Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

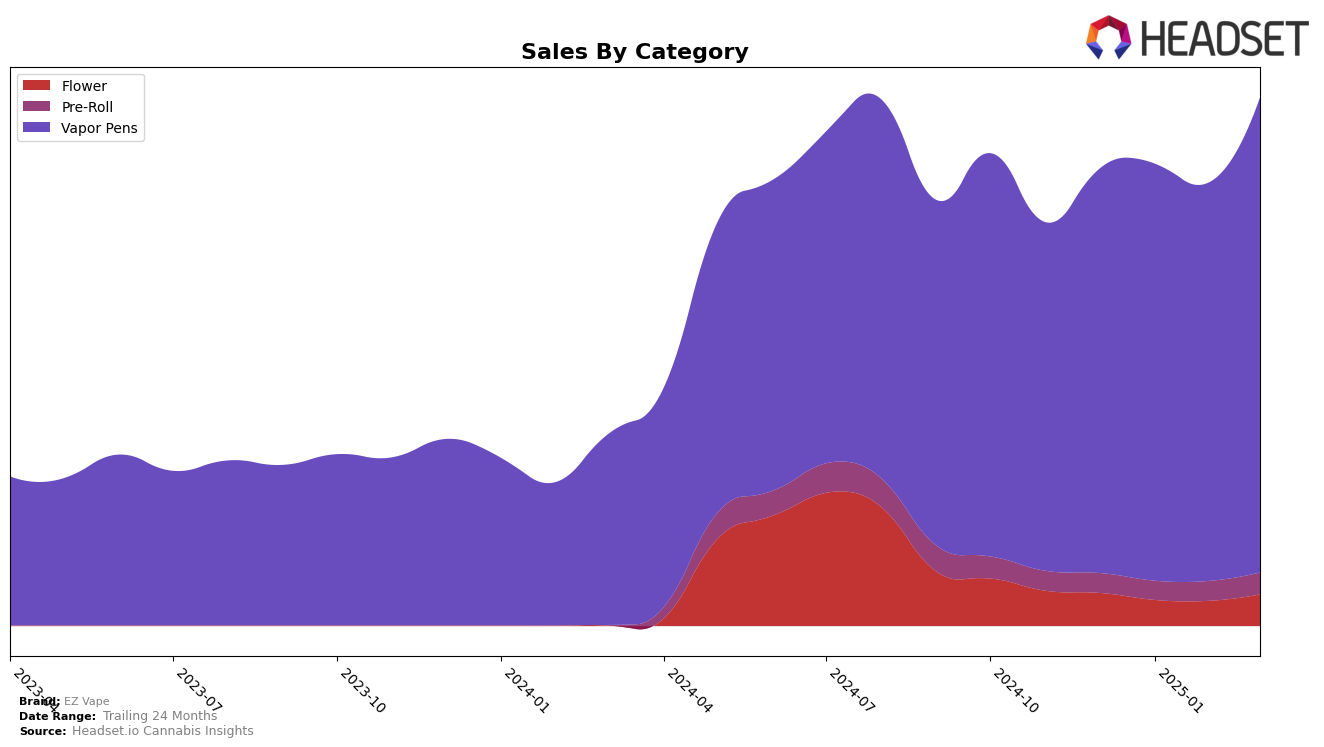

EZ Vape has shown varied performance across different product categories in Washington. In the Flower category, the brand was not ranked in the top 30 for several months, only appearing at 91st place in March 2025. This indicates a struggle to gain significant traction in this competitive segment. However, there is a consistent presence in the Pre-Roll category, with a steady climb from 84th in December 2024 to 65th by February and March 2025, suggesting a slow but positive trend in this category.

The Vapor Pens category stands out as a strong performer for EZ Vape in Washington, maintaining a solid 7th place rank from December 2024 through March 2025. This consistency highlights the brand's strong foothold and competitive edge in this particular segment. Notably, the sales figures for Vapor Pens also show an upward trend, with March 2025 sales reaching over $1.1 million. This stability and growth in Vapor Pens contrast with the less robust performance in the Flower category, emphasizing the brand's strategic positioning and consumer preference in the vapor pen market.

Competitive Landscape

In the competitive landscape of vapor pens in Washington, EZ Vape has maintained a consistent rank of 7th from December 2024 through March 2025, showcasing stability in a dynamic market. Despite this steady rank, EZ Vape has experienced a notable increase in sales, particularly in March 2025, where sales surged significantly compared to previous months. This growth trajectory positions EZ Vape favorably against competitors like Dabstract and Snickle Fritz, both of which have consistently ranked lower or equal but have not matched EZ Vape's sales momentum. However, EZ Vape faces stiff competition from Full Spec and Plaid Jacket, which have maintained higher ranks, with Plaid Jacket even reaching 4th place in early 2025. These insights suggest that while EZ Vape is performing well in terms of sales, there is still room for strategic growth to climb higher in the rankings.

Notable Products

In March 2025, the top-performing product from EZ Vape was the Dutch Treat Distillate Cartridge (1g), which climbed to the number one position with notable sales of 2989 units. Trainwreck Distillate Cartridge (1g) made a significant leap from the fifth position in February to second place, showing a strong upward trend. Durban Poison Distillate Disposable (1g) maintained a stable performance, securing the third spot after returning to the rankings. Skywalker OG Distillate Disposable (1g) entered the rankings for the first time, debuting at fourth place. Glueberry Distillate Cartridge (1g), which was the top product in February, dropped to fifth place, indicating a shift in consumer preference.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.