May-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

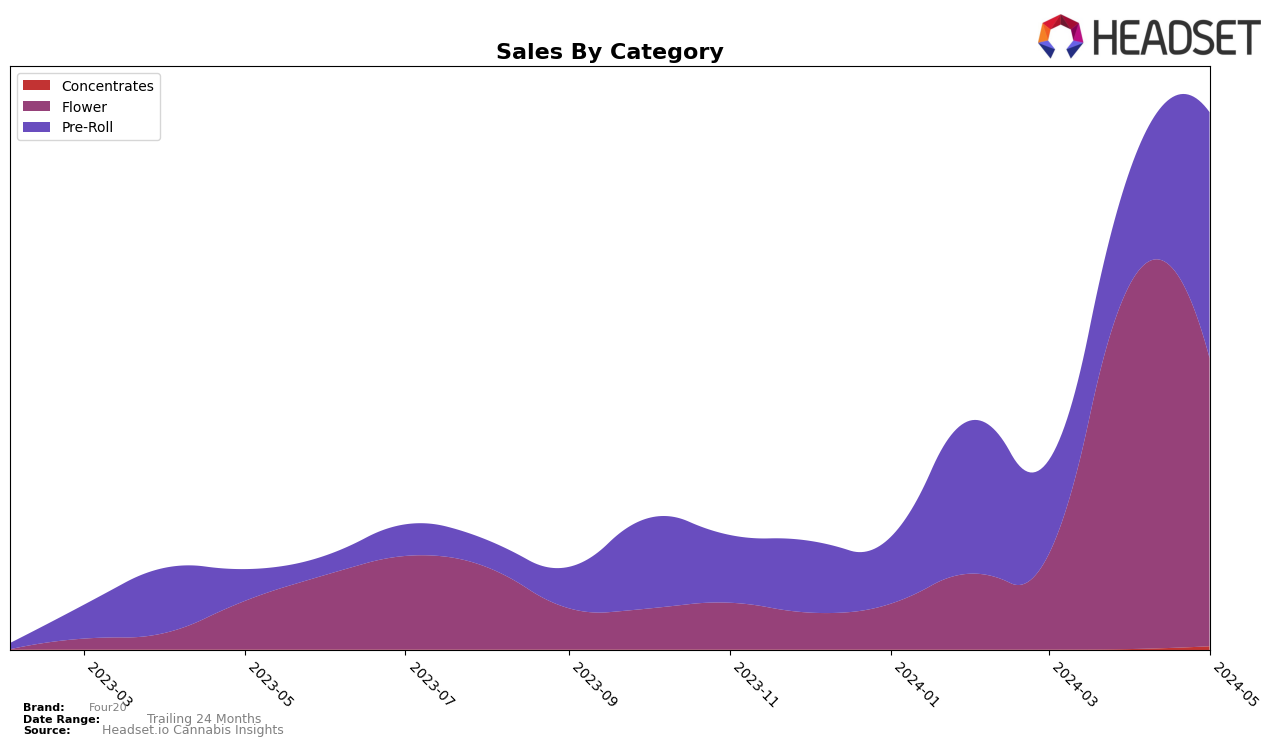

Four20 has shown significant fluctuations in its performance across different categories and states. In Massachusetts, the brand demonstrated a notable improvement in the Flower category, climbing from a rank of 87 in February 2024 to 30 in April 2024 before dropping slightly to 43 in May 2024. This upward trend in April suggests a strong market presence and effective strategies, although the subsequent decline indicates potential challenges or increased competition. The Pre-Roll category also saw some variability, with Four20 moving from rank 28 in February to 19 in May, showing a consistent improvement overall despite a dip in March and April.

In terms of sales, Four20's performance in Massachusetts is indicative of its growing influence, particularly in the Flower category where sales peaked in April 2024. However, it is important to note that the brand did not make it into the top 30 in the Flower category in February and March, highlighting areas for potential growth or market penetration. Meanwhile, their Pre-Roll category saw a significant increase in sales from February to May, suggesting a successful strategy in this segment. These movements across categories and states provide valuable insights into Four20's market dynamics and potential growth opportunities.

Competitive Landscape

In the competitive landscape of the Flower category in Massachusetts, Four20 has shown a significant shift in its market position over the past few months. Starting from a rank of 87 in February 2024, Four20 climbed to 30 in April 2024 before slightly dropping to 43 in May 2024. This upward trend, particularly the leap in April, indicates a strong performance and growing consumer interest. In contrast, Grassroots has consistently ranked outside the top 50, while Harbor House Collective and The Botanist have experienced more stable but less dramatic changes in rank. Notably, Springtime has maintained a stronger position overall, peaking at rank 21 in April 2024 before dropping to 41 in May 2024. These fluctuations highlight the competitive and dynamic nature of the market, with Four20's recent performance suggesting a potential for further growth and increased sales if the brand can maintain its momentum.

Notable Products

In May-2024, Red Velvet Pre-Roll (1g) emerged as the top-performing product for Four20 with sales reaching 6837 units. Jack Skunk Pre-Roll (1g) secured the second position, marking its debut in the rankings. Pink Runtz Pre-Roll (1g) dropped from its previous top rank in April to the third position, despite a notable sales figure of 6131 units. Pure Michigan Pre-Roll (1g) climbed from fifth to fourth place, showing a significant increase in sales. Animal Mintz Pre-Roll (1g) entered the rankings at fifth place with a steady performance.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.