Jun-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

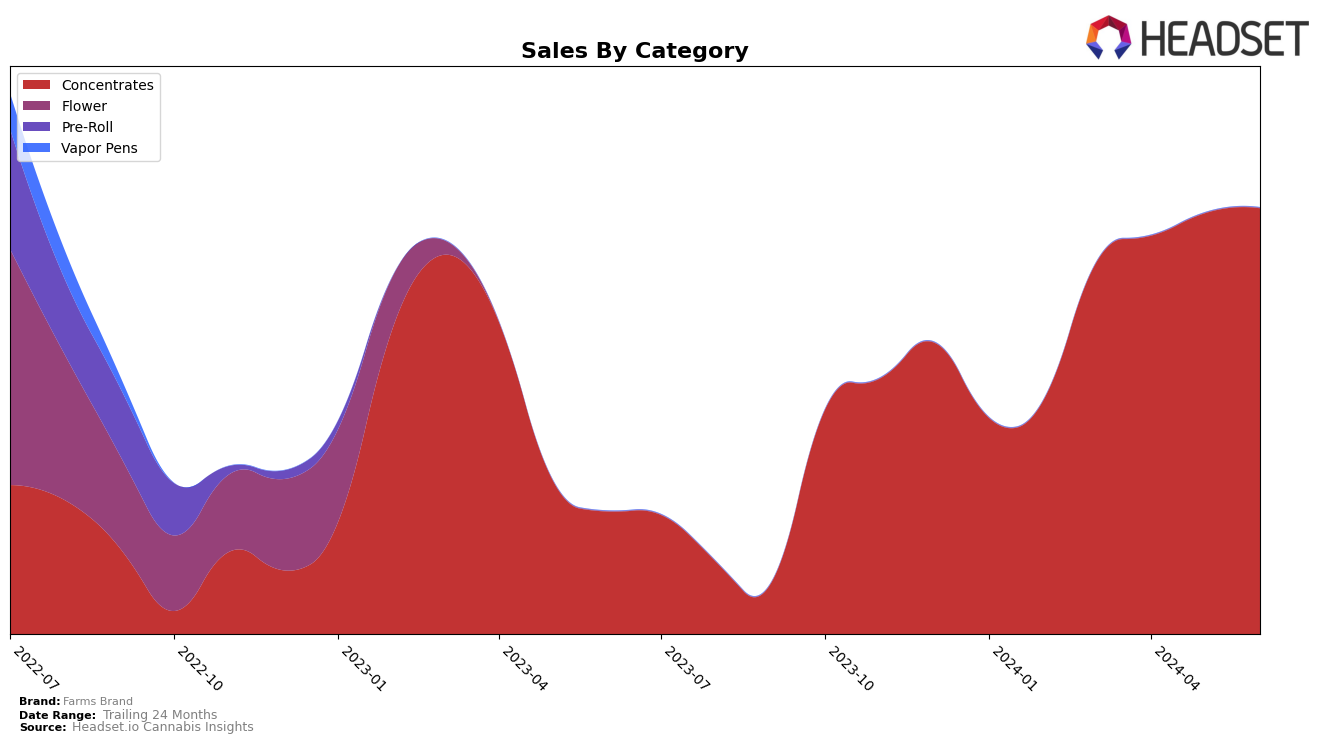

Farms Brand has shown notable progress in the California market, particularly in the Concentrates category. Over the past four months, the brand has consistently improved its ranking, moving from 27th place in March 2024 to 17th place by June 2024. This upward trend indicates a strengthening presence and increasing consumer preference for their products. The fact that they were not in the top 30 prior to March highlights a significant breakthrough in market penetration and brand recognition within this category. This consistent climb in rankings suggests that Farms Brand is effectively capturing a larger share of the market and resonating well with consumers in California.

While the Concentrates category in California shows positive momentum for Farms Brand, the absence of rankings in other states and categories could be a point of concern or an area for potential growth. The lack of top 30 placements in other states suggests that the brand's current market strategy may be heavily localized or not as competitive outside of California. This presents both a challenge and an opportunity for Farms Brand to explore expansion strategies or to optimize their offerings in other regions. Understanding the brand's performance in different states and categories can provide valuable insights into where they can focus their efforts for future growth.

Competitive Landscape

In the competitive landscape of California's concentrates market, Farms Brand has shown a notable upward trend in rankings over the past few months. Starting from a rank of 27 in March 2024, Farms Brand has steadily climbed to 17 by June 2024. This positive trajectory contrasts with the performance of ABX / AbsoluteXtracts, which has seen a decline from rank 8 in March to 18 in June, indicating a significant drop in market position. Similarly, West Coast Trading Co. has fluctuated, dropping out of the top 20 in May but recovering slightly to 16 in June. Meanwhile, Big Red's Farm has made a remarkable leap from rank 47 in March to 19 in June, showing strong growth. Everyday Dabs has also experienced a positive trend, moving from rank 21 in March to 15 in June. These shifts highlight Farms Brand's competitive resilience and improving market presence, making it a strong contender in the California concentrates category.

Notable Products

In June 2024, the top-performing product for Farms Brand was Garlic Cream Sugar Wax (1g) in the Concentrates category, climbing to the number one spot with sales of $1,197. Cheetah Piss Sugar Wax (1g) also made a strong debut, securing the second rank. Alien OG Sugar (1g) improved its position from fourth in May to third in June. Slapz Badder (1g), which had been consistently ranked first in April and May, dropped to fourth place. Orange Z Badder (1g) saw a decline, moving from third in May to fifth in June.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.