Dec-2023

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

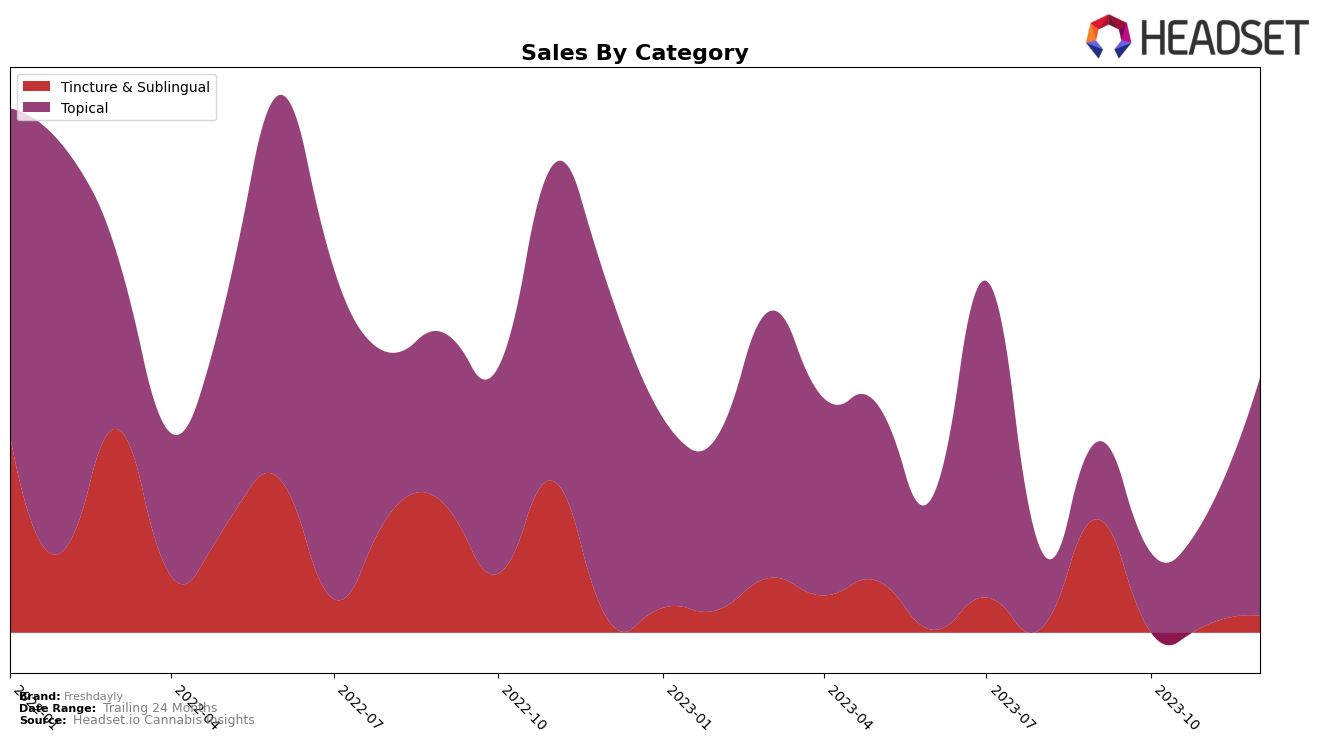

In the Tincture & Sublingual category, Freshdayly has shown some interesting trends. In Alberta, the brand secured a rank of 4 in September 2023, but unfortunately, it did not make it to the top 20 in the following months. This could be a point of concern for the brand. On the other hand, in Ontario, Freshdayly also held a rank of 4 in September 2023. However, the data for the subsequent months is not available which means the brand might have dropped out of the top 20.

Looking at the Topical category, Freshdayly's performance in Alberta has been commendable. The brand was ranked 25 in September 2023 but has progressively improved to rank 17 by December 2023. This indicates a positive upward trend. In Ontario, the brand's performance has been somewhat steady. Starting at rank 25 in September, it moved to rank 23 by December 2023. It's worth noting that despite some fluctuations, the brand has remained within the top 30, suggesting consistent performance.

Competitive Landscape

In the Ontario Topical category, Freshdayly has been experiencing a steady increase in rank and sales from September to December 2023. Despite starting from a lower rank of 25 in September, Freshdayly managed to climb to rank 23 by December, outperforming Atlas Thrive which dropped significantly from rank 16 to 26 over the same period. Freshdayly also surpassed Tidal in December, which fell to rank 20. Interestingly, Transit was not in the top 20 brands in November, indicating a potential volatility in its performance. Lastly, Forty Acre Blends (formerly Backforty Blends) only appeared in the ranking in November and December, but it's already close to Freshdayly's rank. These dynamics suggest a competitive market with opportunities for Freshdayly to continue its upward trajectory.

Notable Products

In December 2023, Freshdayly's top-performing product was the CBD:THC Fresh Face Wash, which climbed from 3rd place in November to 1st, with a significant increase in sales from 10 to 59 units. The CBD:THC Extra Ease Soap Bar moved from 1st to 2nd place, while the CBD:THC EaseWhite Toothpaste dropped from 2nd to 3rd place. The CBD:THC Fresh Body Wash entered the top four for the first time in December, and the CBD:THC Makeup Remover, which was 4th in November, did not make the top four in December. These changes indicate a dynamic market and suggest the importance of continuous monitoring of sales trends.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.