Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

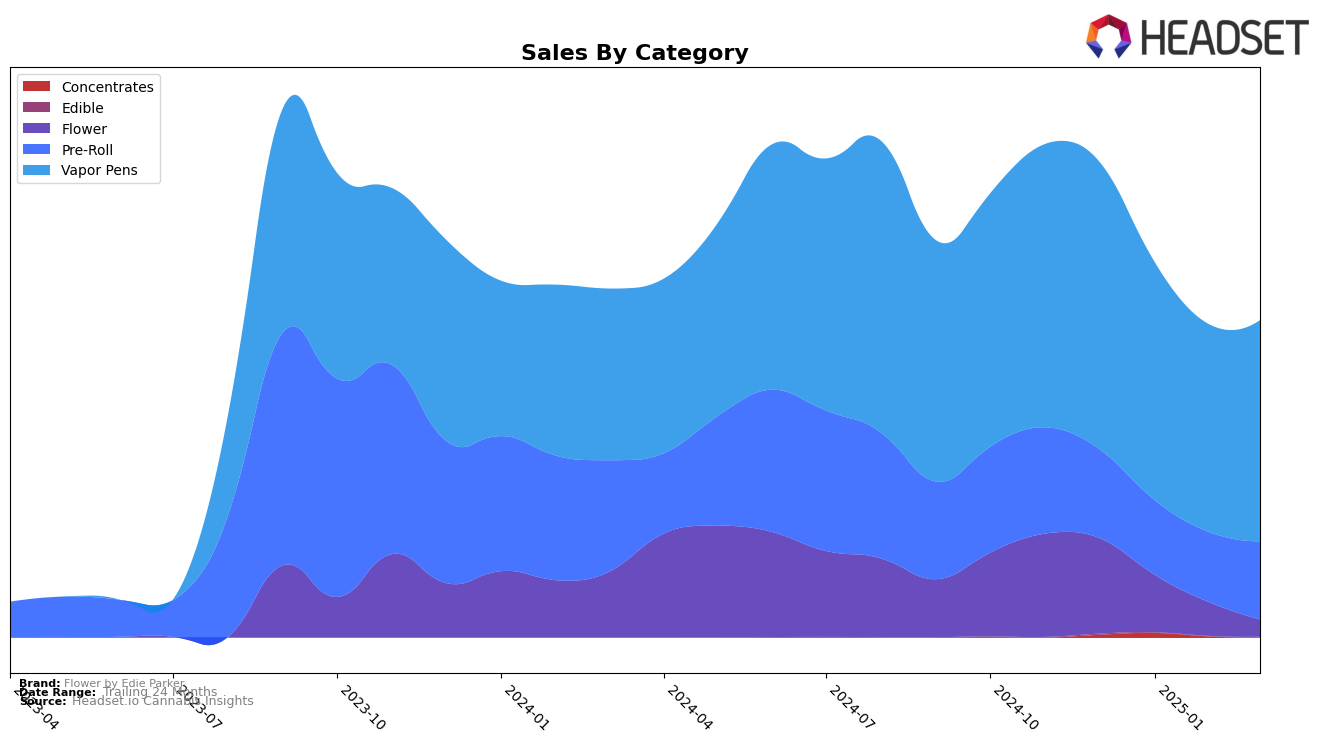

Flower by Edie Parker shows varied performance across different states and product categories. In Illinois, the brand's performance in the Pre-Roll category has been fluctuating, with rankings moving from 31st in December 2024 to 37th by March 2025. This suggests a slight decline in their standing within this category. Conversely, their Vapor Pens in Illinois are showing some signs of stabilization, with a slight improvement in March 2025, moving up to 49th place after a dip in February. In Massachusetts, the Vapor Pens category saw a significant drop from 45th place in December 2024 to 71st by March 2025, indicating a challenge in maintaining market share in this region.

In Maryland, Flower by Edie Parker has had a relatively stable presence in the Pre-Roll category, maintaining a rank within the top 30 throughout the months. However, their Flower category ranking has seen a decline, moving from 27th in December 2024 to 41st in March 2025. Meanwhile, in New Jersey, the brand's Vapor Pens have consistently performed well, staying within the top 20, and even improving to 15th place in March 2025. On the other hand, in New York, the brand's Flower category did not make it to the top 30 in March 2025, reflecting a potential area for growth or reevaluation. These shifts highlight the dynamic nature of the cannabis market and the varying consumer preferences across different regions.

Competitive Landscape

In the competitive landscape of vapor pens in New Jersey, Flower by Edie Parker has experienced fluctuating rankings, indicating a dynamic market presence. While maintaining a consistent position at 16th in December 2024 and January 2025, the brand saw a slight dip to 17th in February 2025 before rebounding to 15th in March 2025. This suggests a resilient recovery amidst competitive pressures. Notably, Rove and Bloom have maintained higher ranks, with Bloom consistently holding the 14th position from January to March 2025, indicating stable consumer preference. Jersey Smooth also presents strong competition, ranking between 11th and 13th during the same period. Despite these challenges, Flower by Edie Parker's ability to climb back in March suggests potential for growth and adaptability in a competitive market.

Notable Products

In March 2025, the top-performing product for Flower by Edie Parker was the Happiest Hour Blend Pre-Roll 2-Pack, which climbed to the first rank from fourth in February. The Early Bird Pre-Roll 2-Pack followed closely, moving up to second place with sales reaching 4,664 units. The Nightcap - Napa Pre-Roll 2-Pack secured the third position, maintaining its strong sales performance from the previous month. Good Night - Lavender Vanilla Distillate Disposable saw a slight drop to fourth place from its first rank in February. Notably, Good Morning - Maui Mango Distillate Disposable entered the top five for the first time, indicating growing popularity in the vapor pens category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.