Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

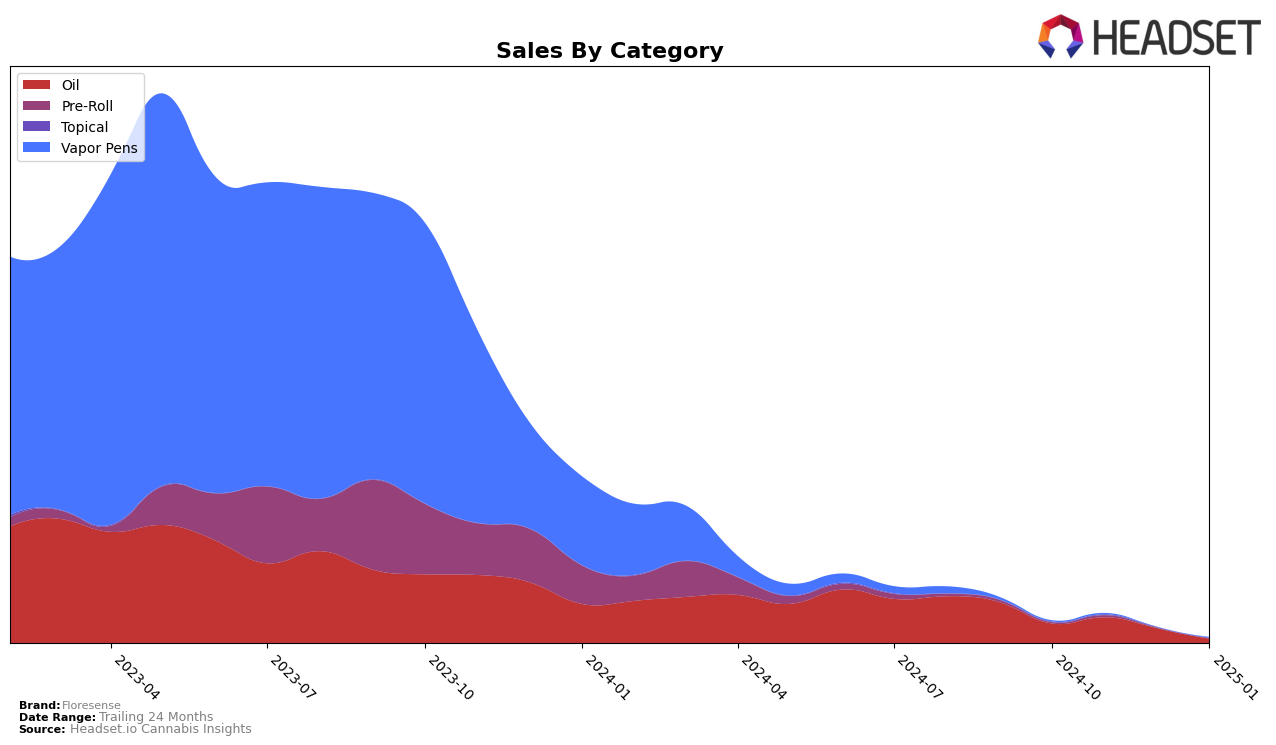

Floresense has shown a consistent presence in the British Columbia market, particularly within the oil category. In October 2024, the brand held the 12th position, improving slightly to 11th in November before settling back to 12th in December. However, by January 2025, Floresense did not appear in the top 30, indicating a significant drop in its ranking. This movement suggests that while Floresense maintained a stable performance towards the end of 2024, the beginning of 2025 was challenging, possibly due to increased competition or market dynamics that did not favor their offerings at the time.

Sales figures for Floresense in British Columbia reflect some interesting trends. There was a notable increase in sales from October to November 2024, followed by a decline in December. The absence of January 2025 sales data in the top 30 could imply a substantial decrease in market traction. This fluctuation highlights the volatility in consumer preferences or potentially seasonal factors affecting the oil category. These insights into Floresense's performance could be crucial for understanding their market strategy and positioning in British Columbia, as well as anticipating future movements.

```Competitive Landscape

In the competitive landscape of the oil category in British Columbia, Floresense has shown a fluctuating presence, maintaining a rank just outside the top 10 over the last quarter of 2024. Despite this, it has not managed to break into the top 10, as evidenced by its ranks of 12th in October and December, and slightly improving to 11th in November. This suggests a stable yet challenging market position, especially when compared to competitors like Redecan, which consistently held a strong 3rd place in October 2024, indicating significantly higher sales. Meanwhile, Emprise Canada entered the top 20 in January 2025, ranking 12th, which could indicate an emerging threat if their growth continues. Floresense's sales figures show a peak in November, but the subsequent decline in December suggests a need for strategic adjustments to maintain momentum and improve its standing in the competitive market.

Notable Products

In January 2025, the top-performing product for Floresense remained CBD 100 Clear Oil (20ml), maintaining its first-place rank for four consecutive months despite a decrease in sales to 146 units. CBD Focus Roller Lubricant (200mg CBD, 10ml) rose to the second position, improving from fourth place in December 2024. CBN:THC:CBD 10:5:1 Blueberry Dreams (30ml) experienced a drop to third place after consistently holding the second rank in the previous months. The Social Series - Cranberry Beach Distillate Cartridge (1g) and Social Series - Strawberry Chill Distillate Cartridge (1g) both achieved the fourth rank, with the latter making a notable reappearance in the rankings. This shift in rankings highlights a dynamic change in consumer preferences within the Floresense product lineup.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.