Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

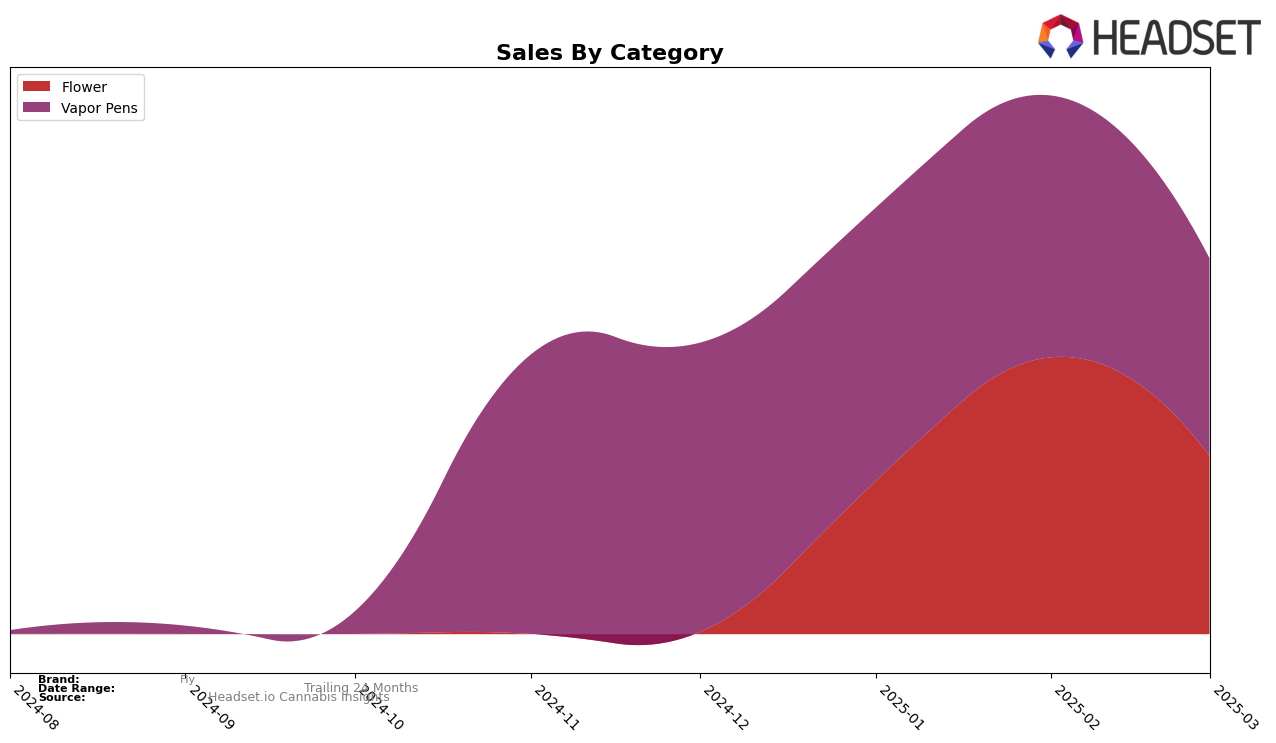

In the state of Michigan, Fly has shown varied performance across different product categories. Notably, in the Flower category, Fly did not make it into the top 30 brands from December 2024 to March 2025, indicating a challenging competitive environment or potential issues in market penetration for this category. This absence from the top ranks suggests that Fly may need to reassess its strategies in Michigan's Flower market to improve its standing. On the other hand, Fly's presence in the Vapor Pens category has been consistent, maintaining the 24th position from December 2024 to February 2025, before slipping to the 30th rank in March 2025. This decline, albeit still within the top 30, indicates a need for vigilance to prevent further drops and to regain its previous position.

Fly's sales trajectory in Michigan offers some insights into its market dynamics. The Vapor Pens category, while experiencing a slight decline in rank, also saw a decrease in sales from December 2024 to March 2025, which could be attributed to either seasonal trends or increased competition. This downward trend in sales might necessitate a strategic review to identify potential areas for improvement or innovation. Interestingly, despite the challenges in the Flower category, Fly's overall sales figures suggest there are underlying strengths in its portfolio that could be leveraged to bolster performance across other categories. For more detailed insights, one might consider examining the broader competitive landscape in Michigan or exploring Fly's strategies in other states or provinces.

Competitive Landscape

In the Michigan Vapor Pens category, Fly experienced a notable shift in its competitive positioning from December 2024 to March 2025. Initially ranked 24th, Fly maintained its position through January and February 2025 but dropped to 30th by March. This decline in rank is coupled with a decrease in sales, indicating potential challenges in maintaining market share. In contrast, Hyman showed a remarkable improvement, climbing from 54th in December to 28th in March, suggesting a successful strategy in capturing consumer interest. Similarly, Society C improved its rank significantly from 67th to 33rd over the same period, reflecting a positive sales trajectory. Meanwhile, Gelato experienced a decline, dropping from 22nd to 31st, which could indicate a shift in consumer preferences or competitive pressures. These dynamics highlight the competitive volatility in the Michigan Vapor Pens market and underscore the importance for Fly to reassess its strategies to regain its competitive edge.

Notable Products

In March 2025, Fly's top-performing product was the Sour OG Distillate Cartridge (1g) from the Vapor Pens category, which climbed to the number one spot with sales reaching 7,134 units. Sunshine Kush (3.5g) in the Flower category secured the second position, marking its debut in the rankings for the month. The Gelato Distillate Cartridge (1g) maintained a strong presence in the third position, slightly improving from February's fifth rank. The Cereal Milk Distillate Cartridge (1g), previously in the top spot in January and February, fell to fourth place. Melonade Distillate Cartridge (1g) entered the rankings at fifth place, showcasing a solid performance for the month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.