Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

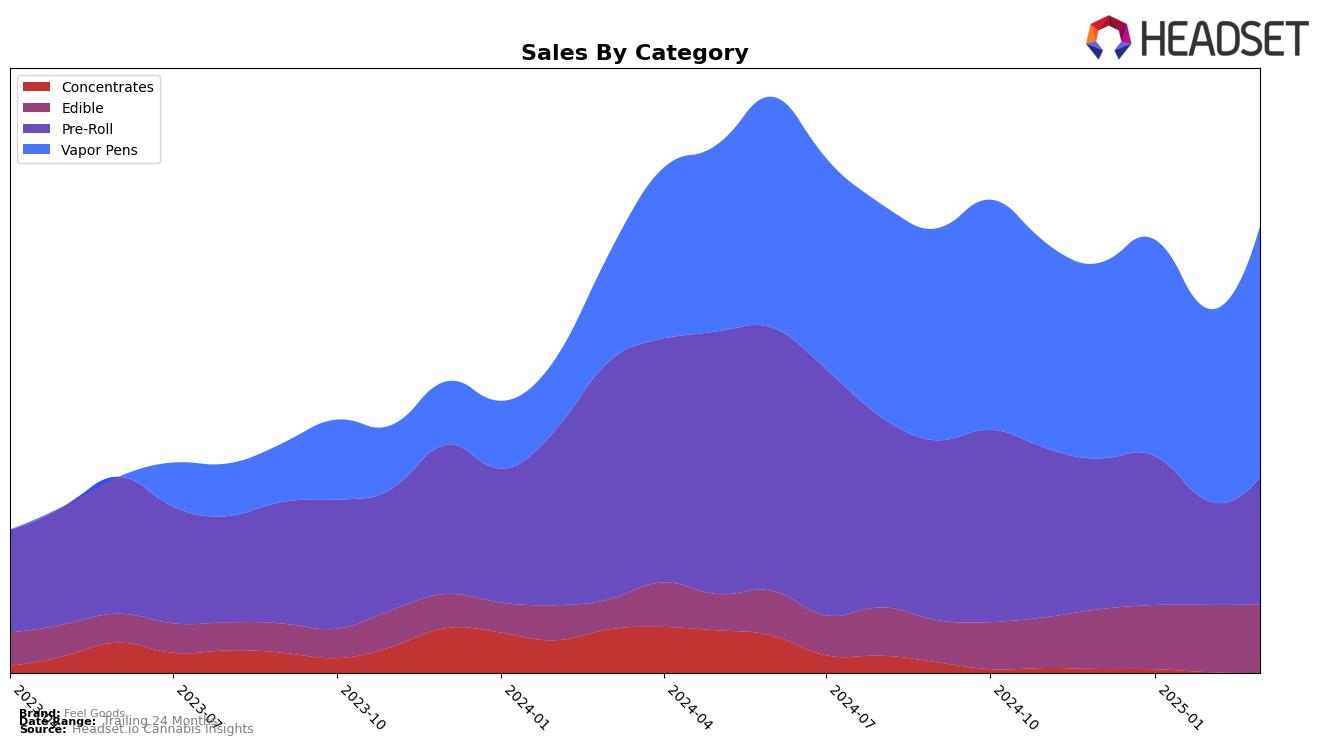

In the state of Oregon, Feel Goods has shown consistent performance in the Edible category, maintaining a steady rank of 14th from January through March 2025. This stability is accompanied by a gradual increase in sales, indicating a solid foothold in this category. However, the Pre-Roll segment presents a more fluctuating picture, with Feel Goods experiencing a dip to 22nd place in February before improving to 18th in March. Such variability suggests potential challenges in maintaining consistent market share in Pre-Rolls, despite a recovery in sales towards the end of the quarter.

For Vapor Pens, Feel Goods has demonstrated a positive trajectory in Oregon, climbing from 22nd in December 2024 to 19th by March 2025. This upward movement is particularly noteworthy given the substantial increase in sales during March, suggesting effective strategies or increased consumer demand in this category. Notably, Feel Goods did not break into the top 30 in any other categories beyond Edibles, Pre-Rolls, and Vapor Pens in Oregon, which could be seen as an area for potential growth or diversification. The brand's performance across these categories highlights both strengths in specific segments and opportunities for expansion in others.

Competitive Landscape

In the competitive landscape of Vapor Pens in Oregon, Feel Goods has shown a notable upward trajectory in rankings over the first quarter of 2025. Starting at rank 22 in December 2024, Feel Goods improved to rank 19 by March 2025, indicating a positive trend in market presence. This improvement is significant when compared to competitors like Select, which saw a decline from rank 15 to 17 over the same period, and Bobsled Extracts, which fluctuated but ended at rank 18. Despite Elysium Fields and Private Stash not breaking into the top 20 consistently, Feel Goods' ability to climb the ranks suggests a strengthening brand appeal and potentially increasing sales momentum. This trend highlights Feel Goods' potential to capture more market share, especially as other brands face challenges in maintaining or improving their standings.

Notable Products

In March 2025, the top-performing product from Feel Goods was the Watermelon Straw Gummy 100mg, maintaining its leading position since January 2025 with sales of 5,824 units. The Blueberry Straw Gummy 100mg followed closely in second place, consistently holding this position since January. The Razzleberry Straw Gummy 100mg improved its ranking to third, up from fourth in February, indicating a positive sales trend. Meanwhile, the Strawberry Straw Gummy 100mg slipped to fourth place from third in February. Notably, the Blue Dream Pre-Roll 2-Pack 2g entered the rankings for the first time in March, debuting at fifth place, suggesting a new interest in pre-roll products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.