Oct-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

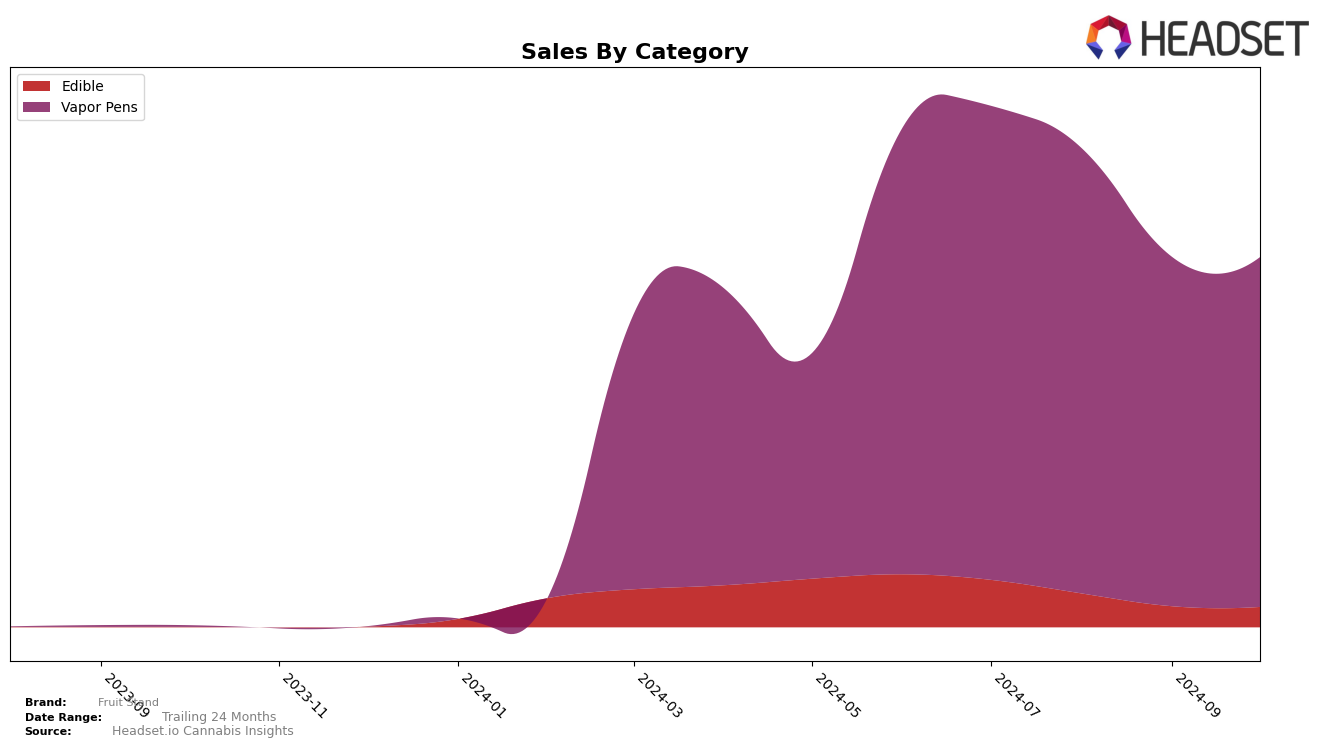

Fruit Stand's performance across different categories in Illinois shows mixed results over the past few months. In the Edible category, the brand has consistently struggled to break into the top 30, with its rank slipping from 47th in July 2024 to 56th by October 2024. This downward trend is coupled with a significant decline in sales, indicating a potential challenge in maintaining consumer interest or facing stiff competition. On the other hand, in the Vapor Pens category, Fruit Stand has managed to maintain a more stable position, hovering around the 30th rank. This steadiness suggests a more loyal customer base or effective product offerings in this segment, despite a slight dip in sales from July to October.

The contrasting performance between categories highlights the varying levels of success Fruit Stand experiences within the same state. While their Vapor Pens have managed to sustain a presence in the competitive landscape of Illinois, their Edible products have not made similar headway. The consistent absence from the top 30 in Edibles could indicate areas for improvement or a need for strategic adjustments. The data suggests that while Fruit Stand has the potential to compete effectively in certain segments, it may need to reassess its approach in others to enhance its overall market presence.

Competitive Landscape

In the competitive landscape of vapor pens in Illinois, Fruit Stand has experienced fluctuating rankings over the past few months, indicating a dynamic market position. In July 2024, Fruit Stand held the 29th rank, slightly improving to 28th in August, but then dropping to 31st in September before climbing back to 30th in October. This oscillation reflects a competitive environment where brands like Classix consistently maintained a stronger position, ranking 30th in July and August, and improving to 28th in both September and October. Meanwhile, Mozey Extracts demonstrated notable volatility, starting at 24th in July, dropping to 29th in August, then surging to 21st in September, only to fall back to 29th in October. Despite these shifts, Fruit Stand's sales figures reveal a resilience, with a notable dip in September but a recovery in October, suggesting potential for stabilization and growth amidst fierce competition. Brands like Timeless and Aeriz also present competitive pressures, with Timeless showing a consistent upward sales trend, although their rankings remained outside the top 20. This competitive analysis highlights the importance for Fruit Stand to leverage strategic marketing and product differentiation to enhance its market position in Illinois.

Notable Products

In October 2024, the top-performing product for Fruit Stand was the Strawnana Distillate Cartridge (1g) in the Vapor Pens category, maintaining its first-place ranking from the previous month with sales of 2,888 units. The Blue Razz Distillate Cartridge (1g) held the second position, consistent with its September ranking, despite a slight decrease in sales. The Grape BDT Distillate Cartridge (1g) remained steady at third place, though its sales figures showed a gradual decline over the months. Sour Blue Razz Gummies 10-Pack (100mg) in the Edible category continued to hold the fourth position, showing an increase in sales compared to September. Notably, the Blue Raspberry BDT Cartridge (1g) debuted at fifth place, indicating a new entry in the rankings for October.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.