Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

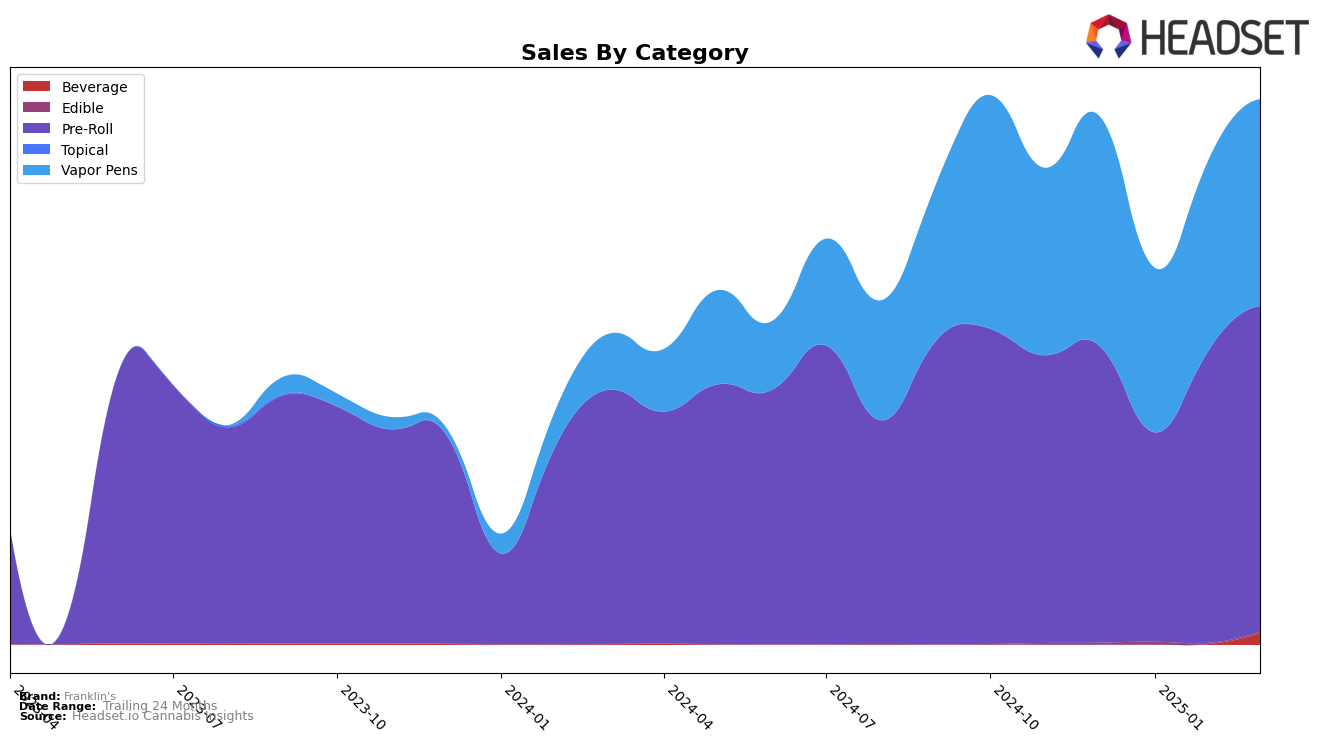

Franklin's has shown a notable performance in the Missouri cannabis market, particularly in the Pre-Roll category. Over the first quarter of 2025, Franklin's moved up the ranks, starting at 15th in December 2024, briefly dipping to 16th in January, then climbing to 12th in February, before settling back at 15th in March. This consistent presence in the top 15 indicates a strong foothold in the Pre-Roll segment, with sales peaking in March 2025. In contrast, the brand's presence in the Beverage category was not recorded in the top 30 until March 2025, where it debuted at 8th place, suggesting a strategic push or successful product launch in this category.

In the Vapor Pens category, Franklin's experienced some challenges maintaining a top 30 position in Missouri. The brand started at 33rd in December 2024 and dropped to 40th in January 2025, indicating a competitive landscape or potential supply issues. However, by March 2025, Franklin's improved its rank to 35th, showing signs of recovery. The fluctuations in ranking within this category suggest that while Franklin's is making strides, there is room for growth and stabilization. The brand's ability to bounce back in Vapor Pens, combined with its solid performance in Pre-Rolls, highlights its adaptability and potential for future expansion in the Missouri market.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in Missouri, Franklin's has demonstrated a dynamic performance with notable fluctuations in its rankings over the past few months. Starting from a rank of 15th in December 2024, Franklin's experienced a slight dip to 16th in January 2025, before climbing to 12th in February, only to settle back at 15th in March. This volatility in rank reflects the competitive pressures from brands like Flora Farms, which consistently maintained a higher rank, and Local Cannabis Co., which showed a steady upward trend, moving from 23rd in December to 16th by March. Meanwhile, Packs Cannabis (MO) displayed a downward trend, which could present an opportunity for Franklin's to capitalize on. Despite these challenges, Franklin's sales trajectory is promising, with a significant recovery in March, suggesting potential for further growth if strategic adjustments are made to leverage market dynamics effectively.

Notable Products

In March 2025, Franklin's top-performing product was the Berries & Cherries Distillate Cartridge (1g) in the Vapor Pens category, maintaining its number one rank from February with sales of 1757 units. The Berries & Cherries Blunt 5-Pack (3.75g) in the Pre-Roll category rose to second place from fourth in February, indicating a significant increase in popularity. Meanwhile, the Berries & Cherries Blunt (1g), also in Pre-Roll, dropped to third place from its previous second place rank. The Draco Distillate Cartridge (1g) held steady in fourth position, consistent with its February ranking. Notably, the Sour Banana Sherbet Infused Blunt (1g) entered the rankings at fifth place, showing potential for future growth.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.