Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

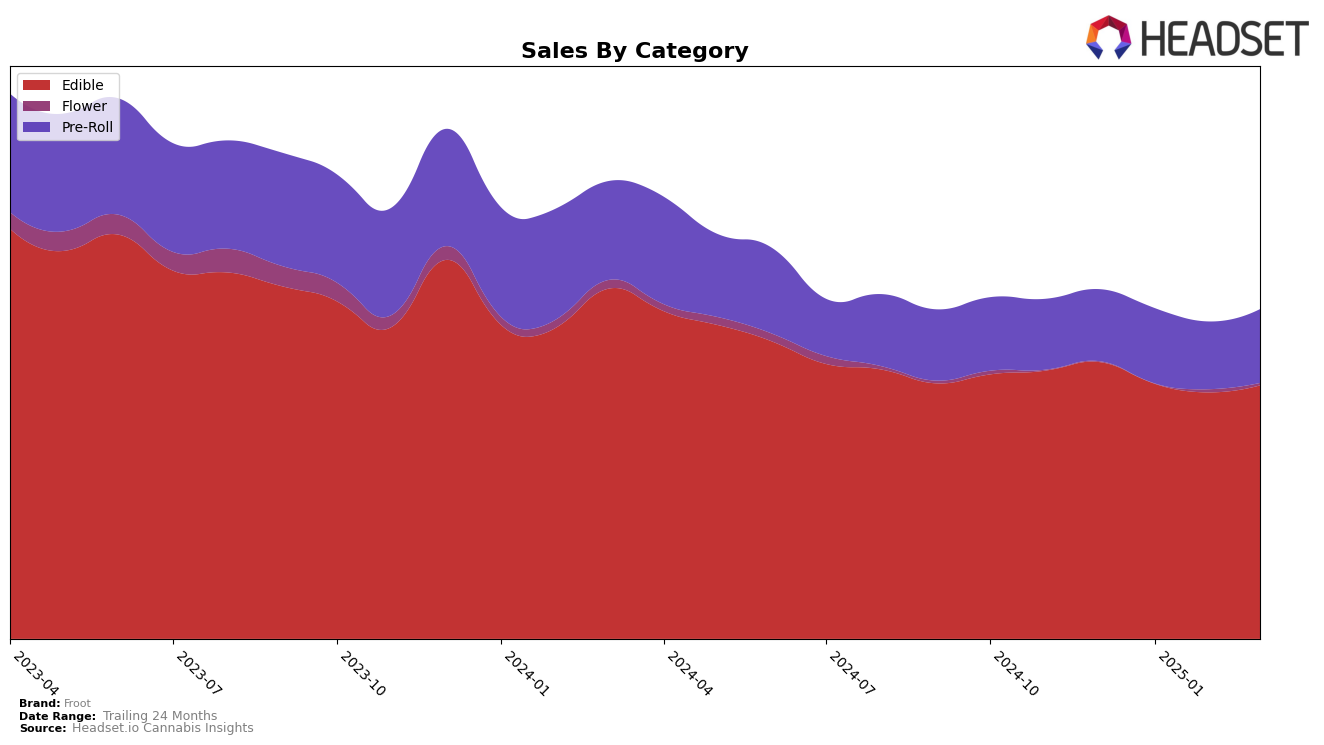

In California, Froot has consistently maintained a strong presence in the Edible category, holding steady at the 5th position from December 2024 through March 2025. This stability suggests a robust consumer base and effective product offerings in this segment. However, it's worth noting that their sales have seen a gradual decline over these months, with a slight rebound in March. This pattern could indicate seasonal fluctuations or shifts in consumer preferences, which may require strategic adjustments to sustain their market position.

Meanwhile, Froot's performance in the Pre-Roll category in California shows a positive upward trend. Starting at the 30th position in December 2024, they have climbed to the 26th rank by March 2025. This improvement in ranking, coupled with fluctuating sales figures, highlights a growing recognition and acceptance of their Pre-Roll products. The increase in rank suggests successful marketing efforts or product enhancements that are resonating with consumers, despite not being in the top 30 in some months previously. This upward trajectory could be a promising sign for Froot's future in this category.

Competitive Landscape

In the California edible market, Froot has maintained a consistent rank at 5th place from December 2024 through March 2025, indicating stability in its market position. In contrast, Kanha / Sunderstorm and Lost Farm have consistently held higher ranks at 3rd and 4th places, respectively, suggesting a competitive edge over Froot. Meanwhile, Heavy Hitters experienced a slight decline from 6th to 7th place in March 2025, while Good Tide improved its position from 9th in December 2024 to 6th in March 2025, surpassing Heavy Hitters. This shift highlights a dynamic competitive landscape where Froot's stable ranking contrasts with the fluctuating positions of its competitors, emphasizing the need for strategic initiatives to enhance its market share amidst the evolving competitive pressures.

Notable Products

In March 2025, the top-performing product from Froot was Sour Grape Ape Gummies (100mg), which climbed to the number one rank after being third in February. Hybrid Blue Razz Dream Chews 10-Pack (100mg) maintained its second position from the previous month, showing consistent sales performance. M.Y. Sleep - THC/CBN/Melatonin 5:2:2 Mellow Berry Fruit Chews 20-Pack (100mg THC, 40mg CBN, 40mg Melatonin) slipped to third place, despite having been the top product from December 2024 through February 2025. Sour Watermelon Chews 10-Pack (100mg) continued its downward trend, ranking fourth in March. Notably, Indica Cherry Pie Gummies 10-Pack (100mg) entered the rankings for the first time, securing the fifth position with sales of 10,557 units.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.