Jul-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

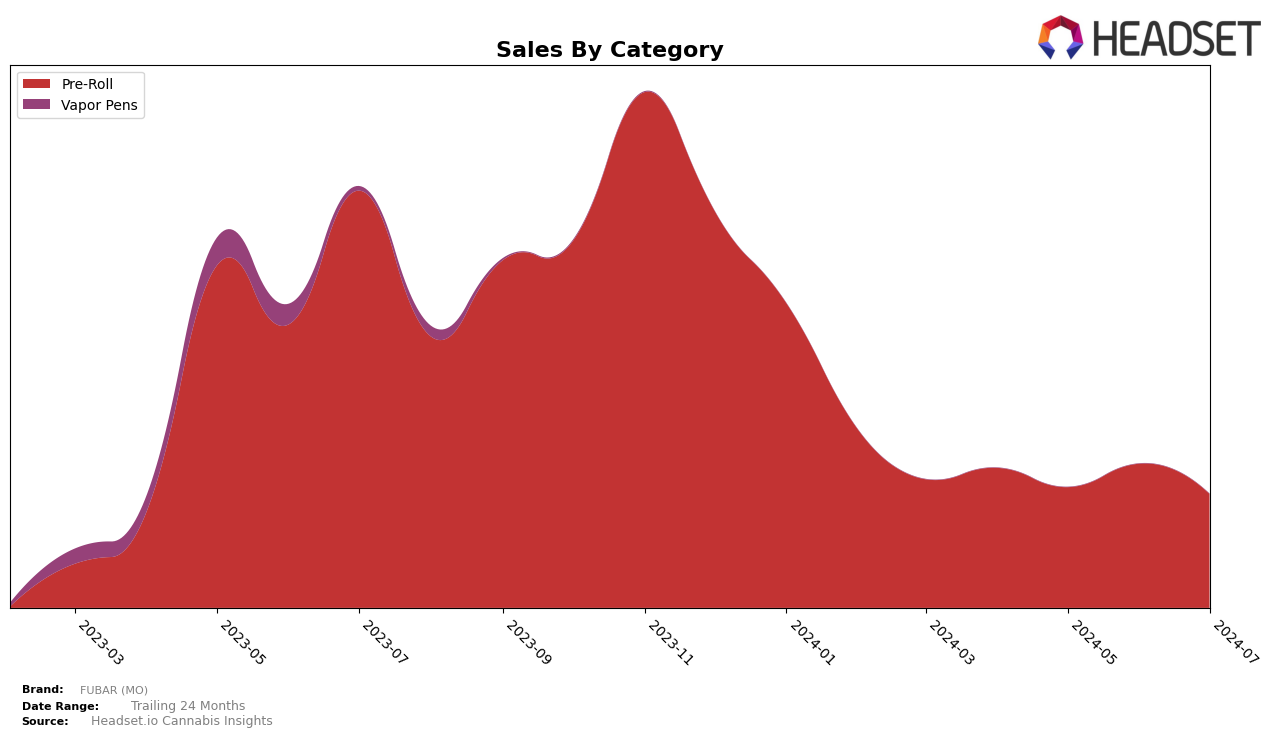

FUBAR (MO) has demonstrated a consistent presence in the Pre-Roll category within Missouri. Over the past few months, the brand has fluctuated between the 20th and 23rd positions, indicating a stable but not dominant market position. For instance, in April 2024, FUBAR (MO) held the 20th rank, but by May, it slipped to 23rd. This movement suggests that while the brand maintains a foothold, it faces significant competition. The sales figures mirror this trend, with a noticeable dip in May, followed by a recovery in June before another decline in July. This pattern points to a volatile market environment where consumer preferences may be shifting rapidly.

It's important to note that FUBAR (MO) has managed to stay within the top 30 brands in the Pre-Roll category throughout the observed period. This consistency is a positive indicator of the brand's resilience and ability to maintain relevance in a competitive market. However, the fact that it has not climbed higher than the 20th position suggests there is room for growth and improvement. Brands that fail to appear in the top 30 in any given month are at risk of losing visibility and market share, so FUBAR (MO)'s steady ranking is a crucial strength. Future performance will depend on the brand's ability to adapt to market demands and enhance its competitive edge.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in Missouri, FUBAR (MO) has shown a fluctuating but stable presence in the rankings over the past few months. Despite a slight dip from 20th in April 2024 to 23rd in May 2024, FUBAR (MO) managed to regain its 20th position in June before slipping back to 23rd in July. This indicates a competitive but volatile market. Notably, Willie's Reserve has demonstrated a significant upward trajectory, climbing from 50th in April to 19th in June, before stabilizing at 21st in July. This rise could pose a threat to FUBAR (MO) if the trend continues. Meanwhile, TRIP and Vertical (MO) have shown more consistent performance, with TRIP maintaining a rank between 22nd and 29th, and Vertical (MO) fluctuating between 19th and 26th. Plume Cannabis (MO) has also remained close to FUBAR (MO) in the rankings, indicating a tight competition. These dynamics suggest that while FUBAR (MO) holds a competitive position, it must strategize effectively to counter the upward momentum of brands like Willie's Reserve and maintain its market share.

Notable Products

In July 2024, the top-performing product from FUBAR (MO) was Frozen Coke THCa Diamond Infused Pre-Roll (1g), which climbed to the first rank with notable sales of 1815 units. Moonshot Diamond Infused Pre-Roll (1g) held steady at the second rank, showing consistent performance with 1343 units sold. Motorhead Diamond Infused Pre-Roll (1g) dropped to the third rank from its top position in June 2024, with sales decreasing to 959 units. Sweet Tea XL Sauce Boss Infused Pre-Roll (1.25g) improved its ranking slightly to fourth place, while Grandpa Larry Diamond Infused Pre-Roll (0.75g) entered the top five for the first time. Overall, the rankings reflect dynamic shifts, with Frozen Coke THCa Diamond Infused Pre-Roll (1g) showing the most significant improvement.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.