Feb-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

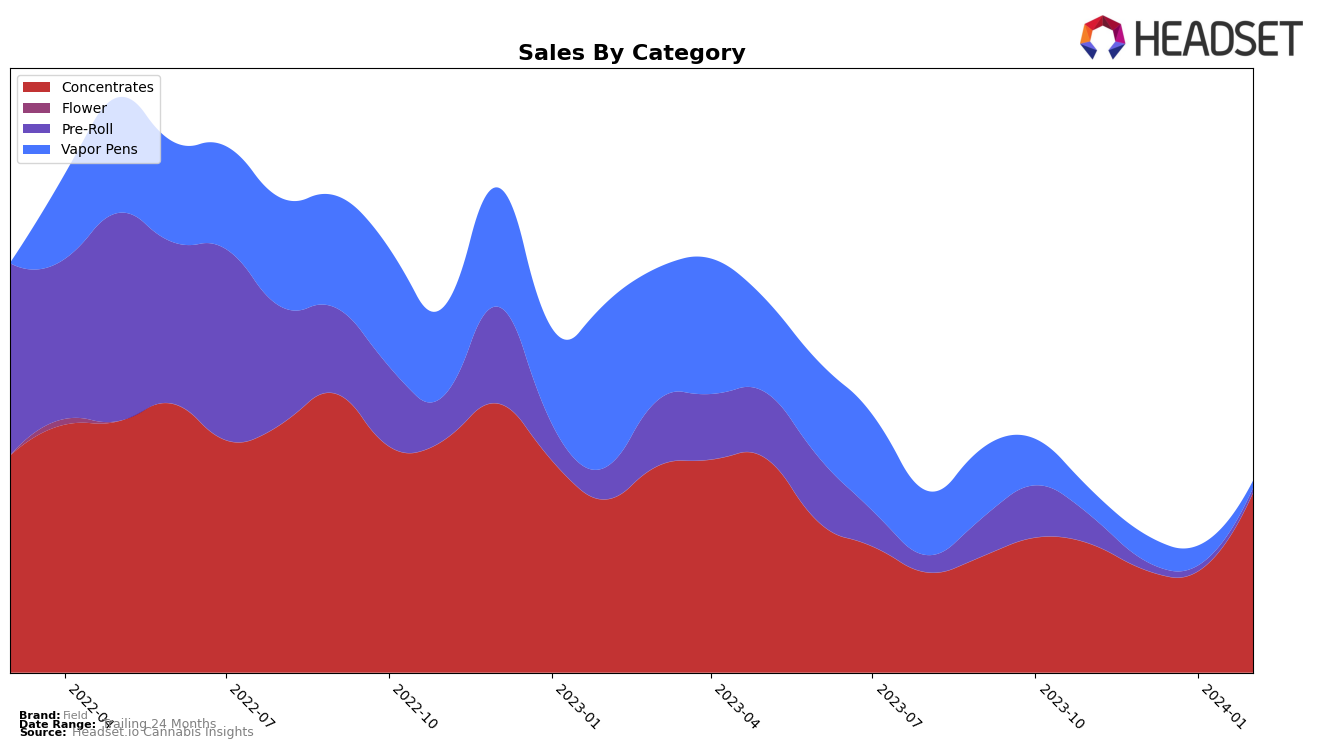

In the competitive landscape of California's cannabis market, the brand Field has shown a notable trajectory within the Concentrates category. Initially, Field was not within the top 30 brands for November 2023, ranking at 39th, which indicates a position outside the core competitive set. However, there was a discernible downward trend as the brand slipped further to 48th in December 2023 and to 50th in January 2024, suggesting challenges in maintaining or growing its market share during this period. Despite these setbacks, February 2024 marked a significant turnaround for Field, as it surged to the 30th rank. This rebound is particularly noteworthy, reflecting a potential strategic shift or market dynamics that favored Field's offerings. The sales figures underscore this point, with a notable increase in February 2024 to 123675.0, hinting at a successful recovery or adaptation strategy by the brand.

The fluctuation in Field's performance in the Concentrates category over these months reveals several layers about its market presence and strategy in California. The initial absence from the top 30, followed by a declining rank, could be interpreted as a struggle to capture and retain consumer interest or to compete effectively with other brands. However, the positive shift in February 2024 suggests a potential revival in Field's market strategy or consumer engagement efforts. This period of volatility highlights the dynamic nature of consumer preferences and competitive positioning within the cannabis industry. While specific strategies employed by Field to regain its footing are not detailed, the observed outcomes suggest effective adjustments that could serve as a case study for brand resilience and adaptability. Nonetheless, the detailed analysis of these strategic moves remains beyond the scope of this overview, inviting further exploration into the factors driving Field's performance in the California market.

Competitive Landscape

In the competitive landscape of the concentrates category in California, Field has shown a notable fluctuation in its market position, moving from a rank outside the top 20 in November 2023 to 30th place by February 2024. This trajectory indicates a significant improvement in its market standing, despite starting from a lower base. Competitors such as Locals Only Concentrates and Community Cannabis have experienced shifts in their rankings as well, with Locals Only Concentrates seeing a drop to 28th place in February after holding a stronger position in the top 20 earlier. Community Cannabis, on the other hand, has maintained a more stable presence, slightly improving to 29th place. Notably, Field's sales in February surpassed those of Clsics and Community Cannabis, suggesting a positive momentum that could challenge these competitors if the trend continues. This dynamic market movement underscores the importance of monitoring sales and rank changes to understand the competitive pressures and opportunities within the California concentrates market.

Notable Products

In February 2024, Field's top-performing product was Papaya Melonz Live Rosin (1g) within the Concentrates category, maintaining its January rank at number 1 with impressive sales of 1295 units. The second spot was taken by a newcomer, Lilac Diesel Live Resin (1g), which did not have any sales or ranking data for the previous months. Following closely, Fatso Live Resin (1g) secured the third position, another new entry to the rankings. Gush Mints Live Resin (1g) experienced a slight drop, moving from the second position in January to the fourth in February, indicating a shift in consumer preferences. Lastly, Guava'z Live Resin (1g) entered the top five at the fifth position, marking its first appearance in the rankings since prior data was not available.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.