Nov-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

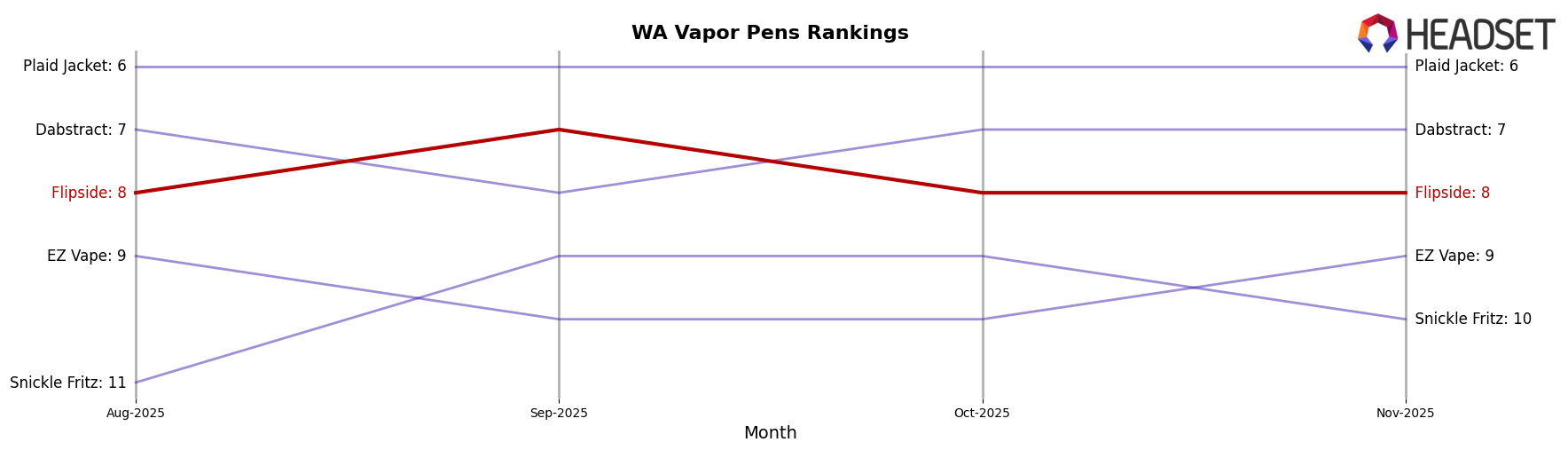

In the state of Washington, Flipside has shown a consistent performance in the Vapor Pens category, maintaining a steady rank around the top 10. Despite a slight fluctuation, the brand has held its position at 8th place for three of the four months analyzed, with a brief improvement to 7th place in September 2025. This consistency suggests a stable consumer base and effective market presence in Washington, although there is a noticeable downward trend in sales from August to November. This decline might indicate a need for Flipside to reassess its market strategies or product offerings to regain momentum.

Notably, Flipside's absence from the top 30 in other states or categories could be seen as a potential area for growth or a concerning gap in their market reach. The brand's focus and success in Washington's Vapor Pens category highlight a niche strength, but it also underscores the importance of expanding their footprint across other categories and regions. Understanding the dynamics of these markets and identifying opportunities for entry could be key for Flipside to diversify its brand presence and increase its overall market share.

Competitive Landscape

In the competitive landscape of Vapor Pens in Washington, Flipside has experienced a slight fluctuation in its ranking over recent months, maintaining a position within the top 10. In August 2025, Flipside was ranked 8th, improved to 7th in September, but slipped back to 8th in October and November. This fluctuation is notable when compared to competitors like Dabstract, which consistently held the 7th position, and Plaid Jacket, which maintained a strong 6th place throughout the same period. Despite these shifts, Flipside's sales have shown a downward trend, contrasting with the stable or slightly increasing sales of its competitors. For instance, Dabstract saw a sales increase from October to November, while Flipside's sales decreased. This competitive pressure highlights the need for Flipside to strategize effectively to regain and maintain a higher rank and bolster sales in this dynamic market.

Notable Products

In November 2025, Flipside's top-performing product was the Watermelon Sugar Flavored Distillate Disposable (1g) in the Vapor Pens category, maintaining its number one rank for four consecutive months with sales of 1707 units. The Strawberry Lemon Haze Flavored Distillate Disposable (1g) climbed to second place, up from third in October, showing a notable increase in sales. The Watermelon Sugar Distillate Cartridge (1g) dropped to third place after being second in October. Meanwhile, the Strawberry Lemon Haze Distillate Cartridge (1g) maintained its fourth-place position. A new entry, the Tangie Banana BHO Live Resin Cartridge (1g), debuted at fifth place in the rankings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.