Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

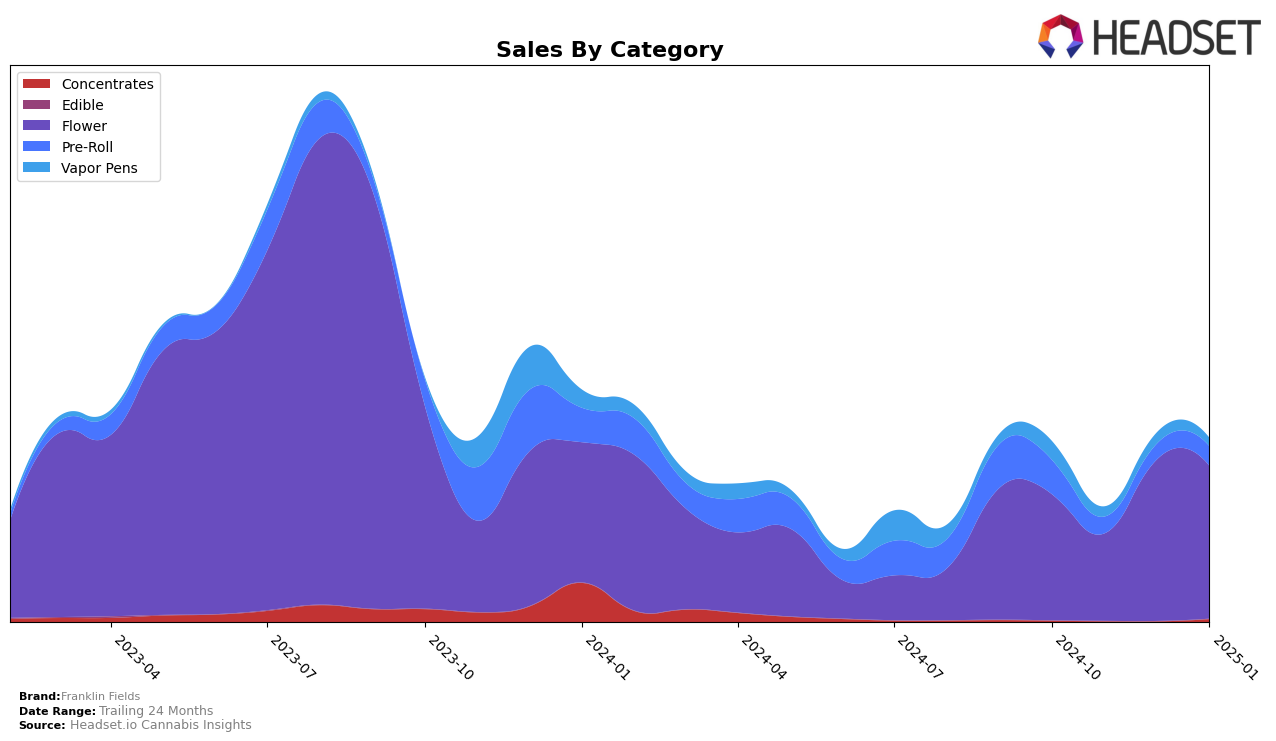

Franklin Fields has shown notable fluctuations in their performance across different product categories in Michigan. In the Flower category, the brand experienced a significant upward trajectory, climbing from a rank of 65 in November 2024 to 29 by January 2025. This improvement is reflected in their sales, which saw a substantial increase from November to December 2024. However, in the Vapor Pens category, Franklin Fields faced challenges, as evidenced by their absence from the top 30 rankings in November and a decline to rank 99 by January 2025. This suggests a need for strategic adjustments in their approach to this segment to regain market share.

In the Pre-Roll category, Franklin Fields has demonstrated some recovery, moving from rank 86 in December 2024 to 72 in January 2025. Despite this positive movement, their presence outside the top 30 in all months indicates that there is still considerable room for growth. The brand's overall sales figures in this category also reflect a gradual recovery, although they remain below the peak seen in October 2024. Observing these trends, it is clear that while Franklin Fields has capitalized on opportunities in the Flower category, there remains a challenge in maintaining consistent performance across all categories, particularly in the Vapor Pens and Pre-Roll segments.

Competitive Landscape

In the competitive landscape of the Michigan Flower category, Franklin Fields has shown a notable upward trajectory in recent months. After starting at a rank of 50 in October 2024, Franklin Fields improved significantly to reach the 29th position by January 2025, marking a strong comeback from a dip in November. This improvement in rank is accompanied by a substantial increase in sales from November to December, indicating a successful strategy in capturing market share. In comparison, NOBO experienced a decline in rank from 21 in November to 30 in January, suggesting potential challenges in maintaining its earlier momentum. Meanwhile, Candela maintained a relatively stable position, hovering around the 27th to 33rd ranks, with consistent sales figures. HOG Cannabis Co. also saw a significant jump from 65 in December to 28 in January, indicating a late surge in performance. These dynamics highlight Franklin Fields' competitive edge in rebounding effectively and positioning itself favorably against peers like Cresco Labs, which remained outside the top 20 throughout this period. This analysis underscores Franklin Fields' potential for continued growth and its ability to leverage market opportunities effectively.

Notable Products

In January 2025, Franklin Fields saw First Class Funk Pre-Roll (1g) rise to the top position, achieving the highest sales figures with 5,376 units sold. Jilly Glue Pre-Roll (1g) followed closely, securing the second rank, an improvement from its fifth place in December 2024. Orange Zkittles Shake (28g) entered the rankings at third place, indicating strong sales for this new entry. Klumps Pre-Roll (1g) and Chemistry Pre-Roll (1g) took the fourth and fifth spots respectively, marking their debut in the top five. Overall, the pre-roll category dominated the rankings, with notable shifts in product popularity from the previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.