced a gradual decline over the subsequent months, landing at rank 30 by March 2024. This movement is significant, as it indicates the brand's ability to maintain a position within the top 30, despite facing stiff competition and a downward trend in sales from December's $420,161 to March's $193,354. This decline in rank and sales could signal a need for strategic adjustments to counter market pressures and consumer preferences shifting away from their offerings in this category.

The detailed rankings month-over-month highlight a consistent slide for Evolution Pharms in Arizona's Flower category. Notably, the slip from a mid-tier position in December to the brink of the top 30 by March underscores the competitive nature of the Arizona market. The decline from rank 18 to 30, while still maintaining a spot in the top 30, suggests that while Evolution Pharms is facing challenges, it has not yet fallen out of favor entirely. This performance could be interpreted in several ways; it might indicate brand loyalty or product quality that keeps it in the rankings, or perhaps market saturation and competitive pricing strategies from rivals. Such insights could be invaluable for stakeholders looking to bolster Evolution Pharms' market position or for competitors aiming to capture some of their market share.

Competitive Landscape

In the competitive landscape of the Arizona cannabis flower market, Evolution Pharms has experienced a notable shift in its standing. Initially ranked 18th in December 2023, it saw a gradual decline to 30th by March 2024. This trend reflects a decrease in sales over the same period, positioning Evolution Pharms in a challenging spot amidst its competitors. Notably, Fade Co. has shown resilience and improvement, moving from a rank of 31st to 29th, alongside an increase in sales that suggests a stronger market presence. Similarly, FENO has leapfrogged in the rankings, ending up at 28th by March 2024, with a significant uptick in sales. In contrast, brands like TRYKE and Fig Farms have not shown substantial progress in their rankings or sales, indicating a relatively stagnant position in the market. Evolution Pharms' decline in rank and sales amidst these dynamics highlights the competitive pressures it faces, underscoring the need for strategic adjustments to reclaim and enhance its market position.

Notable Products

In March 2024, Evolution Pharms saw Gorilla Zkittles (3.5g) leading its sales with a notable figure of 4786 units, maintaining its top position from February. Following closely behind was Sour Legend (3.5g), which impressively held onto the second spot for two consecutive months, despite being a newer addition to the ranking. Mendo Cookies (3.5g) climbed up one rank to secure the third position, showing a consistent increase in consumer preference. Wedding Cake (3.5g), despite being the top seller in December 2023, fell to the fourth position in March 2024, indicating a shift in consumer tastes over the quarter. Lastly, Gelato Dream (3.5g) made its first appearance in the top five, albeit with minimal sales, hinting at potential growth or an emerging interest in this product.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.