Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

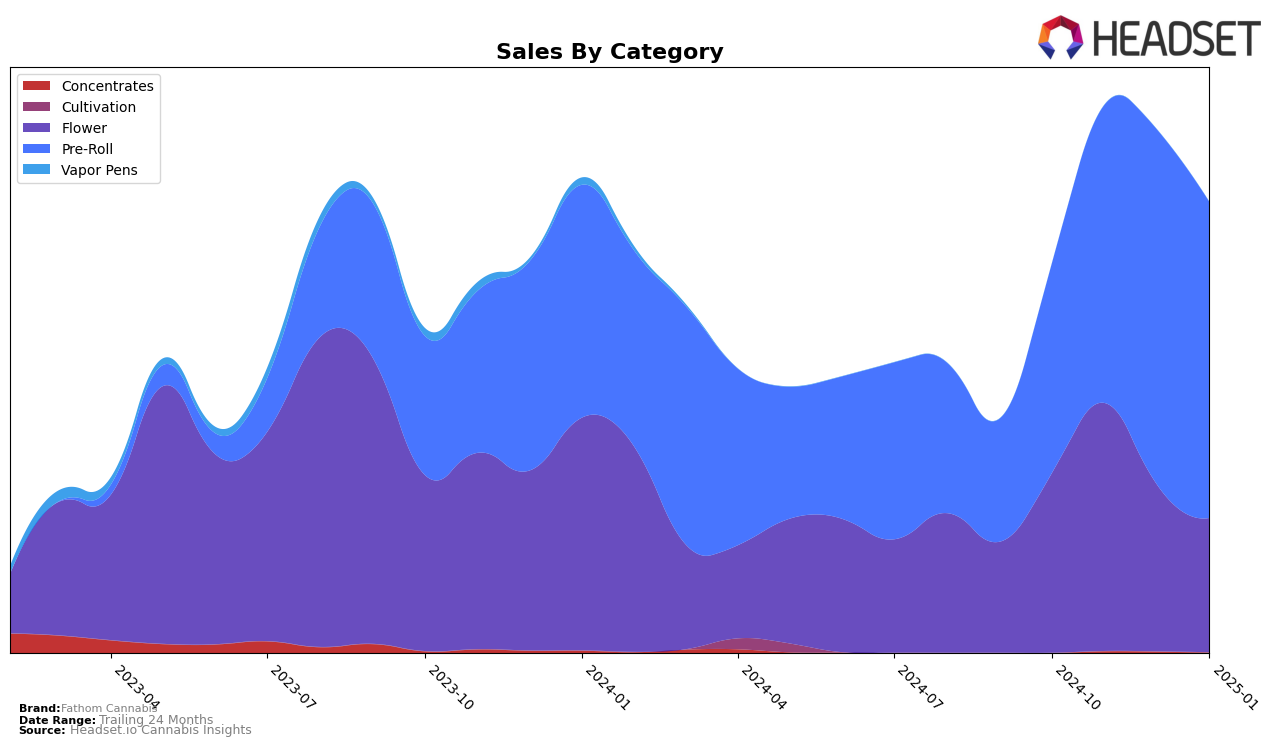

Fathom Cannabis has shown varied performance across different categories and states, with notable movements in the Massachusetts market. In the Flower category, the brand has not been able to break into the top 30, with rankings fluctuating between 43 and 57 from November 2024 to January 2025. This indicates a struggle to maintain a consistent position in a competitive environment. On the other hand, their sales figures in this category show a downward trend, with a notable decrease from October 2024 to January 2025, suggesting challenges in sustaining consumer interest or market share in Massachusetts.

Conversely, Fathom Cannabis has demonstrated a stronger presence in the Pre-Roll category within Massachusetts. The brand consistently held a top 30 position, peaking at rank 15 in December 2024 and maintaining it through January 2025. This stability in rankings, coupled with sales growth from October to December 2024, highlights their effective strategy or appeal in the Pre-Roll segment. However, the slight dip in sales from December 2024 to January 2025 could indicate emerging competitive pressures or seasonal fluctuations that the brand might need to address.

Competitive Landscape

In the competitive landscape of the Massachusetts Pre-Roll category, Fathom Cannabis has shown a notable upward trajectory in recent months. Starting from a rank of 23 in October 2024, Fathom Cannabis improved its position to 16 by November and maintained a stable rank of 15 through December and January 2025. This steady climb in rank is indicative of a positive trend in sales performance, as evidenced by the increase in sales from November to December. In comparison, Glorious Cannabis Co. experienced fluctuations, reaching a peak rank of 11 in November before dropping to 13 by January, which suggests a less consistent performance. Meanwhile, Happy Valley, despite starting strong with a rank of 7 in October, saw a decline to 14 by January, indicating potential challenges in maintaining its market position. Additionally, Impressed made a significant leap from rank 60 in October to 16 in January, showcasing a rapid growth trajectory that could pose a competitive threat. Overall, Fathom Cannabis's consistent rank improvement and sales growth position it favorably against its competitors in the Massachusetts Pre-Roll market.

Notable Products

In January 2025, the top-performing product from Fathom Cannabis was Shoki Pre-Roll (1g), which climbed to the number one spot with notable sales of 6,056 units. Deluxe Sugar Cane Pre-Roll (1g) followed closely as the second top-seller, despite a slight drop from its first-place ranking in December 2024. Diesel Dawg Pre-Roll (1g) secured the third position, maintaining a consistent presence in the top ranks over the past months. White Tahoe Pre-Roll (1g) made a significant leap to fourth place, having not been ranked in the previous two months. Grape Gas Pre-Roll (1g) completed the top five, experiencing a decline from its second-place finish in December 2024.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.