Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

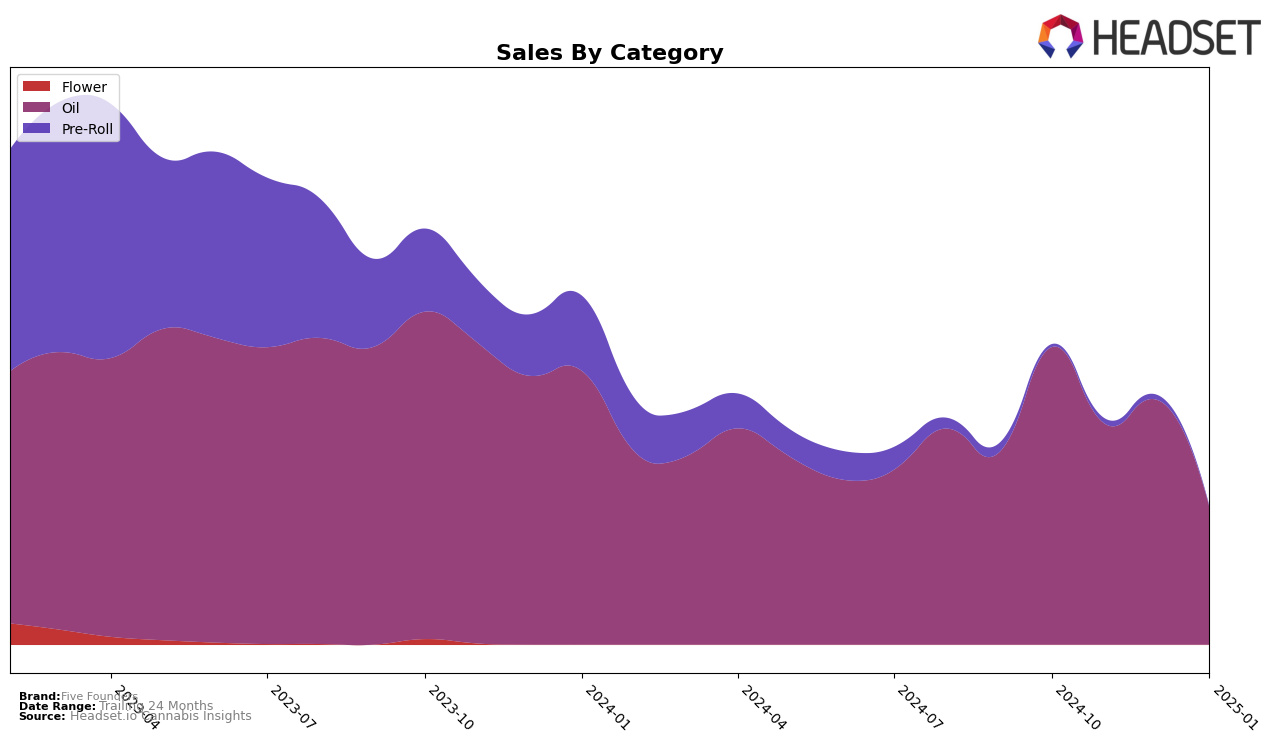

Five Founders has shown notable performance across different categories and regions, with some interesting movements in rankings over the observed months. In the Oil category, Five Founders made a significant entry into the top 10 in Alberta in November 2024, maintaining its position in December before dropping out of the top 30 by January 2025. This drop could suggest increased competition or shifting consumer preferences in the region. Meanwhile, in Ontario, Five Founders experienced a gradual decline in rankings from October 2024 through January 2025, moving from 7th place to 13th place. This consistent downward trend might indicate challenges in maintaining market share or the impact of new entrants in the Oil category.

While specific sales figures are sparse, the available data reveals some intriguing insights. In Ontario, Five Founders experienced a significant drop in sales from October 2024 to January 2025, which aligns with their declining rank in the Oil category. This suggests that their sales strategy might need reevaluation to regain traction. In contrast, the brand's sudden appearance in Alberta's top 10 rankings in November and December 2024, followed by a disappearance in January 2025, hints at a potential short-term strategy or promotion that temporarily boosted their market presence. Understanding these trends could be crucial for stakeholders looking to optimize Five Founders' market positioning and growth strategies across different regions.

Competitive Landscape

In the Ontario oil category, Five Founders has experienced a notable decline in rank and sales over the past few months. Starting from a strong position at 7th place in October 2024, the brand has slipped to 13th by January 2025. This downward trend in rank is mirrored in its sales figures, which have dropped significantly from October to January. In contrast, Twd. has maintained a relatively stable position, consistently ranking between 11th and 12th place, suggesting a steadier performance despite a gradual decline in sales. Meanwhile, Solei and Frank have shown fluctuations in their rankings, with Solei improving from 18th to 14th and Frank rising from 18th to 13th before settling at 15th. Notably, Divvy entered the top 20 in December, quickly climbing to 9th place by January, indicating a rapid gain in market traction. These shifts suggest that while Five Founders faces challenges in maintaining its market position, competitors like Divvy are capitalizing on the opportunity to capture a larger share of the market.

Notable Products

In January 2025, the top-performing product for Five Founders was THC Oil (30ml) in the Oil category, maintaining its consistent first-place ranking from previous months, despite a decrease in sales to 710 units. CBD Oil (30ml) also held its second-place position in the Oil category, continuing its stable performance. Balanced Oil (30ml) saw an improvement, climbing to third place from fourth in December 2024, with a notable increase in sales figures. CBD:THC 8:5 Balanced Oil moved up to fourth place, showing a slight gain in sales. Indica Blend Pre-Roll 5-Pack (2.5g) experienced a drop in ranking to fifth place, indicating a decline in its sales performance compared to prior months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.