Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

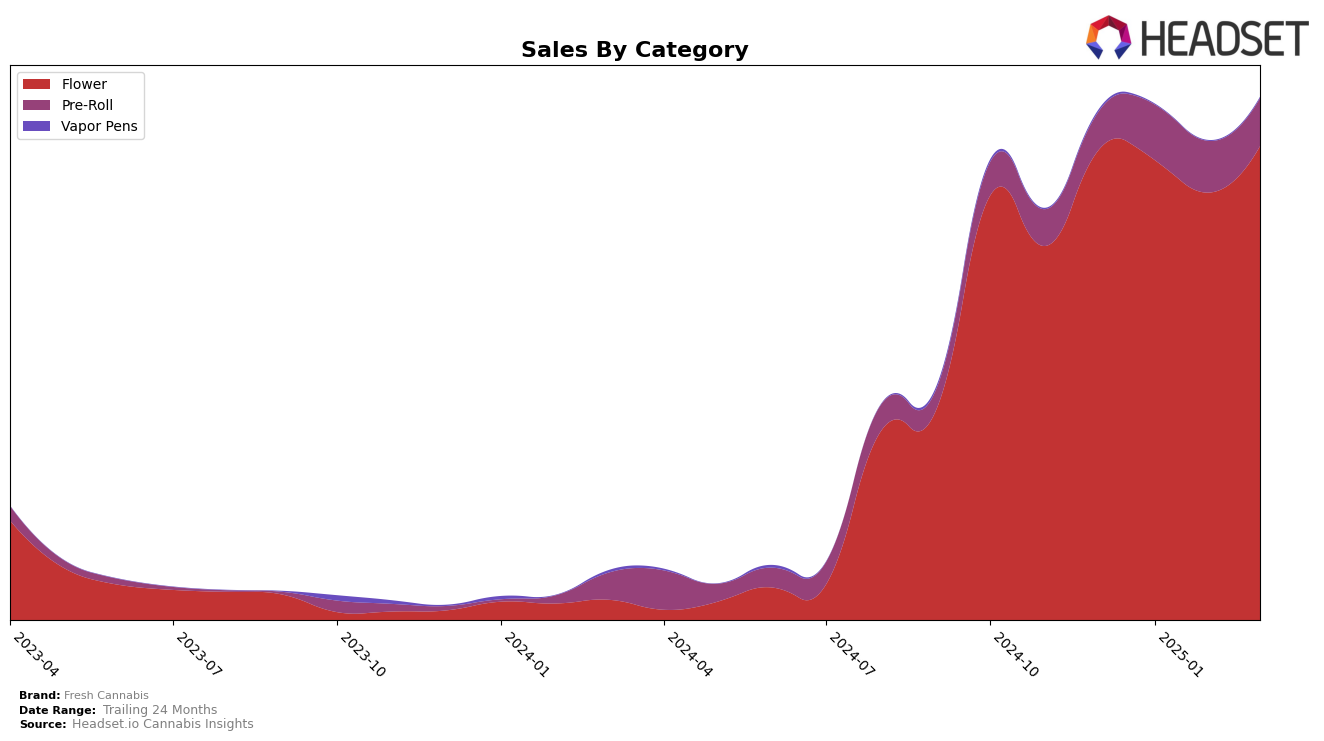

Fresh Cannabis has shown varied performance across different states and categories, with notable shifts in their market presence. In Colorado, the brand has made significant strides in the Flower category, improving its rank from 49th in December 2024 to 39th by March 2025. This upward movement is supported by a steady increase in sales, indicating growing consumer preference and market penetration. In contrast, their presence in the New Jersey Flower category has seen a slight decline, moving from 22nd to 27th place over the same period. While the sales figures in New Jersey have decreased, it's important to note that they still maintain a presence within the top 30, suggesting a resilient market position despite the challenges.

In the Pre-Roll category in New Jersey, Fresh Cannabis has shown some fluctuations, with ranks shifting from 46th in December 2024 to 41st by March 2025. This movement, coupled with a decrease in sales, highlights both the volatility and competitive nature of the Pre-Roll market in this region. The brand's ability to remain within the top 50 in both categories across states indicates a stable, albeit challenging, market presence. The absence of Fresh Cannabis from the top 30 in the Pre-Roll category in Colorado suggests potential areas for growth or strategic re-evaluation. These insights provide a glimpse into the brand's dynamic performance, offering a foundation for further exploration and analysis of Fresh Cannabis's strategies and market adaptation.

Competitive Landscape

In the competitive landscape of the flower category in New Jersey, Fresh Cannabis has experienced a slight decline in rank from December 2024 to March 2025, moving from 22nd to 27th place. This shift is notable as it reflects a broader trend of fluctuating market dynamics. Competitors such as &Shine and Illicit / Illicit Gardens have also seen changes in their rankings, with &Shine dropping from 16th to 28th and Illicit / Illicit Gardens moving from 17th to 25th over the same period. Despite these shifts, Fresh Cannabis maintains a competitive edge with relatively stable sales figures, particularly when compared to Kynd Cannabis Company and FullTilt Labs, which have experienced more significant sales volatility. This analysis suggests that while Fresh Cannabis faces challenges in maintaining its rank, its sales performance remains robust in a competitive market environment.

Notable Products

In March 2025, the top-performing product from Fresh Cannabis was the Mai Tai Pre-Roll (0.5g) in the Pre-Roll category, which climbed to the first position despite a slight decrease in sales to 1509 units. Miracle Alien Cookies (3.5g), a newcomer in the Flower category, secured the second position with notable sales of 1458 units. The Animal Face x Kush Mints (3.5g) maintained its third position in the Flower category, showing consistent performance with sales reaching 1451 units. Coffee Creamer Pre-Roll (0.5g) experienced a drop from the top spot in the previous months to the fourth position, highlighting a shift in consumer preference. Bubba Fett (3.5g) entered the top five for the first time, ranking fifth, indicating a growing interest in this Flower product.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.