Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

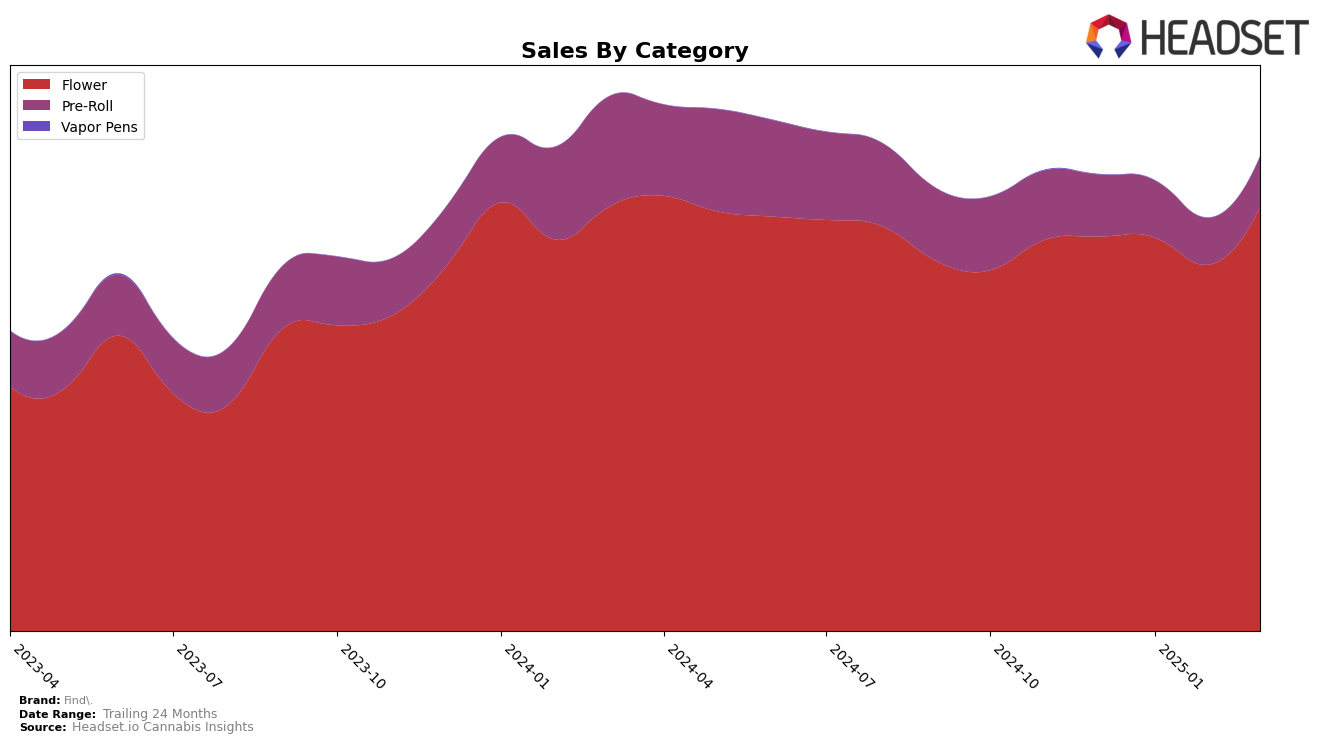

In the state of Arizona, Find. has shown a consistent dominance in the Flower category, maintaining the top rank from December 2024 through March 2025. This stability is underscored by a steady increase in sales, peaking at over 4.6 million in March 2025. However, in the Pre-Roll category, the brand's performance has seen a slight decline, moving from 6th to 8th place over the same period, which might be a cause for concern if the trend continues. Meanwhile, in New York, Find. has maintained a strong presence in the Flower category, consistently ranking within the top five, indicating a solid market position.

On the other hand, in Illinois, Find.'s Flower category presence has improved significantly, climbing from outside the top 30 in December 2024 to 26th place by March 2025, which suggests a positive trajectory in this market. In Massachusetts, the brand has been relatively stable in both the Flower and Pre-Roll categories, maintaining a mid-tier ranking with slight fluctuations. However, in Maryland, the absence of a ranking in February 2025 for the Flower category could indicate a challenge in maintaining consistent market presence. These insights suggest that while Find. is performing well in certain regions and categories, there are areas where strategic adjustments may be needed to enhance their market position further.

Competitive Landscape

In the Arizona Flower category, Find. has maintained a consistent lead as the top-ranked brand from December 2024 through March 2025. This stability in rank suggests a strong market presence and customer loyalty. Despite a slight dip in sales from December to January, Find. rebounded with increased sales in February and March, indicating resilience and effective market strategies. In contrast, Mohave Cannabis Co. consistently held the second rank, with sales figures significantly lower than Find.'s, although they experienced a notable sales spike in January. Meanwhile, Shango maintained the third position from January onwards, showing a steady performance but with sales figures that are considerably lower than both Find. and Mohave Cannabis Co. The competitive landscape highlights Find.'s dominant position, but the growth of competitors suggests a dynamic market where maintaining leadership will require continued innovation and customer engagement.

Notable Products

In March 2025, the top-performing product for Find was Zmintz 14g in the Flower category, which climbed to the number one rank, showing a significant increase in sales to 10,220 units. El Chivo #5 Pre-Roll 1g secured the second position, followed by Motor Breath Pre-Roll 1g in third place. The Mac N Chz 14g also made a strong showing in fourth place, while Martian Mints Pre-Roll 1g rounded out the top five. Notably, Zmintz 14g rose from second place in February 2025 to claim the top spot, highlighting its growing popularity. These shifts indicate a dynamic change in consumer preferences within the Find product lineup.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.