Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

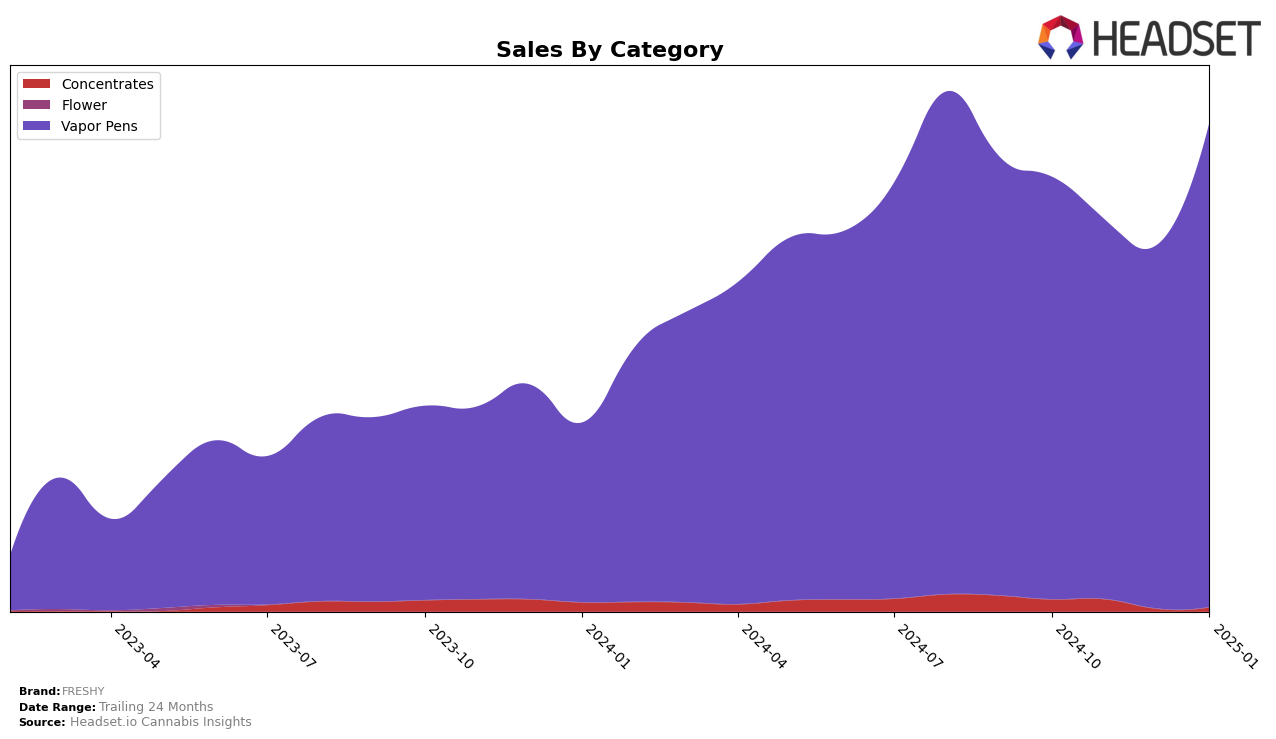

FRESHY has shown notable performance variability across different product categories and states. In the Oregon market, the brand has struggled to maintain a top 30 position in the Concentrates category, as evidenced by their absence from the rankings in December 2024 and January 2025. This indicates a challenge in gaining traction or possibly increased competition in this segment. However, their presence in the Vapor Pens category is much more robust, with a consistent climb from a rank of 7 in November 2024 to 4 in January 2025. This upward trend suggests a strong consumer preference or effective market strategies in this category, which is an area of strength for FRESHY in Oregon.

While FRESHY's performance in Vapor Pens is commendable, the lack of presence in the top 30 for Concentrates in recent months highlights a potential area for strategic focus or improvement. The brand's ability to capture consumer interest in Vapor Pens is reflected in the sales growth seen in January 2025, suggesting that FRESHY has successfully capitalized on this category. The contrasting performance across these categories underscores the importance of targeted marketing and product differentiation strategies to bolster their position in the less successful segments. Observing how FRESHY adjusts its approach in the coming months will be crucial for understanding its adaptability and potential for growth in the competitive cannabis market.

Competitive Landscape

In the competitive landscape of vapor pens in Oregon, FRESHY has demonstrated a dynamic performance over the past few months, reflecting both challenges and opportunities in the market. While FRESHY's rank fluctuated from 5th in October 2024 to 7th in November, it rebounded to 5th in December and climbed to 4th by January 2025. This upward trajectory in January is particularly notable as it coincides with a significant increase in sales, suggesting effective strategic adjustments or successful marketing campaigns. In contrast, NW Kind experienced a slight decline, dropping from 4th in November and December to 6th in January, potentially opening up space for FRESHY's advancement. Meanwhile, Entourage Cannabis / CBDiscovery maintained a stronghold on the top position until January when it slipped to 2nd, indicating a possible shift in consumer preferences or competitive pressures. White Label Extracts (OR) consistently held the 3rd rank, showing stability in their market presence. FRESHY's ability to navigate this competitive environment and improve its ranking highlights its potential for continued growth and increased market share in Oregon's vapor pen category.

Notable Products

In January 2025, FRESHY's Tiger's Blood Live Resin Cartridge (1g) emerged as the top-performing product, maintaining its number one position from November 2024, with impressive sales of 3607 units. Shirley Temple Live Resin Cartridge (1g) climbed to the second spot, a significant improvement from its fifth position in November, with sales figures reaching 3273 units. Watermelon Splash Flavored Live Resin Cartridge (1g) held steady at the third rank, showcasing consistent demand. Blueberry Burst Live Resin Cartridge (1g) dropped from its December top rank to fourth place, while Banana Candy Flavored Live Resin Cartridge (1g) entered the top five, indicating a renewed interest. Overall, the Vapor Pens category dominated the rankings, with all top products belonging to this category, reflecting a strong consumer preference for these offerings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.