Dec-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

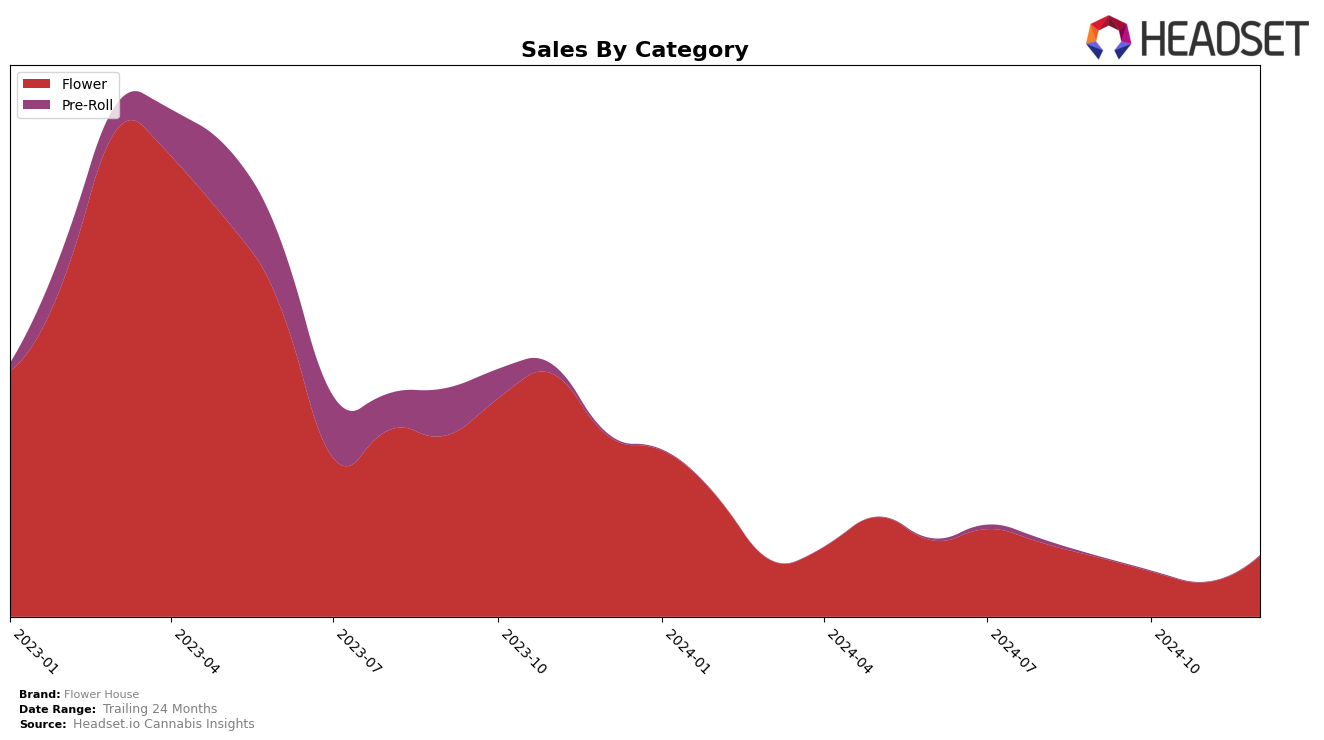

In the Nevada market, Flower House has shown a notable fluctuation in its ranking within the Flower category. Starting at the 23rd position in September 2024, the brand experienced a dip in October and November, falling out of the top 30 in November, before making a strong comeback to the 16th position by December. This resurgence coincides with a significant increase in sales from November to December, highlighting a positive trend. The ability to recover and improve their standing in a competitive market like Nevada suggests strategic adjustments or successful marketing efforts during this period.

Conversely, in New York, Flower House has struggled to maintain a foothold in the top rankings. Throughout the last quarter of 2024, the brand did not manage to break into the top 30, starting at the 63rd position in September and gradually declining to 93rd by December. This downward trajectory in New York may indicate challenges in market penetration or competitive pressures that the brand has yet to overcome. The consistent drop in rankings, despite fluctuations in sales, suggests that Flower House may need to reassess its strategies to gain traction in this market.

Competitive Landscape

In the competitive landscape of the flower category in Nevada, Flower House experienced notable fluctuations in its ranking over the last quarter of 2024. Starting at rank 23 in September, Flower House saw a dip in October to rank 25, followed by a significant drop to rank 37 in November. However, December marked a strong recovery as it climbed to rank 16. This rebound suggests a positive turnaround in sales performance, aligning with a substantial increase in sales from November to December. In contrast, CAMP (NV) experienced a volatile ranking, peaking at rank 5 in November but dropping to rank 18 in December, indicating potential instability in their sales. Meanwhile, Highlights and Good Green showed a consistent upward trend, with both brands improving their ranks from September to December. Super Good demonstrated a more stable and upward trajectory, finishing December at rank 14, slightly ahead of Flower House. These dynamics highlight the competitive pressure Flower House faces, yet its December recovery indicates resilience and potential for growth in the Nevada flower market.

Notable Products

In December 2024, Mai Tai (3.5g) emerged as the top-performing product for Flower House, achieving the number one rank with impressive sales figures of 3,388 units. Tropsanto (3.5g) climbed to the second position, showing a significant increase from its previous fifth place in October. Strange Haze #8 (3.5g) dropped to third place after maintaining the top position in both October and November. Jungle Pie (3.5g) entered the rankings at fourth place, while Matanuska Thunder Fuck (3.5g) rounded out the top five, moving down from its second-place ranking in November. Overall, the rankings illustrate a dynamic shift in consumer preferences with new entries and notable movements among the top contenders.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.