Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

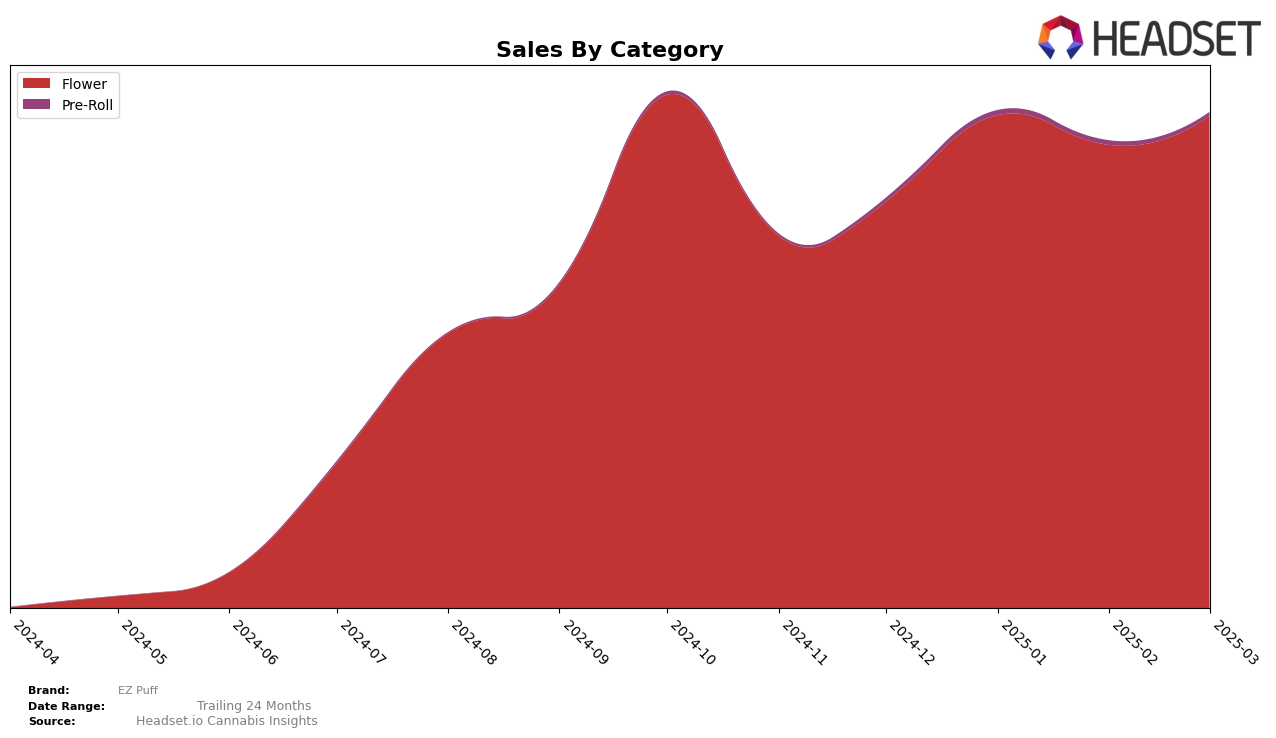

EZ Puff has shown a notable performance in the Washington market, particularly in the Flower category. Starting from December 2024, the brand was ranked 18th and has steadily climbed up the ranks, reaching the 11th position by March 2025. This positive trend indicates a growing consumer preference for EZ Puff's products in this category. The sales figures corroborate this upward trajectory, with a significant increase from December 2024 to January 2025, followed by a slight dip in February before stabilizing in March. This consistency in the top 15 highlights EZ Puff's strong foothold in the Washington Flower market, making it a brand to watch in the coming months.

While the performance in Washington is commendable, it's important to note that EZ Puff's presence in other states or provinces is not mentioned in the data, indicating that the brand may not be in the top 30 in those regions. This could either suggest a strategic focus on the Washington market or a potential area for growth and expansion in other states. The absence of rankings in other markets might be seen as a missed opportunity for EZ Puff to diversify its consumer base and increase its brand visibility across different regions. As the cannabis industry continues to evolve, monitoring EZ Puff's strategies in expanding its market reach could provide valuable insights into its overall growth trajectory.

Competitive Landscape

In the competitive landscape of the Flower category in Washington, EZ Puff has shown a commendable upward trajectory in brand ranking, moving from 18th place in December 2024 to consistently holding the 11th position by February and March 2025. This improvement in rank is indicative of a strategic gain in market presence and consumer preference. Notably, EZ Puff has outpaced brands like Thunder Chief Farms, which fluctuated between 12th and 16th positions during the same period. However, it faces stiff competition from Fifty Fold and K Savage (WA), both of which have maintained a stable presence within the top 10, albeit with some rank volatility. The sales trends further highlight EZ Puff's competitive edge, with a notable increase from January to March 2025, suggesting effective marketing strategies and product offerings that resonate well with consumers. As EZ Puff continues to solidify its position, monitoring these competitive dynamics will be crucial for sustaining its growth momentum in the Washington Flower market.

Notable Products

In March 2025, the top-performing product for EZ Puff was Gary Payton (3.5g) in the Flower category, reclaiming its number one spot after falling to second place in the previous months. Georgia Pie (3.5g), also in the Flower category, slipped to the second rank from its previous first place position in January and February. Durban Cookies (3.5g) showed significant improvement, climbing to third place from the fifth position in the preceding months, with sales reaching 1378 units. Gary Payton (7g) re-entered the rankings in fourth place, showing a notable increase from its absence in the previous months. Georgia Pie (7g) took the fifth spot, maintaining a steady performance despite a slight drop in sales.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.