Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

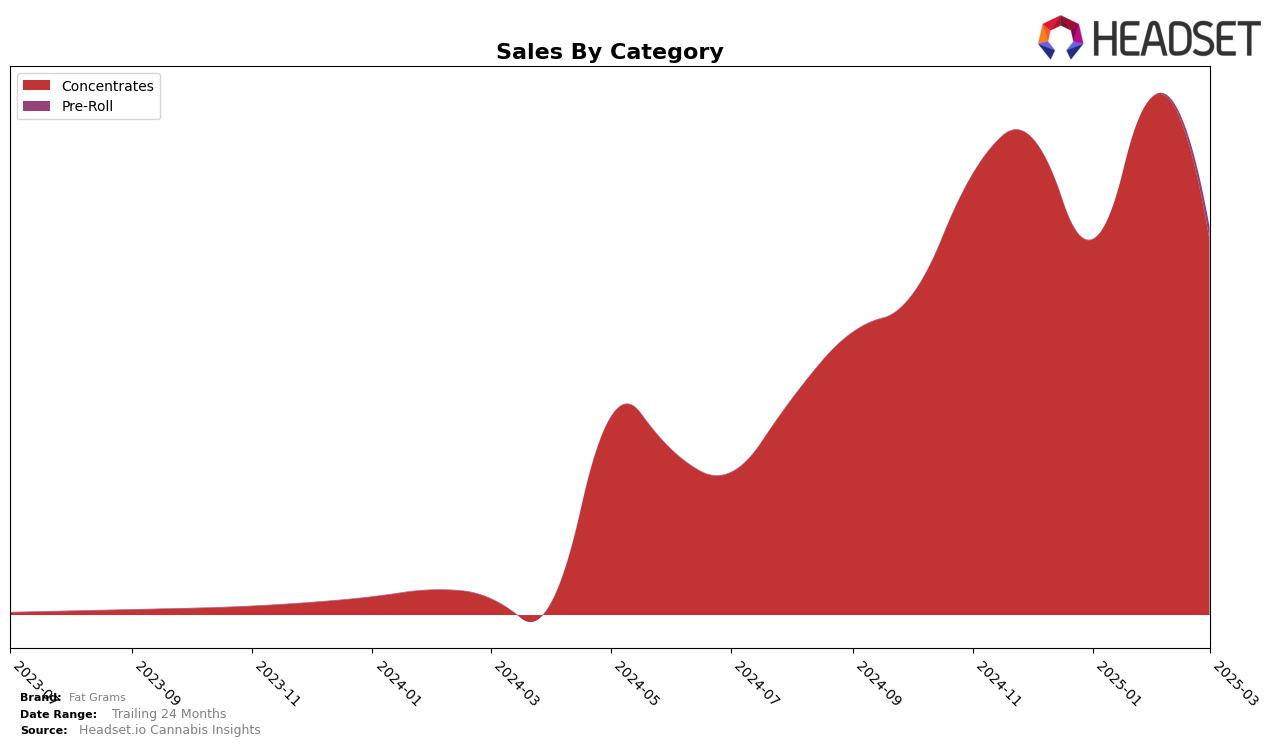

Fat Grams has shown a fluctuating performance in the Colorado market, particularly within the Concentrates category. In December 2024, the brand was ranked 18th, but it slipped to 22nd in January 2025. However, there was a notable recovery in February 2025, when Fat Grams climbed back to 17th place, only to drop slightly to 19th in March 2025. This movement suggests a dynamic market presence with the potential for growth, especially considering the brand's ability to rebound in February. The sales figures also reflect this volatility, with a peak in February 2025, suggesting a potential seasonal or promotional influence that could have driven sales during that month.

While Fat Grams did not consistently maintain a top-tier position in the Concentrates category in Colorado, its presence in the rankings indicates a competitive stance. The absence of rankings in some months outside the top 30 could be seen as a challenge for the brand to maintain consistent visibility and consumer interest. This inconsistency highlights potential areas for strategic improvement, such as enhancing product offerings or increasing marketing efforts to sustain higher rankings throughout the year. The brand's ability to bounce back into the top 20 in February is an encouraging sign, suggesting that with the right strategies, Fat Grams could strengthen its market position across different periods.

Competitive Landscape

In the competitive landscape of concentrates in Colorado, Fat Grams has experienced notable fluctuations in its ranking over the past few months. Starting from December 2024, Fat Grams held the 18th position, but by January 2025, it slipped to 22nd, only to rebound to 17th in February before settling at 19th in March. This volatility highlights the dynamic nature of the market and the intense competition Fat Grams faces. Notably, Olio consistently maintained a presence in the top 20, with a rank of 17th in both December and March, indicating a stable performance despite a dip in the intervening months. Meanwhile, Nuhi showed a more consistent upward trend, improving from 21st in December to 18th by March. Interestingly, Mile High Dabs made a significant leap from outside the top 20 to 20th place in March, suggesting a potential emerging competitor. These shifts underscore the importance for Fat Grams to strategize effectively to maintain and improve its market position amidst such competitive pressures.

Notable Products

In March 2025, Fat Grams' top-performing product was Super Emberz Live Resin (2g) in the Concentrates category, achieving the number one rank with sales of 407 units. Hawaiian Moonshine Wax (2g) followed as the second best-seller, while Tropical Charmz Live Resin (2g) ranked third, showing a decline from its top position in December 2024. Nightshifter Wax (2g) secured the fourth spot, and Dry Ice #1 Live Resin (2g) rounded out the top five. Notably, Super Emberz Live Resin (2g) saw a remarkable ascent from fourth place in December 2024 to the leading position in March 2025, indicating a significant boost in popularity and sales performance.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.