Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

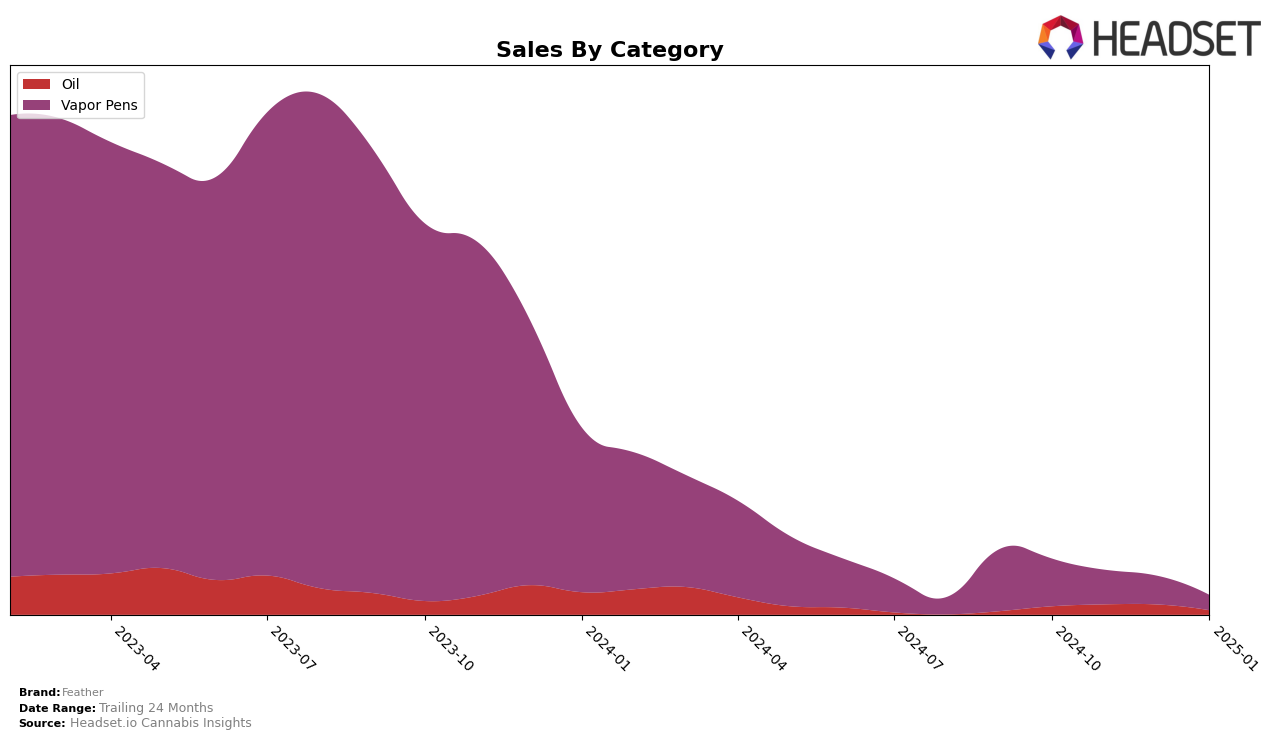

Feather's performance in the Canadian cannabis market shows a mixed trajectory across different provinces and product categories. In Alberta, Feather's presence in the Vapor Pens category has seen a decline over the last few months. Starting from a rank of 59 in October 2024, the brand slipped to 75 by November and maintained a similar position in December, before dropping out of the top 30 by January 2025. This downward trend is reflected in the sales figures, with a significant decrease from October's $36,070 to just over $12,500 by December. The absence of a rank in January suggests a challenging competitive landscape for Feather in Alberta's Vapor Pens category.

Contrastingly, in Ontario, Feather has maintained a more stable presence in the Oil category. The brand held a consistent rank of 22 in both October and November 2024, before improving slightly to 21 in December. This improvement is mirrored by a steady increase in sales, from $10,071 in October to $13,146 by December, indicating a positive reception and potential growth in this market. The consistent ranking within the top 30 in Ontario highlights Feather's stronger foothold in the Oil category compared to its performance in Alberta's Vapor Pens market.

Competitive Landscape

In the competitive landscape of the oil category in Ontario, Feather has shown a notable upward trajectory in its rankings over the last few months. Starting from the 22nd position in October and November 2024, Feather improved to the 21st rank by December 2024, although it did not make it into the top 20 by January 2025. This upward movement is significant, especially when compared to Peace Naturals, which maintained a steady rank of 20th in October and November but dropped out of the top 20 by December 2024. Meanwhile, Emprise Canada consistently outperformed Feather, holding a higher rank from 17th in October to 20th by January 2025, despite a decline in sales over the same period. Feather's sales have shown resilience and growth, particularly from November to December 2024, suggesting a strengthening market presence and potential for further rank improvements if the trend continues.

Notable Products

In January 2025, the top-performing product from Feather was the Melon Bubble Haze Distillate Disposable (1g) in the Vapor Pens category, achieving the number one rank with sales of 154 units. The THC Dose Control Spray (8.23ml) maintained its second-place position, consistent with its ranking from November and December 2024. The Blue Mystic Haze Distillate Disposable (1g) held the third spot, showing a decline from its previous top rank in October 2024. Notably, the Purple Pom Distillate Cartridge (1g) entered the rankings for the first time, securing the fourth position. The Melon Bubble Haze Distillate Cartridge (1g) dropped from its top rank in November and December 2024 to fifth place in January 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.