Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

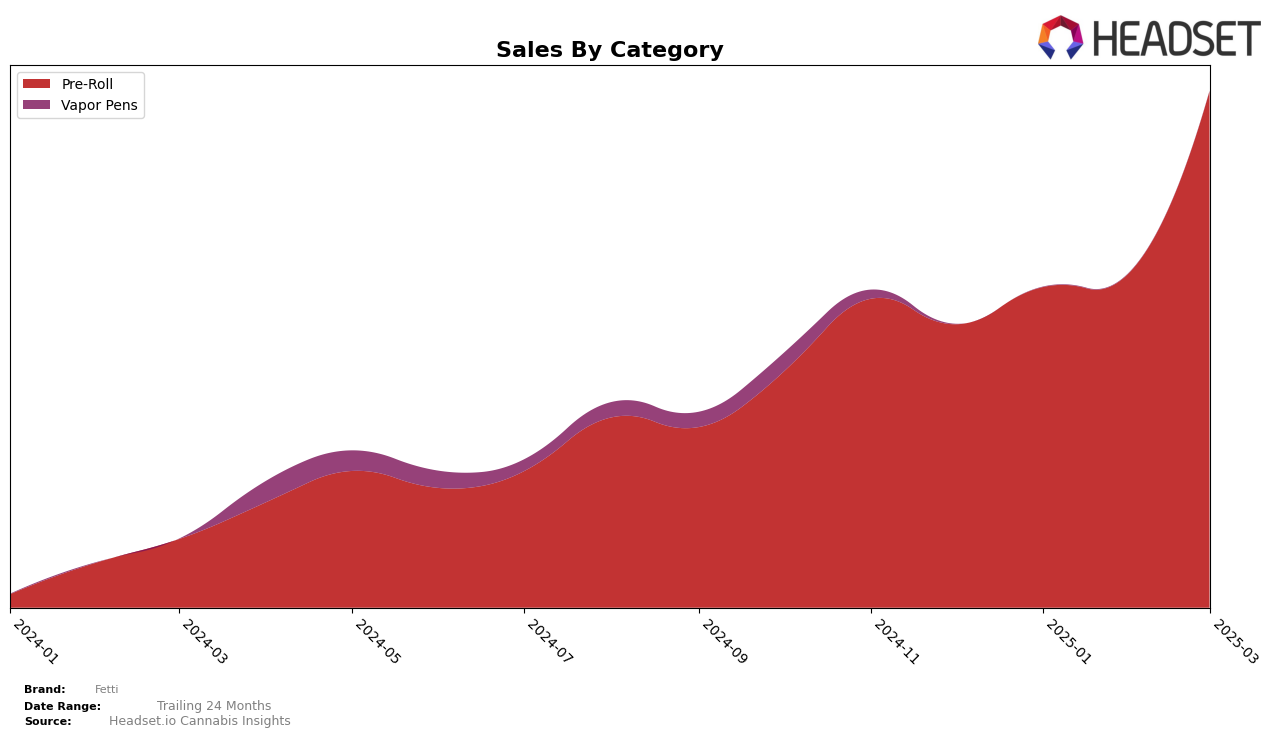

Fetti's performance in the Washington market has shown a positive trajectory in the Pre-Roll category over the past few months. Starting from a ranking of 47 in December 2024, Fetti climbed to 25 by March 2025. This consistent upward movement highlights a significant improvement in their market positioning within this category. Notably, the brand was not in the top 30 as of December 2024, which indicates that their recent efforts have been effective in enhancing their visibility and consumer acceptance in Washington's competitive Pre-Roll market.

While Fetti's rise in Washington's Pre-Roll category is commendable, the absence of rankings in other states or categories suggests that their presence might be limited or less competitive outside this specific segment. This lack of visibility in other regions or categories could be seen as a potential area for growth or a challenge that the brand might need to address. The sales figures in Washington, however, reflect a positive trend, with a notable increase from January to March 2025, indicating that their strategies in this state are yielding favorable results. Further exploration into their performance across different states and categories could provide deeper insights into their overall market strategy and potential areas for expansion.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in Washington, Fetti has demonstrated a notable upward trajectory in its rankings over the past few months. Starting from a rank of 47 in December 2024, Fetti climbed to 25 by March 2025, showcasing a significant improvement in its market position. This upward movement is indicative of a strong increase in sales, aligning with a broader trend of growing consumer preference for Fetti's offerings. In contrast, competitors like Artizen Cannabis and Sky High Gardens (WA) have experienced fluctuating ranks, with Artizen Cannabis not making it into the top 20 throughout this period. Meanwhile, Seattle's Private Reserve and Seattle Marijuana Company have shown more stable but less dynamic rank changes. Fetti's rapid ascent in rank suggests a successful market strategy and increasing consumer loyalty, positioning it as a formidable competitor in the Washington Pre-Roll market.

Notable Products

In March 2025, Fetti's top-performing product was the Lemon Cherry Gelato THCA Infused Pre-Roll 5-Pack (2.5g) in the Pre-Roll category, which climbed from third place in February to secure the top spot with sales reaching 1659 units. The Fuzzy Grape Infused Pre-Roll 2-Pack (1g) maintained its position in second place, showing consistent performance with sales of 1486 units. The Blueberry Pancake Infused Pre-Roll 2-Pack (1g) dropped one rank to third, despite a strong showing with 1477 units sold. Motorbreath Infused Pre-Roll 2-Pack (1g) fell from first in February to fourth place, indicating a slight decline in its popularity. The Joker Candy Infused Pre-Roll 5-Pack (2.5g) entered the top five in March, moving up from fourth to fifth place, suggesting a growing interest in this product.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.