Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

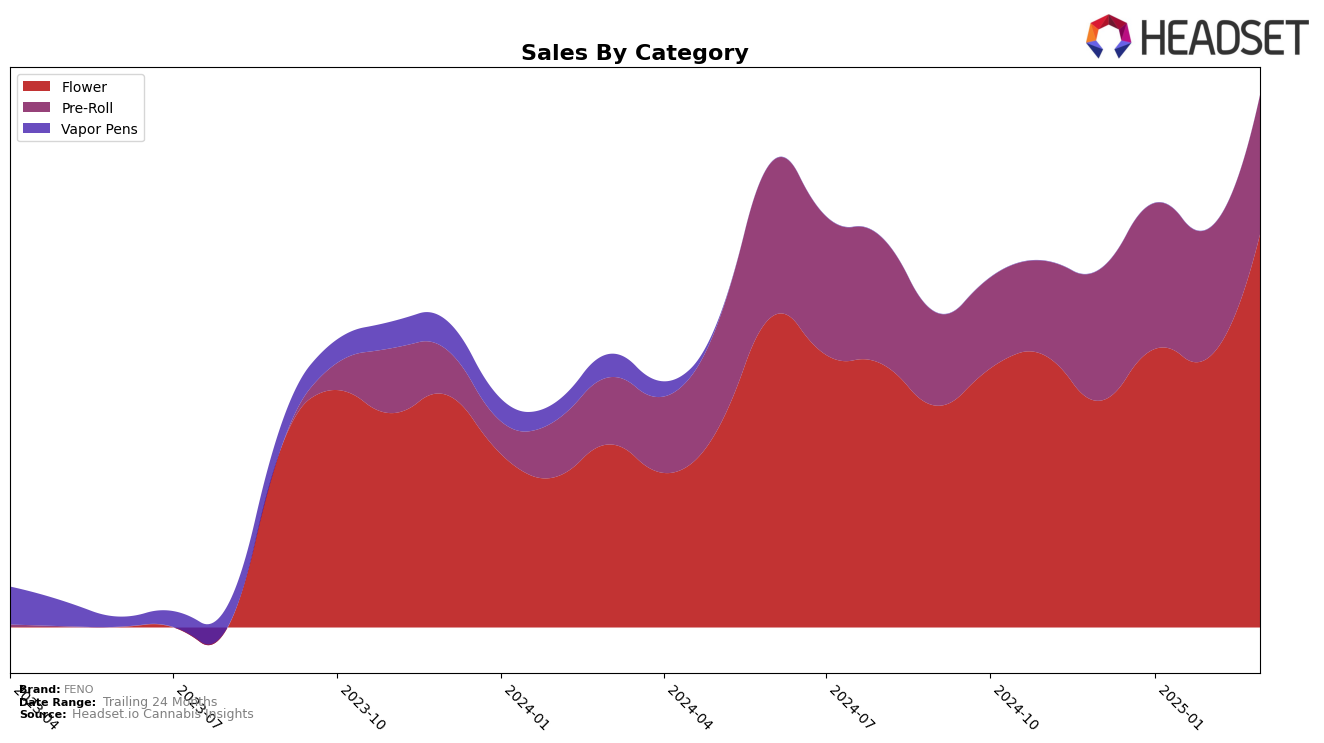

In Arizona, FENO has shown notable performance in the Flower category, improving its rank from 26th in December 2024 to 22nd by March 2025. This upward trajectory in rankings is accompanied by a significant increase in sales, with March 2025 figures reaching a remarkable $478,912. However, despite these gains, FENO's presence in other states or categories remains absent from the top 30, indicating potential areas for growth or missed opportunities in broader markets.

Within the Pre-Roll category in Arizona, FENO maintained a relatively stable position, beginning and ending the period with ranks of 15th in December 2024 and March 2025, respectively. The consistency in ranking suggests a steady market presence, though fluctuations in sales figures hint at underlying market dynamics or consumer preferences that may require further analysis. The absence of FENO in the top 30 for other categories or states suggests that while they have a foothold in Arizona, expansion or diversification could be key to enhancing their market presence.

Competitive Landscape

In the competitive landscape of the flower category in Arizona, FENO has shown a notable upward trajectory in its rankings, moving from 26th place in December 2024 to 22nd place by March 2025. This improvement in rank is accompanied by a significant increase in sales, particularly evident in March 2025, where FENO's sales surpassed those of 22Red, which experienced a decline in both rank and sales over the same period. FENO's upward movement contrasts with Dr. Greenthumb's, which saw a sharp decline from 6th to 21st place, indicating potential market share opportunities for FENO. Meanwhile, Daze Off and MADE have shown mixed results, with Daze Off improving its rank to 23rd place while MADE consistently stayed around the 20th position. These dynamics suggest that FENO is effectively capitalizing on market trends and consumer preferences, positioning itself as a rising player in Arizona's competitive flower market.

Notable Products

In March 2025, FENO's top-performing product was the Grape Gas Pre-Roll 5-Pack (3.5g), which reclaimed its number one spot with sales of 1869. The Crescendo Pre-Roll 5-Pack (3.5g) emerged strongly, securing the second position, while the Crescendo (14g) followed closely at third. Notably, the Culiacancito Pre-Roll 5-Pack (3.5g) experienced a drop to fourth place after leading in previous months. Meanwhile, the Culiacancito (14g) maintained a steady performance, ranking fifth. This shift in rankings highlights the dynamic nature of product performance within FENO's offerings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.