Oct-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

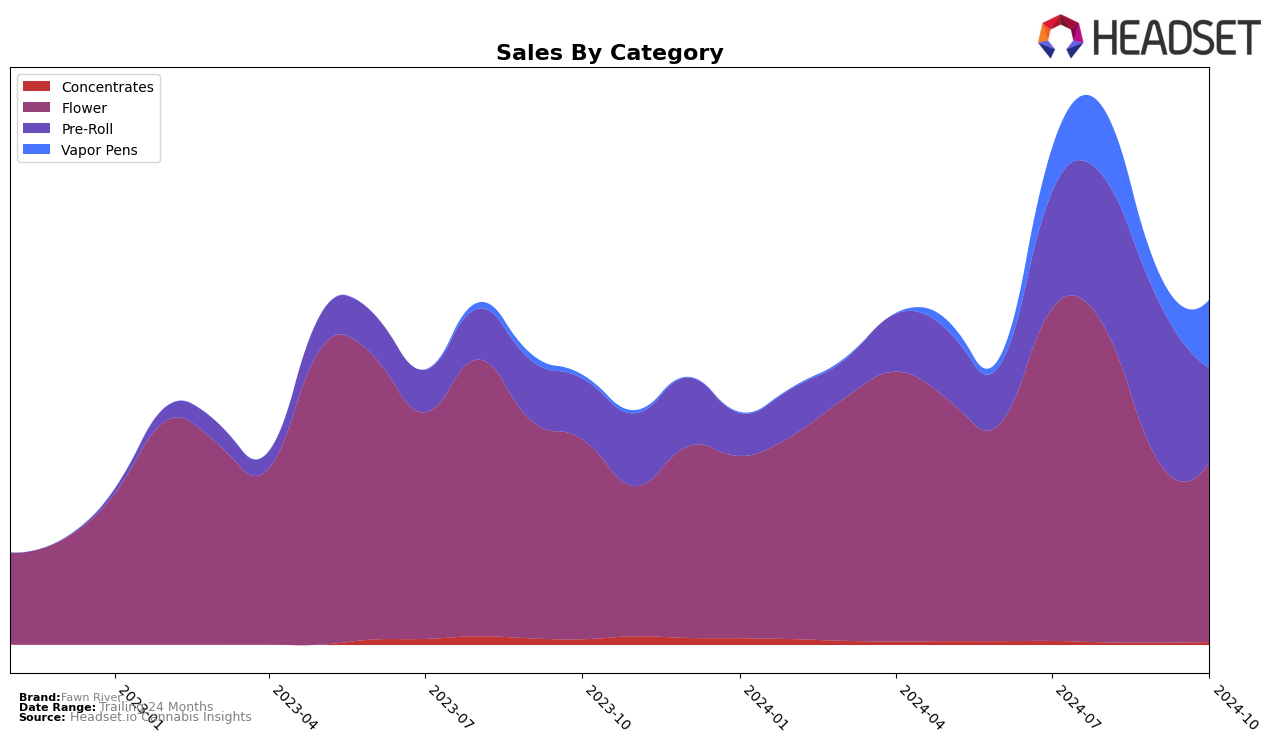

Fawn River's performance in the Michigan market shows varied results across different product categories. In the Flower category, the brand experienced a decline in rankings, moving from 24th place in July 2024 to 44th place by October 2024. This downward trend is reflected in their sales, which saw a significant drop over the same period. Conversely, in the Vapor Pens category, Fawn River showed some resilience. Despite a dip in September, where they fell out of the top 50, they managed to climb back to 35th place by October. This suggests a potential recovery or strategic adjustment in their vapor pen offerings.

In the Pre-Roll category, Fawn River demonstrated a fluctuating performance. They started strong, moving up to 14th place in September 2024, but then dropped to 25th place in October. This volatility might indicate a competitive market or shifting consumer preferences in Michigan. Interestingly, this category was the only one where Fawn River maintained a top 30 position consistently, highlighting its relative strength in pre-rolls compared to other categories. Such insights suggest that while Fawn River faces challenges in certain segments, there are opportunities for growth and stabilization in others.

Competitive Landscape

In the competitive landscape of the Michigan flower category, Fawn River has experienced notable fluctuations in its rank over the past few months, which could impact its market positioning and sales strategy. Starting strong in July 2024 with a rank of 24, Fawn River saw a decline to 32 in August, further dropping to 46 in September, and slightly recovering to 44 in October. This downward trend contrasts with competitors such as Muha Meds, which improved from 41 in July to 25 in August, although it faced its own challenges with fluctuating ranks in subsequent months. Similarly, The Limit showed a strong upward trajectory, peaking at rank 20 in September before dropping to 42 in October. Meanwhile, Redbud Roots maintained a relatively stable position, managing to stay within the top 45 throughout the period. These dynamics suggest that while Fawn River's sales have been impacted, particularly in September and October, there is potential for recovery if strategic adjustments are made to address the competitive pressures and capitalize on market opportunities.

Notable Products

In October 2024, the top-performing product for Fawn River was the Gigglesticks - Bog Walker Pre-Roll (1g) in the Pre-Roll category, which rose to the number one rank with a notable sales figure of 12,674 units. The Bomb Pop Distillate Cartridge (1g) in the Vapor Pens category debuted strongly at the second position. Following closely, the Tangie OG Distillate Cartridge (1g) secured the third spot, also in the Vapor Pens category. The Giggles - Super Star Fruit Pre-Roll (1g) maintained its fourth-place ranking from September, although its sales decreased to 9,906 units. The Cotton Candy Grape Distillate Cartridge (1g) rounded out the top five, marking its first appearance in the rankings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.