Jan-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

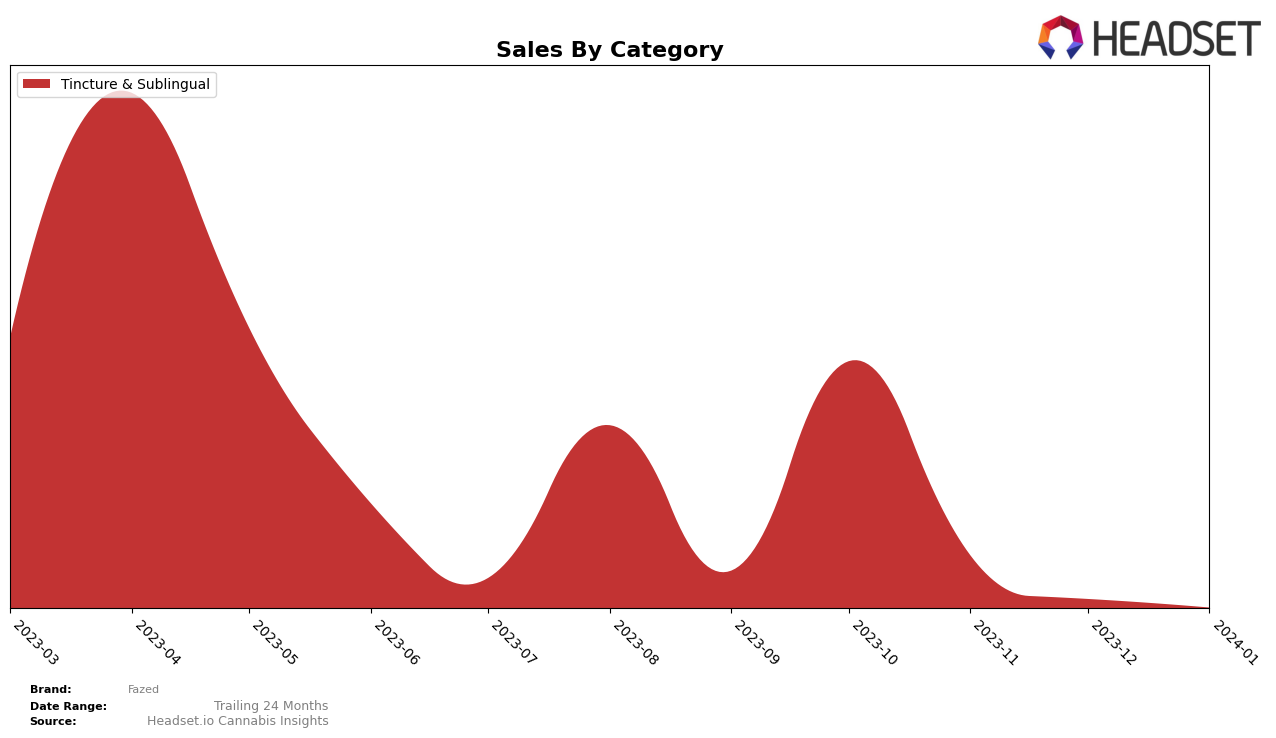

In the Arizona market, Fazed has shown a notable presence in the Tincture & Sublingual category, though its journey over the last few months indicates a fluctuating performance. Initially ranked 5th in October 2023, Fazed experienced a slight dip to 6th place in November, followed by a more significant drop to 11th in December, before slightly recovering to 10th place by January 2024. This trajectory suggests a challenge in maintaining its market position amidst competitive pressures. The sales figures also reflect this volatility, with a sharp decline from October's sales of $8,775 to just $1,033 by January 2024, highlighting a substantial decrease in consumer demand or possible distribution challenges within this period.

The performance of Fazed across categories and states, particularly in Arizona, offers valuable insights into the brand's market dynamics. The absence from the top 20 rankings in certain months underlines the competitive nature of the cannabis industry and the importance of consistent brand positioning and product quality. For Fazed, the Tincture & Sublingual category has been a battleground of ups and downs, with their rankings indicating a struggle to secure a strong foothold. This information, while only a glimpse into Fazed's overall performance, suggests a need for strategic adjustments to enhance market share and consumer retention. The detailed sales and ranking fluctuations serve as a critical barometer for the brand's health and potential areas for improvement.

Competitive Landscape

In the competitive landscape of the Tincture & Sublingual category in Arizona, Fazed has experienced a notable fluctuation in its market position over the recent months. Initially ranked 5th in October 2023, Fazed saw a slight improvement in November, moving up to 6th, before experiencing a significant drop to 11th in December and then slightly recovering to 10th in January 2024. This trajectory indicates a challenging period for Fazed, especially when compared to its competitors. For instance, Gramz has shown remarkable performance, improving from 7th to 4th place by December and maintaining a strong 8th position in January. Conversely, Select, despite experiencing a slight decline from 8th to 12th, managed a recovery to 9th place by January, showcasing resilience in the market. Polite and Tipsy Turtle have had their own challenges and successes, with Polite missing from the rankings in November but securing 9th and 12th places in December and January, respectively, and Tipsy Turtle making an entry at 11th place in January. The fluctuating ranks and sales of Fazed and its competitors highlight the dynamic nature of the market, suggesting that Fazed needs to strategize effectively to regain and improve its market position amidst stiff competition.

Notable Products

In January 2024, Fazed's top-performing product was Peppermint Spray (100mg) from the Tincture & Sublingual category, maintaining its number one rank from December 2023 with sales figures reaching 229 units. Following closely was Orange Spray (100mg), also in the Tincture & Sublingual category, which secured the second position in January, a slight shift from its top position in November 2023. The sales figures for Orange Spray (100mg) saw a significant drop from its previous months, recording just 48 units sold in January. This shift in rankings and sales figures indicates a changing consumer preference within Fazed's product line. The data suggests that while the Peppermint Spray (100mg) has gained traction, the Orange Spray (100mg) has seen a decline in its popularity among Fazed's offerings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.