Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

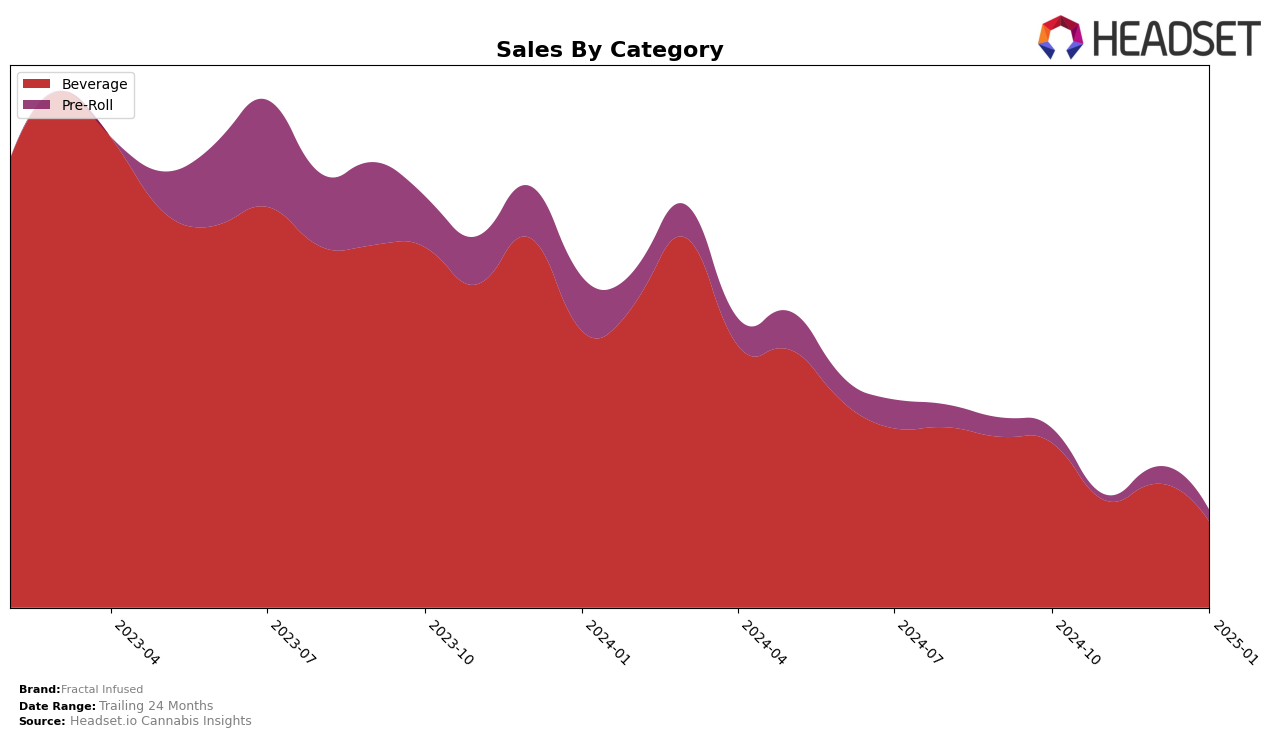

Fractal Infused has shown a consistent presence in the Beverage category within the state of Washington, maintaining a steady 16th rank from October through December 2024. This stability in ranking, despite fluctuations in sales, suggests a strong foothold in the market, possibly due to a loyal customer base or effective distribution strategies. However, it's noteworthy that in January 2025, Fractal Infused did not appear in the top 30 brands, indicating a potential challenge or increased competition in the market that month. This drop from the rankings could be a crucial point for the brand to address to regain its position.

While the steady performance in the last quarter of 2024 indicates resilience, the absence from the January 2025 rankings in Washington could signal a need for strategic adjustments. The brand's sales trajectory, which saw a dip in November followed by a recovery in December, highlights the volatility in consumer demand or market conditions. This fluctuation might prompt Fractal Infused to explore new marketing strategies or product innovations to capture consumer interest and improve their standings in future rankings. The insights from these movements could be pivotal for stakeholders looking to understand the brand's market dynamics and future potential.

Competitive Landscape

In the competitive landscape of the Washington beverage category, Fractal Infused has maintained a consistent rank of 16th from October to December 2024, but it did not appear in the top 20 by January 2025. This indicates a potential decline in market presence or sales performance. In comparison, Soulshine Cannabis consistently held the 15th rank during the same period, suggesting a stable market position slightly ahead of Fractal Infused. Meanwhile, Sinners & Saints appeared in the rankings only in October 2024 at 17th place, indicating a more sporadic presence in the market. The data suggests that while Fractal Infused was competitive, it faced challenges in maintaining its ranking, especially as it dropped out of the top 20 by January 2025, highlighting the need for strategic adjustments to regain and improve its market position.

Notable Products

In January 2025, Mojo Orange Cream Soda (100mg) maintained its position as the top-performing product for Fractal Infused, despite a decrease in sales to 292 units from 514 in December 2024. Mojo Strawberry Guava Soda (100mg) climbed to the second spot, although it experienced a slight drop in sales from 293 to 207 units. Mojo - CBD/THC 1:1 Blue Raspberry Soda rose to third place, showing a consistent improvement in ranking from fourth in November and second in December. Mojo - Amnesia Cookies Infused Pre-Roll entered the top five for the first time, securing the fourth position. Lastly, Mojo - Blue Raspberry Soda slipped to fifth place, marking a decline in both rank and sales over the previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.