Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

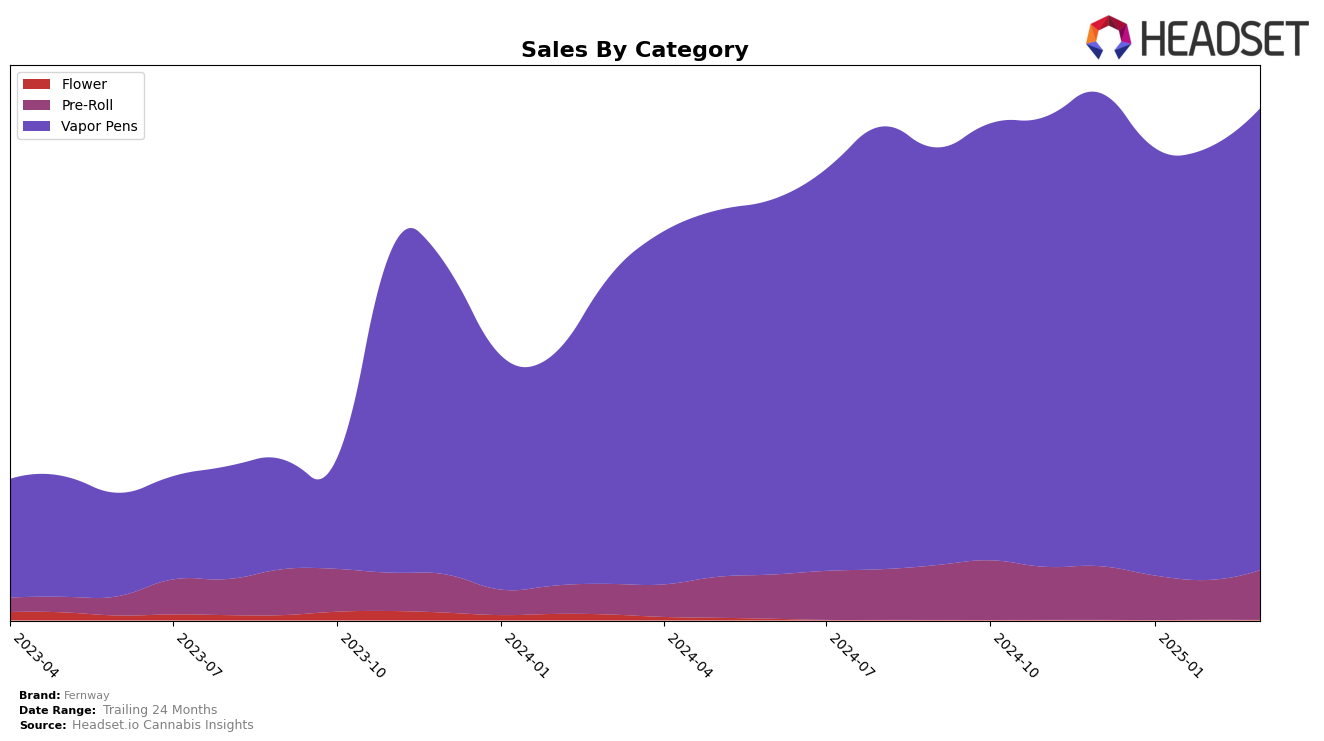

In Massachusetts, Fernway has shown consistent performance in the Vapor Pens category, maintaining a stronghold on the top position for most of the months observed, except for a slight dip to the second position in January 2025. This indicates a robust market presence and consumer preference for their vapor pens. However, in the Pre-Roll category, Fernway's performance is slightly more volatile, fluctuating between the seventh and eighth positions. This suggests room for growth and potential strategies to strengthen their standing in this segment. Notably, the sales figures for vapor pens in March 2025 indicate a significant upward trend, which could be a positive sign for future performance.

In New Jersey, Fernway's Vapor Pens have consistently held the top spot, demonstrating a strong market leadership in this category across all months. This stability contrasts with their performance in the Pre-Roll category, where they ranked outside the top 30 in February 2025, marking a concerning dip. This inconsistency might highlight a need to reassess their approach or offerings in the Pre-Roll segment to capture more market share. Meanwhile, in New York, Fernway's Vapor Pens maintained a steady position around the fifth rank, indicating a stable presence but also suggesting potential opportunities to climb higher in the rankings with strategic efforts.

Competitive Landscape

In the competitive landscape of vapor pens in New Jersey, Fernway consistently holds the top position from December 2024 through March 2025, showcasing its dominance in the market. Despite fluctuations in sales figures, Fernway maintains its lead over competitors like Select and the Essence. Notably, while Select experienced a dip in rank from second to third place in February 2025, Fernway's position remained unchallenged, underscoring its strong brand loyalty and market presence. Meanwhile, the Essence briefly overtook Select in February 2025, indicating a competitive tussle for the second spot, but Fernway's consistent sales performance keeps it well ahead of these competitors. This stability in rank and sales suggests that Fernway's strategies in product quality and customer engagement are effectively sustaining its leadership in the New Jersey vapor pen market.

Notable Products

In March 2025, Fernway's top-performing product was the White Widow Distillate Cartridge (1g) in the Vapor Pens category, maintaining its consistent first-place ranking from previous months with sales of 12,916 units. The Berry Haze Distillate Cartridge (1g) secured the second position, climbing back from a dip to third place in February. The Traveler - Blueberry Cake Distillate Cartridge (1g) ranked third, a slight drop from its second-place position the previous month. The Americano Distillate Cartridge (1g) made its debut at fourth place, indicating a strong entry into the market. Lastly, Mandarin Orange Distillate Cartridge (1g) held the fifth position, consistent with its performance in December and January.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.