Oct-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

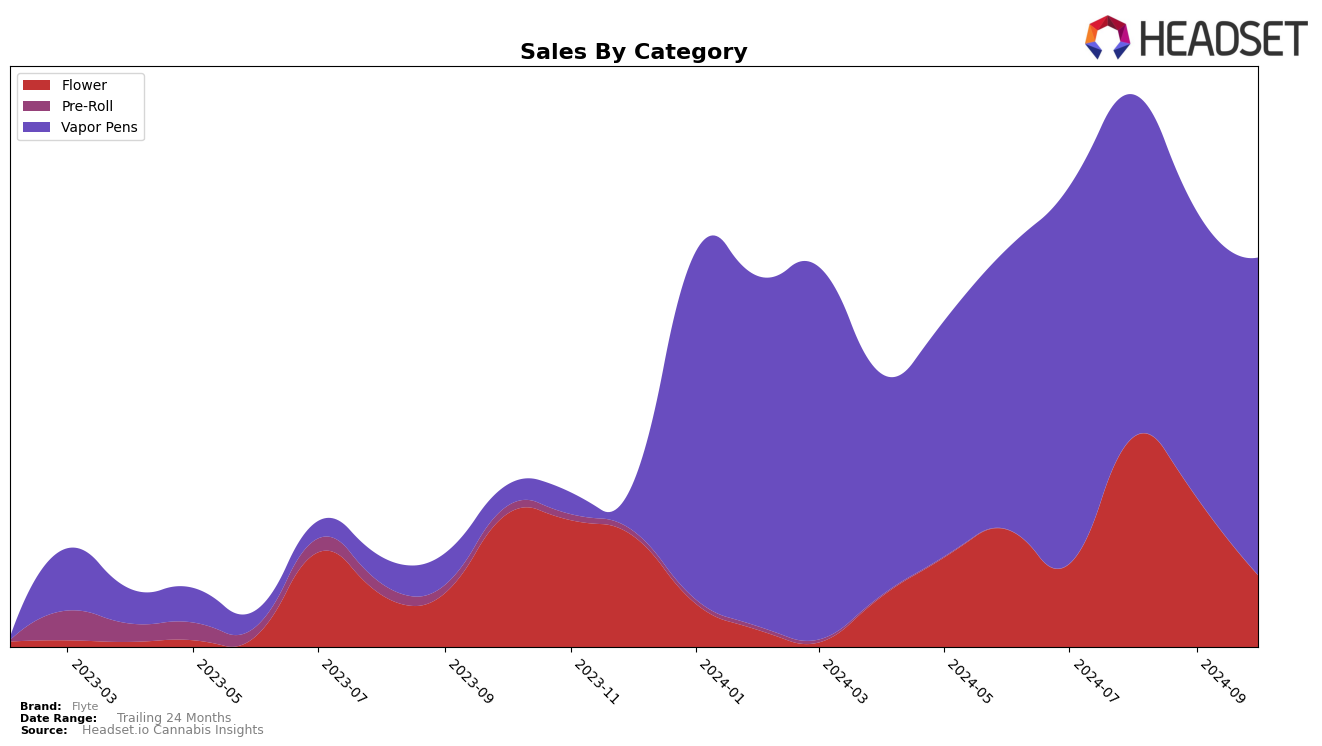

Flyte's performance in the Vapor Pens category in British Columbia has shown a gradual decline in rankings over the past few months. Starting at 24th place in July 2024, the brand slipped to 26th by October 2024. This downward trend is mirrored in their sales figures, which saw a notable dip from July to September, before a slight recovery in October. This suggests that while Flyte is maintaining a presence in the market, it may be facing increased competition or changes in consumer preferences. In contrast, Flyte's entry into the Ontario market for Vapor Pens is just beginning to gain traction, achieving a rank of 95th in October, indicating room for growth and potential for strategic marketing efforts to boost visibility and sales in this region.

In Oregon, Flyte's foray into the Flower category saw them debut at 89th place in August 2024, but they did not maintain a top 30 position in subsequent months. This initial ranking suggests that while there is interest in Flyte's Flower products, the brand may need to enhance its competitive strategy or product offerings to sustain and improve its market position. The absence of rankings in other months could be seen as a challenge for Flyte as it seeks to establish a stronger foothold in the Oregon market. Overall, Flyte's performance across different states and categories highlights both challenges and opportunities, with each region presenting unique dynamics that could influence the brand's future strategies.

Competitive Landscape

In the competitive landscape of the Vapor Pens category in British Columbia, Flyte has experienced a gradual decline in its ranking over the past few months, moving from 24th in July 2024 to 26th by October 2024. This downward trend is accompanied by a decrease in sales, suggesting a potential challenge in maintaining market share. Meanwhile, competitors such as RAD (Really Awesome Dope) have shown resilience, improving their rank from 25th in July to 24th in both September and October, alongside a notable increase in sales in October. Similarly, No Future has demonstrated a fluctuating yet competitive presence, achieving a rank of 23rd in September before settling at 25th in October, with sales figures indicating a recovery trend. These shifts highlight the dynamic nature of the market and the need for Flyte to strategize effectively to regain its competitive edge.

Notable Products

In October 2024, Bella Berry Distillate Disposable (0.5g) maintained its position as the top-performing product from Flyte, continuing its reign from September and August. Smashin Passion Distillate Disposable (0.5g) held steady in second place, showing an increase in sales compared to September with 1,361 units sold. Whata Melon Distillate Disposable (0.5g) debuted on the rankings in October, securing the third position among vapor pens. Carbon Fiber (1g) improved its standing to fourth place in the flower category, rising from fifth in September. Candy Fumez (1g) re-entered the top five, despite a drop in sales from its previous appearance in August.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.