Oct-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

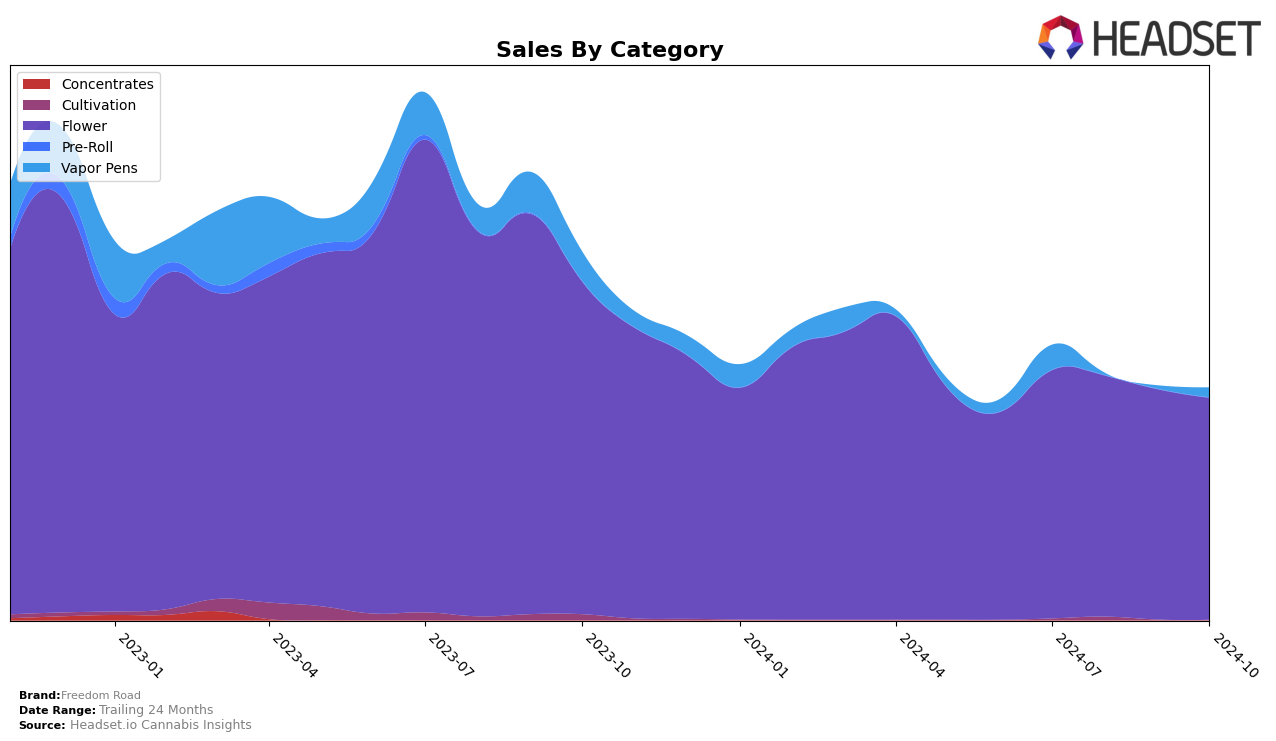

Freedom Road has shown a noteworthy performance in the Colorado market, particularly in the Flower category. Over the past four months, the brand has improved its ranking from 30th in July 2024 to 25th by October 2024. This upward movement in rank is accompanied by a gradual decline in sales, from $244,024 in July to $218,301 in October, suggesting a competitive market where maintaining or improving rank requires strategic adjustments. The consistent presence in the top 30 indicates a stable demand for their Flower products, despite the challenges in sales figures.

In contrast, Freedom Road's performance in the Vapor Pens category in Colorado has not been as prominent. The brand was ranked 76th in July 2024, and it did not appear in the top 30 for the subsequent months, which could be a point of concern or an opportunity for strategic realignment. This absence from the top rankings highlights the competitive nature of the Vapor Pens category and suggests that Freedom Road may need to innovate or adjust its offerings to enhance its market position. Such fluctuations across categories underscore the dynamic nature of the cannabis market and the importance of adaptive strategies to maintain a competitive edge.

Competitive Landscape

In the competitive landscape of the Colorado flower category, Freedom Road has shown a steady improvement in rank from July to October 2024, climbing from 30th to 25th position. This upward trend is notable despite a consistent decline in sales figures over the same period, which suggests that while Freedom Road is gaining ground in rank, it may be due to larger declines or instability among its competitors. For instance, Antero Sciences experienced a significant drop in rank from 20th to 31st in September before recovering to 23rd in October, indicating potential volatility. Meanwhile, Rocky Mountain High maintained a relatively stable rank, although it experienced fluctuations in sales. Indico also improved its rank significantly in October, moving from 36th to 26th, which may pose a future challenge for Freedom Road if this trend continues. Overall, Freedom Road's rise in rank amidst declining sales highlights a competitive edge in market positioning, possibly due to strategic branding or product differentiation, even as it faces a dynamic competitive environment.

Notable Products

In October 2024, the top-performing product from Freedom Road was Whoa-Si-Whoa (3.5g) in the Flower category, which secured the number 1 rank with sales of 1215 units. Mars Hotel (14g) climbed to the second position from fifth in September, showcasing a significant increase in popularity with 1203 units sold. Member Berry (3.5g) dropped from the top spot in September to third place in October, indicating a slight decline in sales momentum. Electro Lime (3.5g) debuted at the fourth rank, while Red Headed Stranger (3.5g) rounded out the top five. These shifts highlight a dynamic change in consumer preferences within the Flower category over the past months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.