Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

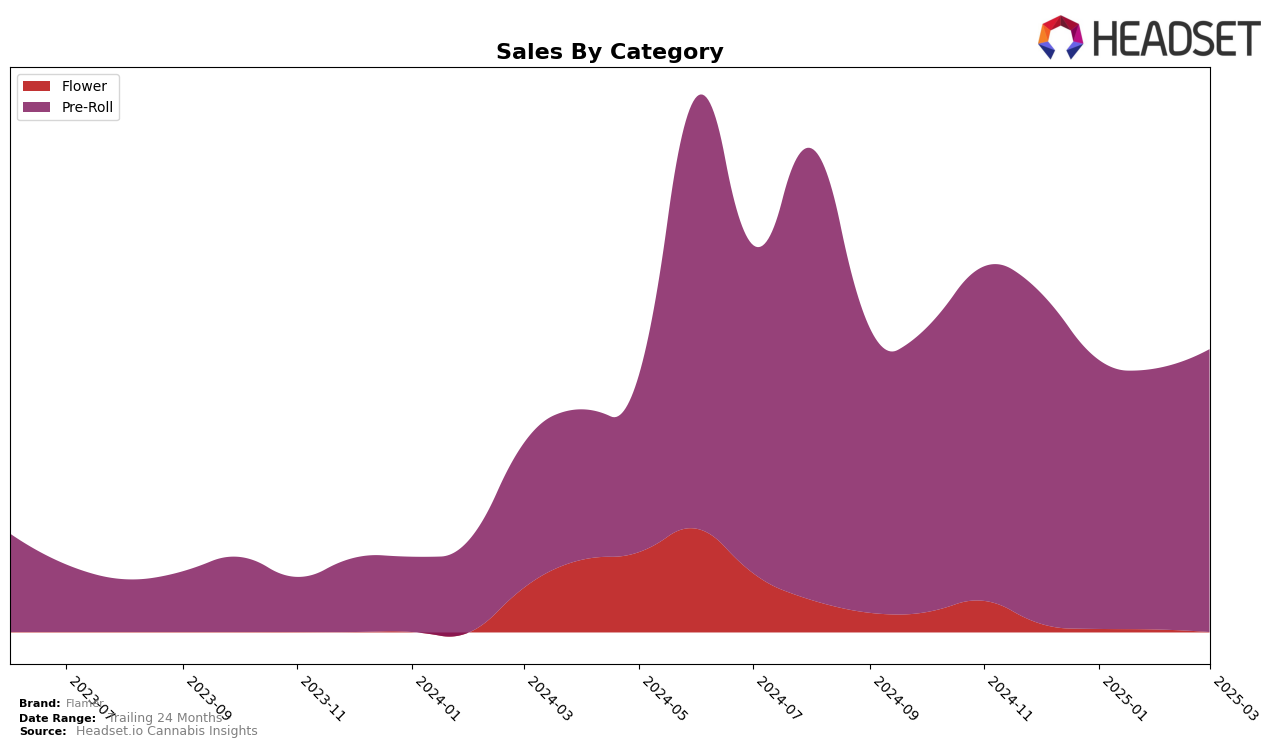

Flamer's performance in the Pre-Roll category in New York has shown a slight decline in the first quarter of 2025. Starting from a rank of 23 in December 2024, Flamer dropped to 27 in January 2025 and continued to slide to 28 in both February and March 2025. This downward trend suggests that the brand is facing increased competition or perhaps a shift in consumer preferences within the state. Despite the decline in rankings, it's noteworthy that Flamer managed to stabilize its position at 28 for two consecutive months, indicating that it might have found a consistent customer base or that their marketing efforts are starting to take effect.

The sales figures for Flamer in New York provide further insight into its performance. While the brand experienced a decrease in sales from December 2024 to February 2025, there was a slight recovery in March 2025, with sales increasing to $177,956. This suggests that while the brand is struggling to climb back up the rankings, it is making some headway in terms of sales volume. The absence of Flamer in the top 30 brands in any other categories or states indicates that New York remains a critical market for them, and focusing on retaining or improving their position here could be pivotal for their overall success.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in New York, Flamer has experienced notable fluctuations in its ranking from December 2024 to March 2025. Starting at rank 23 in December, Flamer saw a decline to rank 27 in January, maintaining a similar position at 28 in both February and March. This pattern indicates a stabilization after an initial drop, suggesting potential challenges in maintaining market share amidst strong competition. Notably, Packs (fka Packwoods) showed a significant rise to rank 13 in January, although it fell to rank 30 by March, indicating volatility. Meanwhile, To The Moon experienced a drop to rank 32 in February but rebounded to 26 in March, showing resilience. Competitors like CRU Cannabis and Lobo consistently hovered around the late 20s, with CRU Cannabis slightly outperforming Lobo in March. These dynamics highlight the competitive pressure Flamer faces, emphasizing the need for strategic adjustments to regain and sustain higher rankings in the New York Pre-Roll market.

Notable Products

For March 2025, Silly Goofy Pre-Roll 5-Pack (2.5g) maintained its position as the top-performing product for Flamer, consistent with its rank as the number one product over the past four months, with sales reaching 1820 units. Following closely, Silly Goofy Pre-Roll (0.75g) rose to the second position, showing an improvement from its third-place ranking in February 2025. Lobotomy Pre-Roll (0.75g) slipped to third place after previously holding the second spot in February. P.N.C Pre-Roll 5-Pack (2.5g) held steady at fourth place, indicating stable performance since February. Lastly, Lobotomy Pre-Roll 5-Pack (2.5g) re-entered the top five, securing the fifth position after not being ranked in January and February.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.